Defendant asserts tax beliefs

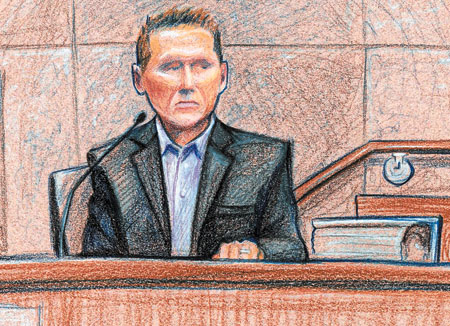

Las Vegas businessman Robert Kahre, who is on trial on charges of evading federal income taxes, this past week spent three days telling the jury his side of the story.

He gave several reasons why he did not pay taxes, including his belief that the Internal Revenue Service is run by foreign agents and that some of the money it collects goes to foreign powers.

Kahre, 48, thinks the treasury secretary, who has oversight of the IRS, is a foreign agent because he plays a role in several international organizations that are not controlled by Congress, namely, the International Monetary Fund and the World Bank.

"The IRS, and who they're collecting for," he testified, "doesn't have anything to do with the people of this country, the common defense and general welfare." The last phrase echoes wording that appears in the preamble to the U.S. Constitution.

Kahre, a 1980 Rancho High graduate, has a folder of letters he solicited for a fee from accountants and lawyers who seem to endorse his theories about government and taxation.

He said he started gathering them while doing research after suffering a corporate bankruptcy in 1992, which he says was precipitated by business partners who cheated him and then disappeared, leaving him holding the bag for past-due federal taxes and other bills. Since then he has structured all his construction-related businesses as sole proprietorships.

But federal prosecutors, when questioning Kahre, suggested that he collected the letters to create the appearance of a genuine belief, which would then provide legal "cover" to avoid indictment and prosecution.

For a tax crime, a jury must establish the defendant's intent to break the law to convict. A mistaken belief about tax law, held in good faith, can be grounds for acquittal.

Kahre, his sister and a former business assistant are charged with tax evasion, conspiring to defraud the government and attempting to interfere with the IRS in connection with a coin-based payroll system Kahre devised.

Judge David Ezra is presiding at the trial of Kahre and three other defendants. Even if acquitted, defendants might still owe taxes, which will not be determined by this trial.

In a session outside the jury's presence, after the judge had heard and denied several motions to dismiss several counts midtrial, the judge said the government's evidence as to Kahre's sincerity is open to interpretation.

Defendants, Ezra said, interpret the evidence to say, "This was simply a businessman who believed in a particular system and was acting on that belief. ... On the other hand, if you look at it through the government prism, the same actions can be viewed as efforts to thwart the tax system."

Prosecutor J. Gregory Damm, while cross-examining Kahre, pointed out an inconsistency in his "foreign agent" belief.

"You kind of pick and choose when you'll deal with the secretary of the Treasury, don't you?" Damm asked.

Then he compared Kahre's refusal to pay income taxes to the IRS against Kahre's choice to deal in gold and silver coins issued by the U.S. Mint, which also falls under the secretary's oversight.

"Mr. Damm, I still have to make a living," is how Kahre justified his decision not to boycott the Mint.

"If you want to take that away from me, too, I don't know what to say."

At the trial's opening, Kahre's attorney, William Cohan, told jurors Kahre is a hero for boycotting the U.S. system of paper money, which is no longer backed by gold reserves.

Kahre buttressed his belief in foreign control of the IRS with another belief, that his workers could be paid in gold and silver coin based on the coins' investment value, but then go by the coins' face value when deciding whether their incomes fell below the threshold that triggers the need to file a tax return.

Kahre considers his workers to be independent contractors, responsible for handling their own taxes. He said that he asked the IRS several times how to handle circulating gold and silver coins for tax purposes but never received an answer.

Kahre used the coins to pay his own workers and those of 35 other local businesses who joined his payroll service.

On payday, workers were free to immediately trade their coins for the cash equivalent to the coins' investment value.

Damm also drew from Kahre that he uses the coins selectively in his personal life, rather than for every payment, which would be a losing proposition in the long term, as a 1-ounce silver dollar is worth about $8 in paper money.

On occasion, Kahre testified, he uses gold and silver coins, at face value, to pay restaurant tips or court fees. But his family does not spend the coins to pay daily expenses such as utility bills or groceries.

Kahre and his attorneys have contended -- ever since his first trial on similar charges in 2007, which ended in a hung jury on his counts -- that Congress created a dual monetary system in 1985 by authorizing the minting of precious-metal coins stamped with dollar values, which are allowed to circulate with paper currency.

Prosecutors last week also ran through a series of legal cases in both Nevada and federal courts since the mid-1990s in which Kahre -- sometimes as defendant, sometimes as plaintiff -- questioned the lawfulness of taxation, his own tax liability and related topics.

Over the years, Kahre has been sanctioned and enjoined from filing what several courts have termed "frivolous" litigation.

Damm asked Kahre on Tuesday, "Did that ever make you question your beliefs, when now for about the fifth or sixth time, a judge ... is telling you your case is meritless?"

No, Kahre answered. Since the lawsuits he filed were shot down before trial, "these issues have never been ruled on," he told Damm.

The present indictment alleges that Kahre's untaxed payroll amounted to at least $25 million over the years in question and that the untaxed payroll of his client companies amounted to at least $95 million.

This week the defense expects to call as witness Wayne Paul, a Texas accountant who provided an opinion to Kahre. Wayne is the brother of Ron Paul, the Texas congressman and one-time presidential candidate.

The defense is also likely to rest its case this week, after which both sides will make closing arguments.

Contact reporter Joan Whitely at jwhitely@reviewjournal.com or 702-383-0268.