Indian casino revenue slides 1 percent in 2009

Revenues produced by America's Indian casino market suffered the same fate as the rest of the industry.

Indian gaming revenues declined 1 percent in 2009, the first time the market ever experienced a year-over-year loss.

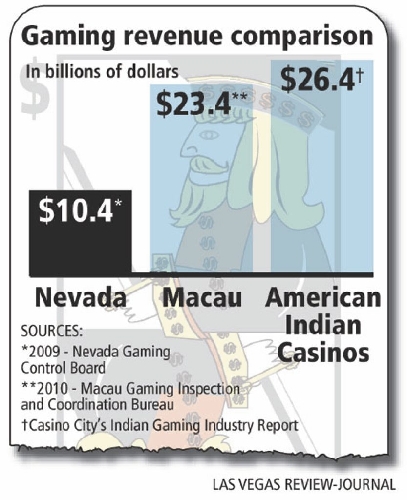

According to the annual Indian Gaming Industry Report, produced by Southern California economist Alan Meister for publisher Casino City, the $26.4 billion collected by the nation's 446 Indian casinos in 28 states was down from $26.7 billion collected by Indian casinos in 2008.

But the roughly $300 million decline might seem somewhat paltry in comparison to other markets.

In 2009, Nevada gaming revenues fell 10.4 percent to $10.4 billion compared with 2008, the largest single-year decline in state history. Nationwide that year, gaming revenues of $30.74 billion fell 5.5 percent in the 13 states where commercial casinos operate.

Meister's 200-page report is a comprehensive look at the Indian casino market, which has seen revenues increase from $121 million in 1988 to a $26 billion-a-year industry following the passage of the Indian Gaming Regulatory Act. In the past 10 years, Indian gaming revenues have increased more than 10 percent nationwide.

But the 2009 decrease showed Indian gaming is not recession-proof.

"The general slowdown in the U.S. economy certainly was a factor," Meister said. "But we did see some states where newer market had a higher stage of development and they were much more productive."

Of the five top Indian gaming revenue-producing states, two markets were down year-over-year, including California. The state's 66 Indian casinos had gaming revenues of $6.95 billion in 2009, a decline of 5.3 percent and the second straight annual decrease.

The figure is down from California's 2007 peak of $7.77 billion in gaming revenues.

California accounted for more than 26 percent of all the Indian gaming revenues produced nationally while the top five states were responsible for 61 percent of all revenues.

"The state's economy was a contributing factor, but there is room for potential development and that's something we might see," Meister said.

Several California Indian tribes signed new gaming compacts with the state in 2008, which would allow for additional slot machines and increased casino floors. But the tribes held back on expansion plans because of the economy. Meister said that might change if the state's economy and other economic indicators improve.

While California was down, other midsized Indian gaming markets helped make up for the losses.

Gaming revenues for Washington's tribes grew 11 percent, revenue for Florida's Indian casinos increased 10.4 percent, and Oklahoma's gaming market grew almost 7 percent.

Meister said the increases were due to several factors, such as switch in gambling products from video lottery terminal-type games to more traditional Las Vegas-style slot machines and the addition of table games.

In 2009 only four new Indian casinos opened nationwide while nongaming revenue spending declined 4 percent to $3.2 billion.

Indian casinos generated 44 percent of all the nation's gaming revenues in 2009 when Meister combined the figures with revenues produced by commercial casinos (46 percent) and racetrack casinos (10 percent).

"Indian gaming continued to gain ground and may overtake the commercial casino segment in the near future," Meister said.

Nevada and several regional casino markets showed slight upticks in 2010, which gave Meister some cause to believe Indian casinos might see a slight turnaround when he files his next report.

"Despite the downturn, the future outlook for Indian gaming remains positive," Meister said.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or

702-477-3871.