Gaming stocks punished during August

Let's cut right to the chase. August was a real stinker of a month for gaming stocks.

All 10 of the publicly traded casino operators and slot machine manufacturers charted by Las Vegas-based financial adviser Applied Analysis saw their average daily stock prices during August decline when compared with July.

Eight of the companies experienced double-digit declines, including a

31 percent drop by Boyd Gaming Corp.

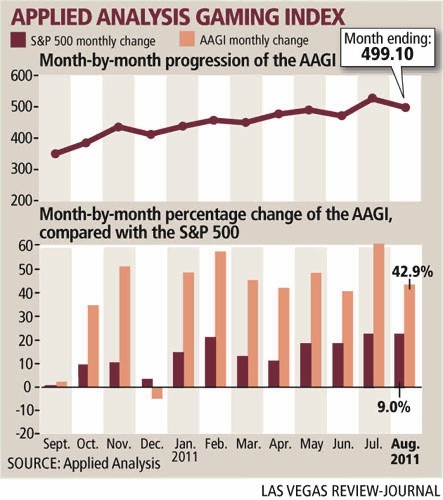

The stock market as whole fell more than 5 percent in August, as it was rocked by several days of 300- to 600-point swings. The gaming sector, impervious to July's slumping stock market, couldn't survive the ups and downs of August.

Following Boyd, the average daily stock price of MGM Resorts International took the second-largest slide, falling 24 percent in August. The stock price of Las Vegas Sands Corp. experienced the smallest drop, down 4.2 percent.

Applied Analysis principal Brian Gordon said companies such as Wynn Resorts Ltd. and Las Vegas Sands Corp., were able to soften the blow somewhat because of casino holdings in the Asia gaming markets.

"Typically, the gaming sector swings wider than the broader market as sector demand is sourced to discretionary spending, a fragile commodity in times of extreme uncertainty," Gordon told the firm's clients.

Gaming analysts said the massive market fluctuations haven't seemed to affect consumer spending -- yet. Susquehanna gaming analyst Rachael Rothman, who met with Penn National Gaming executives recently, said the company, which owns M Resort, has not found a clear relationship between stock market volatility and gaming fundamentals.

"Penn continues to monitor business trends closely for signs of consumer weakening, but has not yet seen any such indications as stable gaming revenue and the rational promotional environment have continued into the third quarter thus far," Rothman told investors.

However, she said Penn leaders said if continued stock market volatility were to negatively affect fundamentals, the company expects a decline in results would occur on a multimonth lag time.

Gordon said several casino operators and equipment manufacturers released unimpressive quarterly earnings during the month, adding to the already weak investment market.

"Most of the downturns experienced during the month were driven by fear and anxiety sourced to economic uncertainty and the possible impacts on travel and leisure decisions," Gordon said.

The stock price of slot machine maker WMS Industries fell more than 28 percent in one trading session early in the month, the day after the company released lower-than-expected fourth-quarter results.

For all of August, the average daily share price of WMS was off 22 percent compared with July.

Credit Suisse gaming analyst Joel Simkins, who visited with WMS executives a week ago, told investors that gaming equipment suppliers will continue to face low demand from casino operators for new slot machines.

Also, the companies could take a hit if wagering slows on games where slot makers and casinos share revenues.

"WMS continues to make progress on its turnaround," Simkins said. "WMS shares have bounced from their recent lows. We do not see the stock running away from us for the next few quarters. It could be a few quarters before the company gets fully back on track and investors become more comfortable with the organizational turnaround."

On the whole, the Applied Analysis Gaming Index, which takes in more than 300 market variables, fell almost 32 points to close at 499.10.

If there is a bright spot, Gordon said that gaming company valuations are still ahead of where they were a year ago.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.

Follow @howardstutz on Twitter.