Why would Congress offer oversight when it can snoop nonprofits?

I'm proud to call Oklahoma home because my home folks may just lead the nation in common sense. I give you the following letter to the editor written by Marguerite in Weatherford, Okla., in one of the statewide newspapers.

Marguerite noted a story about a U.S. senator who "wants to check out all the 'big' televangelists to see if they're spending donor money correctly. We (the public) donate to whomever we choose and if (the senator) wants to check out anything, it should be congressional spending habits! Our tax dollars are confiscated from us and he wants to make sure we're getting our money's worth from free donations? What a crock!"

Heartland common sense. Kudos to Marguerite.

The arrogance of Congress never ceases to amaze me. I've yet to see a call for an investigation of Congress when a member of Congress falls, be it financially, morally or otherwise. Not once have I heard of a call for every member of Congress to bring forth their financial statements or campaign statements in response to the actions of one bad apple.

I'm a little bit perplexed how Congress is so quick to stick its nose into different places. Televangelists driving expensive cars and living in fabulous homes may seem incompatible to some peoples' interpretation of the Scriptures. But I suspect this is more about Uncle Sam not getting what he perceives is his fair share of the offering plate.

This is puzzling for several reasons. These ministries might be misusing parishioners' tithes or offerings. But while we can all speculate on what is or isn't going on in the faith world, we don't need to speculate on what's happening in the financial world.

Congress is sticking its nose into speculation of some evangelists' matters, while everyone in Congress has the facts lying before them regarding the financial shenanigans of Fannie Mae and Freddie Mac. These two taxpayer-supported financial organizations have restated their earnings and skewed their financial statements to an extent that would make any Enron or WorldCom executive blush.

Executives from both companies have resigned under a cloud with billions of dollars unaccounted for. Every member of Congress is well aware of this, yet it has been extremely difficult to get the U.S. Senate to act on reforms.

Every significant voice, including the last two Federal Reserve chairs, the last two HUD secretaries, the last two Treasury secretaries as well as the department within HUD that regulates Fannie and Freddie have said these two companies pose a serious risk to taxpayers and the economic system of the United States.

Indeed, just last week, New York Attorney General Andrew Cuomo, a HUD secretary in the Clinton administration, opened an investigation of Fannie and Freddie over a scandal concerning inflated appraisals.

With all of this for the world to see, one House leader has said he likes Fannie and Freddie the way they are.

We can speculate and hold high-profile public hearings on what we suspect may be happening in the world of televangelism, but we know beyond the shadow of doubt that Fannie and Freddie should have been reformed years ago.

We need a strong regulator who will enforce congressional mandates concerning low- and moderate-income housing goals and to keep Fannie and Freddie within their congressionally mandated boundaries. They have ignored both. They are publicly traded companies that enjoy the benefits of not paying any state and local taxes and the protection of government guarantees if they fail.

Given that, why shouldn't they have to file timely public disclosure statements or abide by the Sarbanes-Oxley Act like every other public company? You deserve to know.

These are on-the-record facts, and your United States Congress is not acting.

Instead, Congress would rather speculate on nonprofits.

I don't stand in blind defense of those who seek donations for tax-exempt organizations. Certainly, from time to time, you'll find a crook in a ministry who has abused the trust of parishioners or donors. Scandals happen where people are involved. There are bad apples in every arena, from business to coaching to teachers and even elected officials. All should be held accountable.

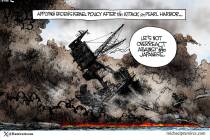

Ironically, those who call for more oversight of television ministries with whom they may disagree are turning a blind eye to the financial elephant in the room. Our modern-day Neros are fiddling while Washington burns.

J.C. Watts (JCWatts01@jcwatts.com) is chairman of J.C. Watts Companies, a business consulting group. He also is chairman of FM Policy Focus, an association seeking reform of government-sponsored enterprises such as Fannie Mae and Freddie Mac. Watts, an Oklahoma representative in the U.S. House from 1995 to 2002, writes twice-monthly for the Review-Journal.

J.C. WATTSMORE COLUMNS