Affordable Care Act

Obamacare, or the Affordable Care Act, is the law of the land, but many Nevadans don’t have a clue how it affects them or their families.

Among the highlights of Obamacare are that uninsured Americans can sign up for health insurance at affordable rates, and pre-existing conditions no longer disqualify them from obtaining insurance. A number of provisions will help Americans afford coverage, as well as guarantee access to insurance with a minimum level of benefits.

Everyone is required to have health insurance beginning Jan. 1, or be subject to paying fines.

Four categories are available on the Silver State Health Insurance Exchange: Bronze, which covers 60 percent of medical costs; Silver, which covers 70 percent; Gold, which covers 80 percent; and Platinum, which covers 90 percent. Nevadans can determine which category is best for them and their families at www.nevadahealthlink.com.

About $7 million in grants have been awarded to private Nevada companies and government agencies to explain and implement the act. Much of that grant is designed to educate the public on insurance plans offered. The federal government set up an insurance exchange website (www.healthcare.gov) to explain the act.

The Affordable Care Act was signed into law March 23, 2010. The most significant effect for Nevada begins Jan. 1.

Employment opportunities

Uninsured Nevada residents will become eligible for preventive medical services in 2014. Routine checkup, vaccination and prenatal care are mandated by the Affordable Care Act.

Obamacare emphasizes preventive care, which will compel medical service business expansion. Office space for routine checkups and preventive care will be needed. Health care facilities are popping up around the valley to meet expected demand. Many entry-level positions in the medical field will be needed.

Companies that specialize in health service insurance policies will expand their employment opportunities and facilities to accommodate rising demand. With 600,000 uninsured Nevadans, and an estimated 29 million citizens nationwide, management and ministration of health services will be monumental job creators.

A part of federal and state grant dollars to private companies is used to hire and train part-time employees to help Nevada residents enroll in Affordable Care’ health insurance plans. Training and education programs will require more classrooms and teachers to train needed enrollment and medical services personnel.

The Affordable Care Act is expected to increase demand for hospital and medical service staff to meet needs of formerly uninsured residents.

Companies such as Urgent Care Extra have come to town with the capability of supplementing preventive medical services outlined in the Affordable Care Act. Dr. Ty Hanks, the medical director, said the company opened its first local clinic in December 2012. Since then, five facilities have opened in the Las Vegas Valley. “Five more clinics are planned in the next six months,” Hanks said.

“The Affordable Care Act is not the primary focus of (our) business model but (we) will be able to expand service with its implementation,” Hanks said.

The clinics seek to offer the “in-between” medical service needed by patients who either do not have a primary family physician or need medical help when their primary family physician is not available.

“We want to complement Las Vegas Valley physician’ services by developing working relationships in the medical community,” Hanks said. “If a patient needs help because of a broken leg at 3 p.m. Saturday or Sunday, Urgent Care Extra will X-ray the break, identify severity and either cast the injury or refer the patient to an appropriate specialist or primary physician for follow-up.

“Our objective is to be patient centered; with referral to specialists or primary family physicians (if there is one) after immediate care has been given,” Hanks said.

“We have 12 part- and full-time physicians for the five current Urgent Care Extra clinics.” Each facility is staffed by one or two physicians (either on-site or on-call), one or two medical assistants, a medical tech and one or two front-office personnel,” he said.

“We interview 10 people for every job opening,” Hanks’ wife, Jacki, said. “Social skill and technical ability are essential qualifications for employment because the clinic’s focus is on patient service.”

Urgent Care Extra uses iPad and Internet feedback applications to monitor patient perception of clinic services, according to Jacki Hanks.

“I use patient feedback to improve staff morale and patient relationships,” she said.

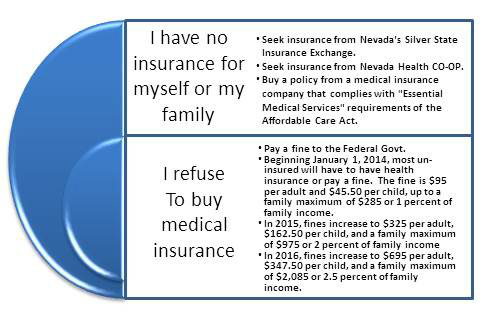

Obtaining health insurance

If you do not have employer provided, personal, or family medical insurance that meets essential medical services requirements, the Affordable Care Act requires purchase of health insurance from qualified private insurers or through Silver State Health Insurance Exchange by the end of 2013.

Call Silver State Insurance Exchange at 775-687-9939 or visit www.nevada healthlink.com for questions. For enrollment assistance, ask for a navigator to help you through the enrollment process.

Nevada Health Co-Op (not associated with Silver State Heath Insurance Exchange) at www.nevadahealthcoop.org is also making appointments for enrollment. You can contact the Co-Op at 702-823-COOP.

Effect on businesses’ group health insurance

If a business has 50 or more full-time employees or full-time equivalent employees, employers must provide employee health insurance beginning Jan. 1, 2015.

There are no penalties for 50-employee-companies until 2015. Beginning Jan. 1, 2015, a $2,000 annual penalty will be charged for each worker after the first 30.

All businesses with less than 50 full-time employees or full-time equivalent employees are exempt from the Affordable Care Act until 2016; at which time one- to 100-employee companies will have to offer health insurance.

Small businesses, fewer than 50 employees, are eligible for tax credits if they provide health insurance to their employees.

For details on the tax credit, visit www.irs.gov/uac/small-business-health-care-tax-credit-for-small-employers.

By checking www.nevadahealthlink.com, small businesses will find what tax credits are available.

Businesses should carefully review hours of work. Even if employees do not work 30-plus hours a week, which is the definition of a full-time employee, one equivalent employee is created when total part-time hours worked per week are divided by 120 with the nearest whole number being classified an equivalent full-time employee.

Effect on family health insurance

If a Nevada resident does not have Medicare or a personal health insurance policy, beginning Jan. 1, individual insurance policies become available through www.nevadahealthlink.com (also known as Silver State Health Insurance Exchange).

Beginning Jan. 1, health insurance cannot be denied to individuals for current or past health issues. Also, no annual or lifetime dollar limits can be applied to insurance coverage.

If an individual adult makes less than $46,022 and does not receive health insurance from an employer, he or she is likely eligible for private policy premium assistance or Medicaid through www.nevada healthlink.com.

If a family of four makes less than $93,701 and does not receive health insurance from an employer, it is likely eligible for private policy premium assistance or Medicaid through www.nevada healthlink.com.

Subsidized premiums for eligible individuals and families can be calculated by entering family income in a calculator shown at www.nevadahealthlink.com.

Starting in 2014, health insurers will only be able to use age, composition of family, geographic area and tobacco use as rating factors for insurance rates.

If an employer has not significantly changed its group medical coverage plan since March 23, 2010, the plan in place is grandfathered and the Affordable Care Act does not apply.

If premium costs exceed 9.5 percent of an employee’s annual income, the coverage is considered “unaffordable” and the employer must look at “affordability safe harbors” provided in the Affordable Care Act.

Policies must have no lifetime or annual limits. Individuals cannot be removed from the plan.

Preventive health services are to be included.

Coverage to be extended to the age of 26 for children of covered employees.

The insurance provider is to follow a proscribed format to explain provided insurance coverage that has minimum coverage in accordance with the Affordable Care Act.

Pre-existing condition exclusions and concomitant pricing of group policies will be prohibited beginning Jan. 1. (Same for individual policy.)

Beginning Jan. 1, most people will have to have health insurance or pay a fine. The fine is $95 per adult and $45.50 per child to as much as a family maximum of $285 or 1 percent of family income.

In 2015, fines increase to $325 per adult, $162.50 per child and a family maximum of $975 or 2 percent of family income.

In 2016, fines increase to $695 per adult, $347.50 per child and a family maximum of $2,085 or 2.5 percent of family income.

Fines can be waived for several reasons, including financial hardship or religious beliefs.

Use the calculator at www.nevada healthlink.com to determine whether your family income is too low to require any payment for an insurance premium. For example, if you enter $16,000 as family income for two, no premium is charged and no fine for the insurance you sign up for is due.

Tax refunds may be withheld for noncompliance fines.

Adults younger than 30 can opt for lower-cost catastrophic plans. (Same for individual family policies.)

Pre-existing condition exclusions and concomitant pricing of group policies will be prohibited beginning Jan. 1.

Essential health benefits are a set of health care services that must be covered with no annual or lifetime dollar limits. These benefits may still have other limitations, such as a visit limit. (See essential benefits on family insurance side-same for group and private policies.)

Starting in 2014, if insurance companies spend less than 80 percent of their premiums on medical costs, they have to pay a rebate to their enrollees. For health plans that are operating in the large group market, if their medical costs are below 85 percent of the premiums, then they have to pay rebates to their enrollees.

NBC News reports that the average premium for one person making $25,000 a year, after a federal tax credit is applied, will be $145 a month for a Silver plan. For a family of four making $50,000 a year, after a federal tax credit is applied, will be $282 a month for a Silver plan. One person making $46,000 a year or more will receive no tax credit.

There is wide disagreement on loss of jobs as a result of the Affordable Care Act. Concern is raised about companies that will reduce employees or reduce hours of employees to stay below the 50 employee threshold. Part-time employee hours are aggregated and divided by 120 to classify employment numbers. (Essential health benefit requirements are the same for group health policies as private policies.)