Culinary Union concerned about increasing influence of hedge funds

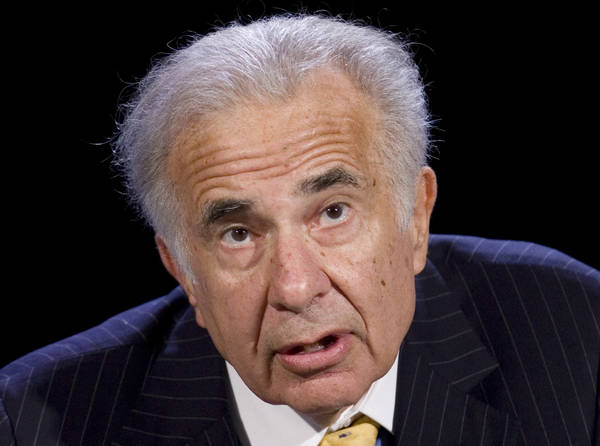

The Culinary union is wary of hedge fund activist Carl Icahn’s growing influence of Caesars Entertainment Corp. and Corvex Capital founder Keith Meister’s influence of MGM Resorts International.

Four union representatives addressed the state Gaming Control Board on Wednesday and submitted letters about their concern about the influence the hedge-fund operatives have with less than 10 percent stock ownership.

The union said that Icahn won three board seats at Caesars and effectively gained the right to select the company’s next CEO in March and that Meister joined the MGM board in January with 3 percent of its stock.

The union fears hedge funds’ short-term investment goals would result in job cuts and understaffing.

“Workers have lived the consequences of mismanagement of the casino industry by Wall Street firms for more than a decade,” said a letter dated Wednesday by Geoconda Arguello-Kline, secretary-treasurer of UNITE HERE Local 226. “In no company is this more apparent than at Caesars under the control of Apollo (Global Management) and TPG (Capital) following the leveraged buyout in 2008. This buyout left the company with a disastrous level of debt and led to a series of financial engineering maneuvers, culminating in a complicated bankruptcy and spinoff of valuable real estate, from which we will be recovering for years go come.”

Analysts have noted that the company already has among the highest margins on the Strip, indicating more cuts are unlikely.

A Caesars spokesman had no comment on the union presentation.

Apollo and TPG sold off their remaining shares in Caesars in March after being invested in the company for 11 years, setting the stage for Icahn to increase his holdings in the company and dictate appointments of two board seats.

TPG and Apollo completed their nearly $30 billion acquisition of Caesars, then called Harrah’s, in January 2008 as the Strip thrived amid an economic boom.

But the party would end a few months later when Lehman Brothers filed for bankruptcy, unleashing the worst U.S. economic downturn since the 1930s.

The private equity firms loaded Caesars with debt to make their purchase, leaving the casino operator vulnerable when the economy crashed in 2008.

Caesars filed for bankruptcy in 2015 and emerged two years later when the private equity firms agreed to spin off some of the company’s properties into a real estate investment trust owned by the debtors.

TPG and Apollo held about 16 percent of Caesars when the company exited bankruptcy in October 2017.

Alber Mora, a baker at Caesars Palace for 10 years, told the board Wednesday that while he was not laid off, the constant juggling of schedules resulted in some departments being short-handed, affecting daily work schedules.

“I call what is happening now deja vu because we are simply going down the same road again,” Mora said. “The industry is healthy. We see lots of people in the casinos. There are new open restaurants, and business is healthy, but the top decision-makers are not making good choices, instead they want to cut to the root.”

The board, meeting in Carson City and taking comments via closed-circuit communication from Las Vegas, accepted the letters but couldn’t discuss or act on the submittals.

The union and Caesars signed a five-year labor agreement a year ago binding the company to its contract negotiated with the union.

A spokeswoman for MGM Resorts International had no comment on the union presentation. The company sought Meister to join the board, seeking his expertise on hedge-fund practices.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.