Home price increase eludes Las Vegas

Home prices around the country rose in August in half of major cities measured by a private survey, a sign that prices are stabilizing in some hard-hit portions of the country.

The Standard & Poor's/Case-Shiller index showed Tuesday that prices increased in August from July in 10 of the 20 cities tracked. That marked the fifth straight month that at least half of the cities in the survey showed monthly gains.

Las Vegas was not among them. Home prices in Las Vegas have hit their lowest point since the housing bust more than four years ago. Cleveland, Detroit, Phoenix and Tampa are also at the bottom of that pile.

While the Case-Shiller report is good news for the overall housing market, the reality is Las Vegas home prices are not ready to be compared in the national light, said Dennis Smith, president of Home Builders Research.

"It's good to see an uptick in pricing anywhere -- I don't care where it is -- because it indicates the national economy is improving," Smith said. "The hotel industry, I'm sure is happy to hear that. We're not going to see an increase in pricing until we see some sort of firm results on inventory. We need to get rid of it. We're working through it."

The Greater Las Vegas Association of Realtors showed 21,866 single-family homes available for sale on the Multiple Listing Service in September, a 3.8 percent decrease from a year ago. Inventory peaked at more than 24,000 in 2007.

"A lot of economists think it's a five-year cycle and last year they said we're halfway through it," Smith said. "I think the five-year cycle has transgressed to a seven-year cycle and we're still halfway through it based on inventory."

The biggest price increases were in Washington, Chicago and Detroit. The greatest declines were in Atlanta and Los Angeles.

Home Builders Research reported a median Las Vegas resale price of $107,000 in August, down 12 percent from the same month a year ago. The median climbed to $108,100 in September.

Home prices have stabilized in coastal cities over the past six months, helped by a rush of spring buyers and investors.

The August data provides a "modest glimmer of hope" that some areas may have bottomed out and could be turning around, said David Blitzer, chairman of S&P's index committee.

He noted that cities in the Midwest -- Chicago, Detroit and Minneapolis -- have shown some strength since May.

In Detroit, the recovering auto industry has helped lead a small rebound in the housing market. Home prices have risen 2.7 percent since August 2010, making it one of only two cities to show a year-over-year gain in that time. The other was Washington.

In Minneapolis and Chicago, fewer homes are being put up for sale, leading to higher prices and better sales figures. That's likely because of fewer foreclosures in those cities.

Robert Shiller, co-founder of the index and a Yale economics professor, told CNBC that overall prices were "flat" and a recovery is not on the horizon.

The index, which covers half of all U.S. homes, measures prices compared with those in January 2000 and creates a three-month moving average. The August data are the latest available.

Prices are certain to fall again once banks resume millions of foreclosures. They have been delayed because of a yearlong government investigation into mortgage lending practices.

Many people remain reluctant to buy more than two years after the recession officially ended. Even the lowest mortgage rates in history haven't been enough to lift sales.

Some can't qualify for loans or meet higher down payment requirements. Many with good credit and stable jobs are holding off because they fear that home prices will keep falling.

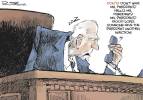

In his visit to Las Vegas Monday, President Barack Obama laid out his Home Affordable Refinance Program, or HARP, that will allow homeowners with up to 25 percent negative equity in their home to refinance. Mortgages must be backed by Fannie Mae or Freddie Mac.

That's not going to solve the problem of excess housing supply in Las Vegas, Smith said.

"Politicians are trying to do what they do, which is get votes by promising new programs that sound good and I hope they work, but the logistics are so big and so large, you still have to address the inventory in Las Vegas and Phoenix. You've got to keep people in their homes. We can't have more inventory."

In Las Vegas, roughly 70 percent of sales are foreclosures and short sales. The large number of unsold homes and foreclosures are sending prices lower and hurting sales.

The Associated Press contributed to this report.