University Medical Center defends the $115,200-a-year contract of an influential doctor, but the public hospital can’t document cases he has reviewed.

The Golden Knights will make a change on defense for Game 2 of their first-round series against the Dallas Stars thanks to an injury.

Elected officials are concerned about the impact the plan could have on Nevada elections, which rely heavily on mail service.

The Raiders made a huge swing to secure their franchise quarterback in the Review-Journal’s final mock draft before the first round begins Thursday.

The city’s mobsters roots run deep. Here are a list of mob-connected homes that has sold in recent years, including one formerly owned by Frank “Lefty” Rosenthal.

An older motel in downtown Las Vegas has sold, and the new owner has big long-term plans for the site.

An executive with more than three decades of experience in Las Vegas is leaving his position once a successor is found.

The closing of “Love,” enforced by construction as Mirage turns into Hard Rock Las Vegas, has initiated rumors “Ka” will be the next Cirque production to shut down.

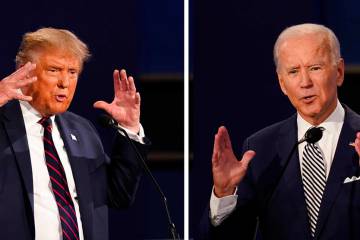

The measure, which President Joe Biden signed Wednesday, requires TikTok’s China-based parent company to sell the social media platform or face a nationwide ban.

One of the bars lies in a sleek Strip hotel, the other off Strip in a longtime locals favorite.

The Golden Knights power play is clicking at one of the highest rates in franchise history entering Wednesday’s Game 2 against the Dallas Stars.

The win was one of several recently across the Las Vegas Valley.

The Biden administration issued final rules Wednesday to require airlines to automatically issue cash refunds for things like delayed flights and to better disclose fees for baggage or canceling a reservation.

Kyle Mitrione fractured his C6 vertebrae while performing in “O” on June 28. A new segment had been added to the show two weeks prior, according to the lawsuit.

This year, you can get more cash for your grass. The Southern Nevada Water Authority (SNWA) has temporarily increased the incentive for homeowners participating in the popular and successful Water Smart Landscapes Rebate Program (WSL). Qualifying homeowners will receive $5 for each square foot of grass they convert (up to the first 10,000 square feet) […]

The 100,000-square-foot center, replacing an aging office complex, will include restaurants, culinary kiosks and a covered alfresco dining lounge.

Terry Fator is using new architecture at The Strat Showroom to his advantage. That venue is part of the resort’s $125 million overhaul under owner Golden Gaming.

Records show that a planned “Vegas Country Music Restaurant” will occupy 10,000 square feet at 63 Las Vegas, according to an insider.

A motorcyclist was killed after a crash with a pickup truck in North Las Vegas.