Web gaming bills help ignite some gaming stocks

Approval of Internet gaming bills in Nevada and New Jersey less than a week apart helped fuel investors’ interest in the gaming industry during the last half of February.

The largest beneficiary was Caesars Entertainment Corp.

Nevada and New Jersey began implementing online gaming websites directed at customers gambling on computers or mobile devices within state borders.

Gov. Brian Sandoval signed Nevada’s interactive gaming bill Feb. 21 after less than one day of debate. Not to be outdone, New Jersey Gov. Chris Christie signed his state’s online gaming bill Tuesday after state lawmakers approved changes suggested by the governor when he vetoed the initial legislation.

Caesars owns four of Atlantic City’s 12 casinos. In Las Vegas, Caesars operates 10 casinos on or near the Strip.

But the company also owns the popular World Series of Poker.

During February, the average daily price per share of Caesars Entertainment rose 46 percent, based primarily on the speculation surrounding Internet gaming in Nevada and New Jersey.

“(Caesars) already has ... experience operating online gaming internationally,” Moody’s gaming analyst Peggy Holloway said. “Additionally, Caesars has a relationship with 888 Holdings, a popular online gaming entertainment and solutions provider.”

Only four casino operators of the 12 publicly traded gaming companies followed by Las Vegas-based investment firm Applied Analysis experienced a decrease in their average daily stock prices during February.

Slot machine manufacturer WMS Industries saw its average daily stock price jump almost 40 percent in February, but that was because of the company’s announced $1.5 billion buyout by lottery equipment provider Scientific Games.

The anticipation over Internet gaming drew the attention of investors.

“While there are still a number of regulatory and logistical issues to be addressed, it is clear the industry is well positioned to take advantage of increased technological capabilities of this emerging sector,” Applied Analysis principal Brian Gordon told the firm’s clients in a research report Thursday.

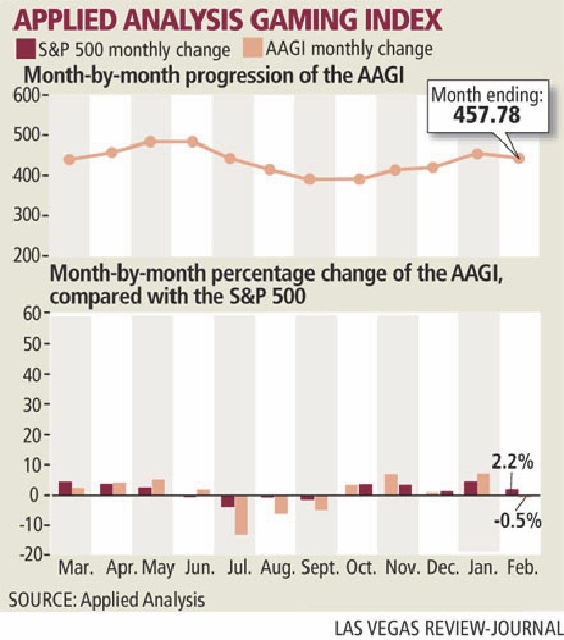

The Applied Analysis Gaming Index, which takes into account more than 300 market variables, fell 2 points to 457.78. A 1.2 percent decline in the average price per share of Wynn Resorts was a primary contribution to the Index’s loss.

Also Thursday, MGM Resorts International announced its MGM China subsidiary will make semiannual dividend payments not to exceed 35 percent of the businesses’ anticipated annual profits.

MGM Resorts owns 51 percent of MGM China . MGM China’s board announced a special dividend of $500 million, to be paid to shareholders March 18 .

Deutsche Bank gaming analyst Carlo Santarelli said the dividend would be viewed positively by shareholders because it provides MGM Resorts with a stable stream of cash that would further bolster the company’s balance sheet.

Contact reporter Howard Stutz at hstutz@reviewjournal

.com or 702-477-3871. Follow @howardstutz on Twitter.