Transportation Secretary Pete Buttigieg is expected to attend the ceremony for the Las Vegas-to-Southern California high-speed train system.

When Lisa Rasmussen pulled into the parking lot of Prince Law Group, she knew the deposition would be intense. She had no idea it would turn deadly.

Five people have been arrested in connection with a double homicide committed nearly two years ago.

The balmy ease of the French Riviera inspires this French-Mediterranean spot.

The Las Vegas hotel-casino confirmed the exec will leave the company for a new position.

The county will spend a little over $2 million to purchase several dozen 2024 Ford Mustang Mach-E SUVs.

A Las Vegas casino is bringing a Disneyland staple to the skies above downtown. Here’s when it will begin.

Phish’s wild audio-visual production creats such a heightened sensation you don’t need assistance.

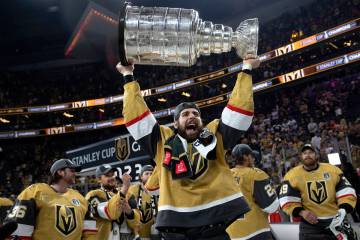

The Golden Knights will begin their quest to win a second straight Stanley Cup on Monday. Check out the full schedule of their first-round series against Dallas.

A 64-year-old woman is facing felony counts of DUI and reckless driving after two pedestrians were killed in a bus stop crash in the east Las Vegas Valley.

People in the building during the shooting deaths of Dennis Prince, wife Ashley and suicide of the shooter, Joseph Houston II, begged 911 operators for police to arrive.

Could there be a Taylor Swift new album rollout without a few additional surprises? No.

Plans include a complete renovation of the casino-resort and further development of 35 unused acres behind it.

The driver’s death marks the 51st traffic-related fatality in Metro’s jurisdiction for 2024.

Generosity: Any act of kindness or support given without expectation of exchange or return from the recipient(s). The game’s biggest stars remain active one month into the NFL offseason. They may not be running drills on the field, but they practice something more important: generosity. Hall of Fame quarterback Troy Aikman and 2022 NFL Man […]

The Asian-inflected wood-fire barbecue restaurant on the Las Vegas Strip has siblings in Manhattan, Miami and Mexico City.

The Golden Knights lost to the Anaheim Ducks in the regular-season finale Thursday at T-Mobile Arena and fell to the second wild-card berth in the Western Conference.

Plans include a complete renovation of the casino-resort and further development of 35 unused acres behind it.

Former NFL star Tom Brady, a minority owner of the Las Vegas Aces, wrote the entry in Time magazine explaining A’ja Wilson’s inclusion on the most influential list.