This generation sees homeownership success in Vegas, but lags nationwide

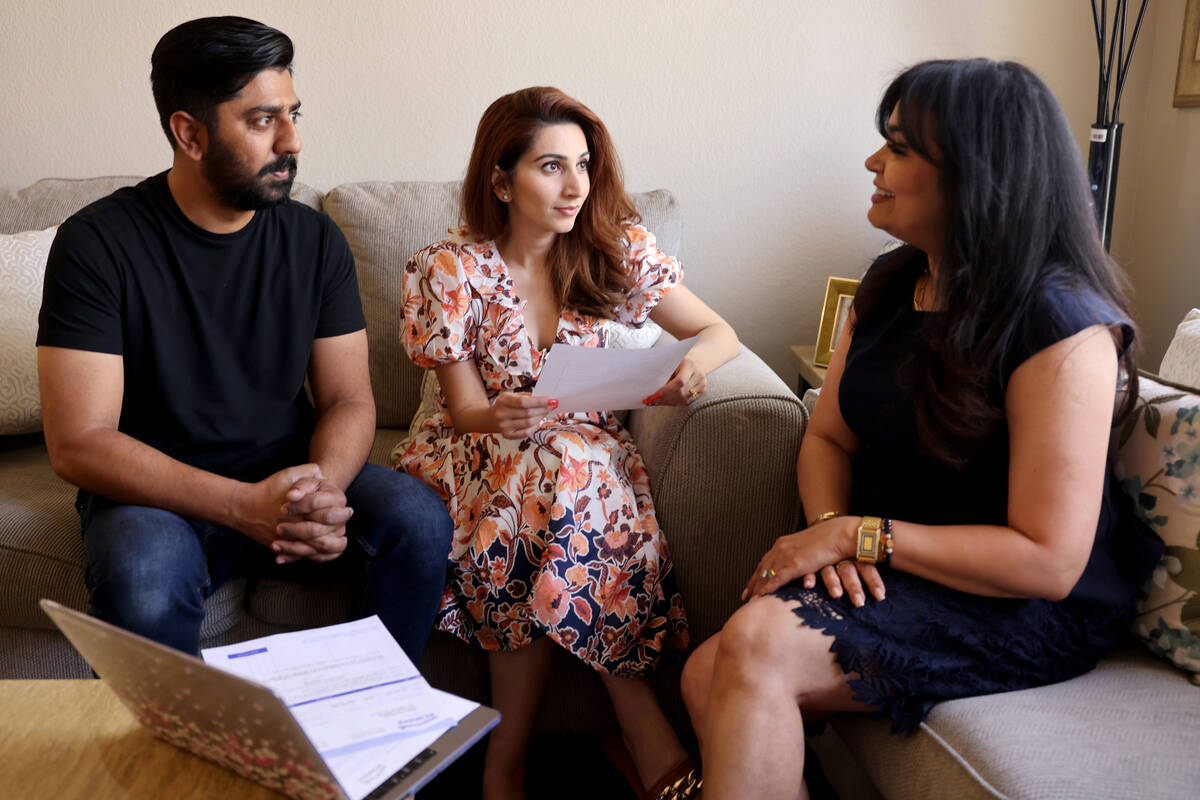

Rahul Sodhi, a Las Vegas lawyer, and his wife, fashion designer Rupali, are in the process of purchasing a new home in the Las Vegas Valley.

The couple, in their early 30s, have an income that would allow them to put a downpayment on a home in The Lakes, but the house they wanted already had multiple offers. It wasn’t the first time that they have come close, yet failed, to buy a home.

Rahul Sodhi said it has been a challenge purchasing a house because prices are much higher, which makes it difficult to save for a down payment, compared with 10 or even 20 years ago.

“Everbody could afford a house back then,” he said. “Today, it’s so hard to save money. Even a smaller house is a challenge to save for.”

It’s a central piece of the classic American dream and possibly the most defining element of economic freedom — homeownership. Baby boomers thrived economically because of the wealth they built with the support of federally financed home mortgages, and today’s adults want their slice of the economic pie.

But a large portion of those born between 1981 and 1996 are finding it challenging to achieve that dream because of college debt, limited savings and the rising cost of housing — though a recent homeownership study shows millennials have made progress.

“It has been quite a bit of a struggle,” said Supriya Mirchandani, a broker at M Realty and the Sodhis’ Realtor. “One of the biggest financial challenges millennials have is paying off their student loans. I feel they’ve been set back generationally.”

The Las Vegas area saw the second-highest increase of millennial homeowners among the largest U.S. metro areas between 2017 and 2022, but the growth rate was still below the national average, according to Apartment List.

It reported a 157.7 percent increase in homeownership among millennials in the Las Vegas metro area — trailing behind Richmond, Virginia, which ranked No. 1 with millennial homeownership increasing by 234 percent over a five-year period ending in 2022.

Yet the homeownership rate in Las Vegas is 42 percent, 9 percentage points below the national average of 51.5 percent. When members of Generation X were the same age as today’s millennials, their homeownership rate was 58 percent, the report said.

“For years, I’ve been promoting that millennials are the next big market,” said Lee Barrett, president of trade association Las Vegas Realtors. “Millennials have run into so many obstacles. They couldn’t get jobs out of college, and they’ve faced so many obstacles other generations hadn’t faced. They were right in the middle of the Great Recession, unemployment, the pandemic and all of those other issues.”

Uphill battle

Retiring boomers are banking on a new generation of homebuyers to purchase their homes, but younger buyers are facing higher mortgage rates, inflationary trends and a great deal of economic uncertainty.

The average rate on a 30-year fixed-rate home loan rose to 6.43 percent from 6.39 percent last week, mortgage buyer Freddie Mac reported Thursday. A year ago it averaged 5.10 percent.

“The 30-year fixed-rate mortgage increased modestly for the second straight week, but with the rate of inflation decelerating, rates should gently decline over the course of 2023,” Sam Khater, Freddie Mac’s chief economist, said in a news release. “Incoming data suggest the housing market has stabilized from a sales and house price perspective. The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.”

The latest numbers posted by the Las Vegas Realtors show home prices in Southern Nevada have remained stable.

The median sales price of existing single-family homes in March was $425,000, nearly the same in February but down 7.6 percent year over year.

The number of houses on the market without offers was 4,196 in March, a decline of 10.1 percent from February and up 109.3 percent from March of last year.

The median price of condos and townhomes sold in March was $260,000, up 2 percent from the previous month but down 3.7 percent year over year.

A total of 1,103 condos and townhomes were listed without offers in March, a decline of 4.5 percent from February and up 179.9 percent year over year.

“Houses have become much less affordable, and rising interest rates have exacerbated that problem,” Jeremy Aguero, principal at Las Vegas-based research firm Applied Analysis, said. “Millennials have a higher propensity to work many jobs. You see folks who are Uber drivers. Plus, they’re relatively young in their careers, so their earning level tends to be less than their older counterparts.”

John Blackmon, founder of Las Vegas-based Blackmon Home Loans LLC, said debt such as student loans can affect the ability of millennials to buy homes, cars and other significant items.

“A lot of them have two car loans, credit card debt and student loans, and that hurts their ability to get home loans,” Blackmon said.

“The last 12 months (interest) rates have basically doubled for homebuyers and have had a chilling effect on home sales. I believe that home sales are down for people who own mortgages, but there are still a lot of cash buyers in the market.”

Meantime, the Sodhis remain hopeful.

“Definitely we’ll find a house,” Rahul Sodhi said. “I’m not frustrated, but the process is frustrating. At the same time, I’m positive we’ll find a house that suits our needs.”

Contact Dave Berns at dberns@reviewjournal.com. Follow @daveberns2 on Twitter.