An older motel in downtown Las Vegas has sold, and the new owner has big long-term plans for the site.

The 300-capacity Sinwave fills a live music void in the Arts District with an anything’s-possible ethos.

An executive with more than three decades of experience in Las Vegas, is leaving his position.

One of the bars lies in a sleek Strip hotel, the other off Strip in a longtime locals favorite.

The win was one of several recently across the Las Vegas Valley.

The closing of “Love,” enforced by construction as Mirage turns into Hard Rock Las Vegas, has initiated rumors “Ka” will be the next Cirque production to shut down.

The Golden Knights power play is clicking at one of the highest rates in franchise history entering Wednesday’s Game 2 against the Dallas Stars.

The 100,000-square-foot center, replacing an aging office complex, will include restaurants, culinary kiosks and a covered alfresco dining lounge.

Elected officials are concerned about the impact the plan could have on Nevada elections, which rely heavily on mail service.

The Biden administration issued final rules Wednesday to require airlines to automatically issue cash refunds for things like delayed flights and to better disclose fees for baggage or canceling a reservation.

Kyle Mitrione fractured his C6 vertebrae while performing in “O” on June 28. A new segment had been added to the show two weeks prior, according to the lawsuit.

After just over a year, former Raiders tight end Darren Waller and Aces guard Kelsey Plum have called it quits on their marriage.

The attorney for Duane Davis, a reputed gang member accused of orchestrating the 1996 killing of Tupac Shakur, said his client is not to be believed.

Every year, school children guess when the desert tortoise will emerge from his burrow, marking the beginning of spring.

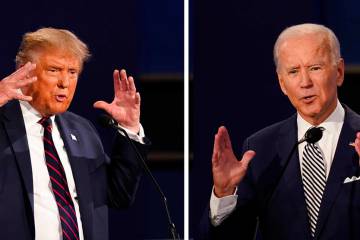

A large field of Republican Senate candidates will face off in the June 11 primary. Here’s where they stand on the border and immigration.

Home Means Nevada—those are three words that every Nevadan knows. Aside from being the title of our state anthem, these words are plastered on bumper stickers, t-shirts and souvenirs across the Silver State. Nevada is renowned for its stunning natural landscapes and bustling entertainment scene and it continues to attract new residents drawn by its […]

Terry Fator is using new architecture at The Strat Showroom to his advantage. That venue is part of the resort’s $125 million overhaul under owner Golden Gaming.

The news comes as the country music star prepares to debut a six-story bar, restaurant and music venue in downtown Nashville this year.

A motorcyclist was killed after a crash with a pickup truck in North Las Vegas.

The reboot of the series that put Las Vegas on the television map won’t live to see a Season 4.