Casino revenue falls

Casino revenue statewide continued a 14-month downward spiral in February. But there was one bright spot in the avalanche of negative numbers -- gaming tax collections increased for the first time in seven months.

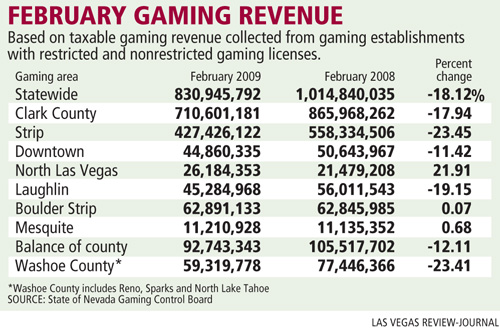

Throughout Nevada, gaming revenue fell more than 18 percent during February and more than 23 percent on the Strip, figures released Tuesday by the Gaming Control Board show. The raw numbers -- $839.5 million statewide and $427.4 million on the Strip -- were the lowest single-month gaming revenue totals since 2004.

For the first two months of 2009, gaming revenue statewide is off 16.3 percent compared with 2008 while Strip gaming revenue is down almost 19 percent.

"As expected, results were soft," JPMorgan gaming analyst Joe Greff told investors.

However, based on February's taxable gaming revenues, Nevada collected almost $65.1 million in gaming taxes, a 22.6 percent increase compared with almost $53.1 million for the same period a year ago. For the fiscal year, gaming tax collections are off 16.3 percent compared with fiscal 2008.

Control board senior research analyst Frank Streshley said the 2009 calendar affected gaming revenues and the tax collection accounting methods. Revenues generated in January by high-end customers during Chinese New Year and Super Bowl weekend were settled in February, which affected tax collections. Both events crossed over between the two months.

"A substantial number of markers that were issued in January were paid in February," Streshley said. "While the revenues were recorded in January, the taxes are recorded in the month the markers are paid. Customers are different. Some won't settle markers for a few months while others will settle up at the end of a trip."

During February, the statewide casino win of almost $839.5 million from gamblers was down from almost $1.145 billion won a year ago. The figure was the lowest statewide one-month total since July 2004, when casinos recorded $813 million in gaming revenues. February's 18.1 percent decline was the third largest monthly decline in state history, following a 22.3 percent drop last October and an 18.9 percent decline last December.

On the Strip, casinos won $427.4 million, down from $558.3 million a year ago. The figure was the lowest single month total since November 2004 when casinos won $426 million. It was the second-largest single month drop ever, trailing only the 25.7 percent drop posted last October.

Wachovia gaming analyst Dennis Farrell Jr. said the uncertain economy continues to curtail discretionary spending by consumers.

"We continue to believe that 2009 could be one of the most agonizing years Las Vegas Strip operators have ever experienced with regard to year-over-year (cash flow) declines," Farrell told investors.

Streshley blamed calendar differences between February 2008 and February 2009 for much of the decline. Last year was a leap year and Feb. 29 fell on Friday, which helped give the month a slight boost. He said the extra day can mean anywhere from a 3 percentage point to 5 percentage point increase in gaming revenues.

"One day may not seem like a lot, but the one extra day falling on a Friday does make a difference," Streshley said. "By all means, this wasn't a good month, but it was actually better than we expected."

Gamblers wagered $9.1 billion on slot machines, a decline of 15.4 percent compared with a year ago, and $2.1 billion on table games, which was down 32.3 percent compared with February 2008.

One boost came from wagering on the Pittsburgh Steelers' 27-23 win over the Arizona Cardinals in Super Bowl XLIII. Casino sports books generated $6.7 million in gaming revenues vs. a loss of $2.6 million from the 2008 Super Bowl.

Deutsche Bank gaming analyst Bill Lerner said Las Vegas visitors are just not spending the same amount of money on gambling they have in the past. Reduced hotel room rates and other incentives are starting to drive visitation but not spending.

"It's going to take time to recover," Lerner said. "These companies have done as much as they can to cut expenses to mitigate declining revenues."

Not all areas of Clark County suffered during the month. Gaming revenues were up almost 22 percent in North Las Vegas, due mainly to the November opening of Aliante Station. The Boulder Strip and Mesquite recorded monthly gaming revenue increases of less than 1 percentage point.

Washoe County, which includes Reno, recorded its 20th straight month of gaming revenue declines.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.

GAMING REVENUE

• State -18%

• Strip -23%

TOURISM -8%

AVERAGE DAILY ROOM RATE -22.9% / $99.25