Gaming stocks up, unaffected by debt ceiling concerns

What debt ceiling?

Gaming industry stocks seemed to be shielded from concern about raising the federal debt ceiling, an issue that has made investors in other sectors somewhat skittish.

Nine of the 10 gaming industry stocks followed by Las Vegas-based financial consultant Applied Analysis showed increases in their average daily share prices during July, including doubled-digit jumps by casino operators MGM Resorts International, Las Vegas Sands Corp. and Wynn Resorts Ltd. Boyd Gaming Corp. saw its average daily stock price climb 9.94 percent.

Slot machine maker International Game Technology's average price per share increased more than 9 percent during the month.

"The gaming sector generated a level of investor interest that hasn't been witnessed in months," Applied Analysis partner Brian Gordon said in a report to the firm's clients.

Gordon said gaming stock prices were helped by several factors.

The Las Vegas market reported stronger-than-expected gaming and tourism figures during the month.

Meanwhile, the second-quarter earnings reports from Las Vegas Sands and Wynn showed Macau as the dominant source of revenue for the companies, but their Las Vegas properties also showed signs of recovery.

Gordon said increases in the average price per day could have been higher.

"The upward pressure on prices began to subside only in the final days of the month under looming federal debt ceiling concerns and uncertainty in broader national economic conditions," he said.

Slot machine maker WMS Industries was the only company to suffer a decrease in its average daily stock price during July. The company's shares took a hit back in April when its first-quarter earnings came in far below Wall Street expectation.

WMS, which has corporate headquarters in Illinois, will report second-quarter earnings on Thursday.

Morgan Joseph gaming analyst Justin Sebastiano said WMS might see a boost in revenues from its slot machines. The company shares in gaming revenues with casinos.

"According to the U.S. monthly gaming revenue that we compile from various state gaming commissions, the June quarter was the fourth consecutive period of year-over-year growth," Sebastiano told investors. "We believe this positive momentum augurs well for WMS along with the launch of new titles. This gives us confidence that our daily yield expectations are achievable and may perhaps even prove conservative."

Sales for slot machine makers slowed over the past years due to the recession. Casino operators have been slow to spend money on the machines or gambling equipment. The largest investments have been in slot machine management systems.

Bally Technologies, which on Thursday announced a deal to place a slot machine system in the casino at New York's Yonkers Raceway, also struck slot system agreements with Caesars Entertainment, South African-based Sun International and two Canadian lotteries.

IGT's third-quarter earnings showed a 3 percent increase in revenues, but a 5.6 percent decline in net income. Still, Gordon said the company impressed investors by completing its purchase of a Swedish online gaming company that will enhance the company's Internet gambling portfolio in legalized European jurisdictions by adding poker, sports bets and bingo.

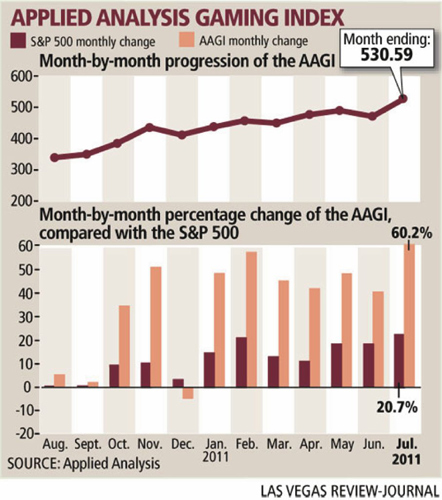

The positive stock figures helped the Applied Analysis Gaming Index, which takes in more than 300 market variables, increased almost 60 points, to 530.59. Gordon said the latest valuation reflects levels not reported since February 2008.

"The climb into positive territory far outpaced movements in the broader markets," Gordon said.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.