Lucky Dragon auction in Las Vegas gets no takers at $35M

The Lucky Dragon’s main lender foreclosed on the shuttered resort Tuesday, opening a new chapter in the Las Vegas hotel’s short but troubled history.

San Francisco developer Enrique Landa’s Snow Covered Capital took ownership of the 2.5-acre property at a foreclosure auction. The opening bid was $35 million, but no one made an offer above that price.

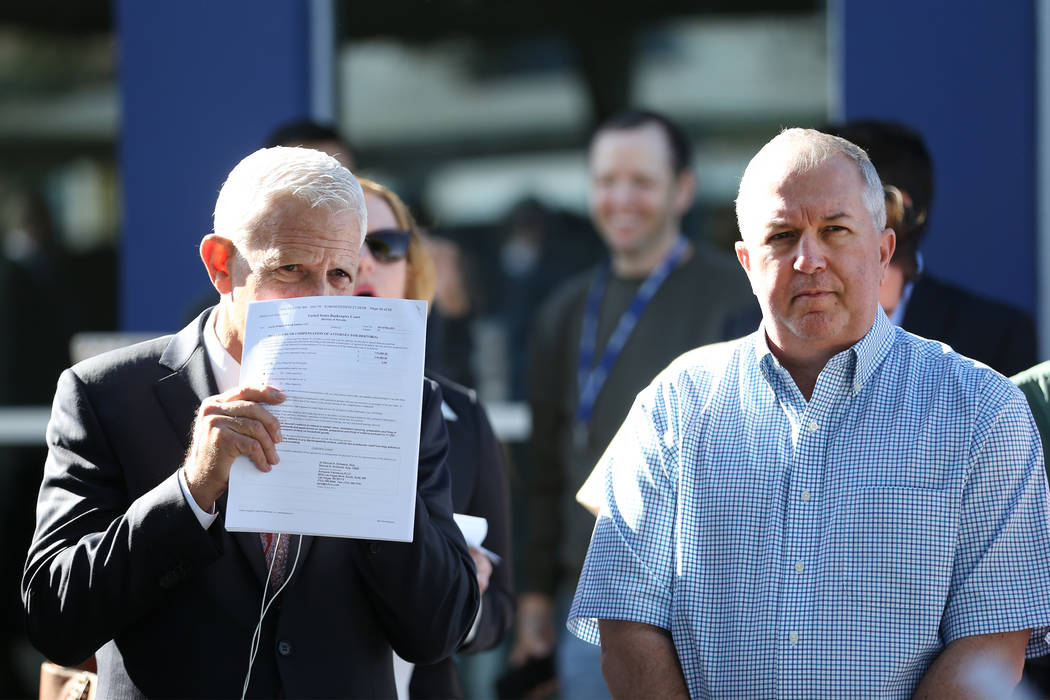

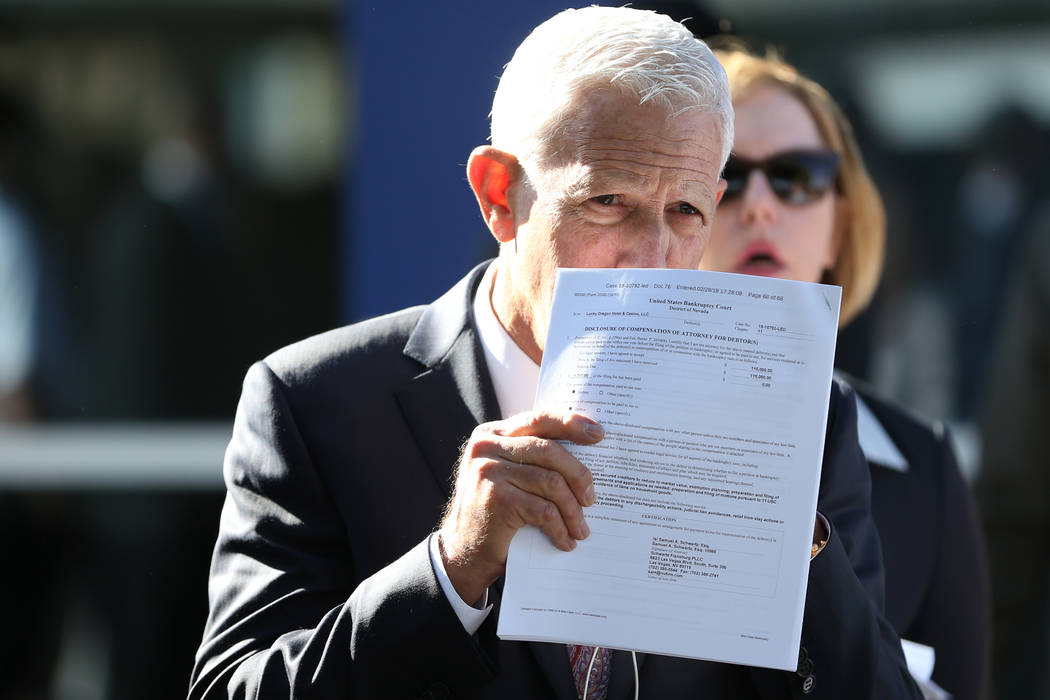

“Going once, twice … not hearing anything from anybody in the crowd, the property is hereby sold” and “reverts back to the (lender),” said auctioneer David Bark, foreclosure trustee and underwriting counsel at First American Title Insurance Co. “Thank you all for attending.”

The auction was held in the parking lot of the Nevada Legal News building, 930 S. Fourth St. near Charleston Boulevard. Around 50 people attended.

The Chinese-themed Lucky Dragon, 300 W. Sahara Ave., opened less than two years ago and was the first hotel-casino built from the ground up in Las Vegas since the recession. Its demise was perhaps the fastest in decades.

^

‘It’s going to reopen someday’

Landa, a partner with Associate Capital, told the Las Vegas Review-Journal after the auction that the 203-room Lucky Dragon “is a very well-built property” but “did not have the right business plan.”

“We think it has a bright future, and in the hands of the right operator, I think this will be very successful,” Landa said.

Asked when it could reopen, he said, “I don’t know.”

Lucky Dragon developer Andrew Fonfa, founder of ASF Realty &Investments, declined to comment Tuesday.

Michael Brunet, a consultant for Snow Covered Capital, acknowledged a few weeks ago that casino owners rarely acquire their properties at repo sales, where a buyer might have to peel off tens of millions of dollars in cashier’s checks for a property like the Lucky Dragon.

He said Tuesday that the off-Strip hotel-casino was “marketed very extensively” before the auction and that more than 80 prospective buyers signed nondisclosure agreements.

Ultimately, the repossession was “not an unexpected outcome,” Brunet said.

“We’re going to find a new owner for it. It’s going to reopen someday, and it’s going to be a very successful property,” he said.

Prospective buyers now have more time to study the property, arrange financing and come up with a business plan, according to CBRE Group broker John Knott, head of the firm’s global gaming group, who is working with Landa’s group to sell the resort.

Fast flameout

The Lucky Dragon opened in November 2016 with its hotel and casino in separate buildings. But the resort, which struggled to draw big crowds, closed its casino and restaurants in January, faced foreclosure soon after and filed for bankruptcy in February.

Its swift demise was finalized in early October when the nine-story hotel tower closed and the property was sealed off with chain-link fencing.

There were signs of financial troubles even before it opened. Las Vegas City Council members, acting as heads of the city’s redevelopment agency, in November 2015 rejected the idea of doling out $25 million in subsidies that the developers wanted for the project.

Fonfa’s group warned they might have to slow or stop work without the help. It was the first time many city leaders could remember even discussing the possibility of propping up a casino with public money, the Review-Journal reported.

The developers later obtained loans from Snow Covered Capital. By the time Fonfa pushed the Lucky Dragon into bankruptcy, Landa’s group was owed almost $50 million.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.