Valley home prices tumble to 2001 levels

Las Vegas home prices have retreated to 2001 levels, although two-thirds of the homes being sold now are foreclosures, housing analyst Larry Murphy of SalesTraq said Wednesday.

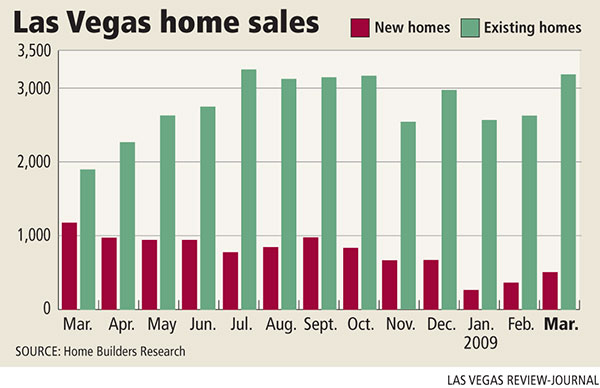

SalesTraq reported a median existing-home price of $134,900 in March, a 41.3 percent decline from the same month a year ago. Existing-home sales during the month increased 85.6 percent to 3,626 recorded closings.

It's the same trend Murphy has seen for the past 11 months: rising sales and declining prices.

Murphy said 66 percent of existing-home closings in March were bank-owned homes with a median price of $127,000. The remaining closings were regular transactions at a median price of $149,900.

"We did have more bank dispositions than bank acquisitions," he said. "It's only happened once since January 2007, but it happened. I had friends calling me saying, 'Don't get too excited because a second wave is coming.'"

New-home sales in March narrowly exceeded depressing numbers from January and February, said Dennis Smith, president of Las Vegas-based Home Builders Research. He counted 491 new-home closings during the month, bringing the first-quarter total to 1,132, a 61 percent decline from a year ago.

"Whew," Smith said. "There isn't much more to say about that."

He believes the first quarter will be the bottom and that quarterly sales will gradually rise for the rest of the year, not enough to declare a "turnaround," but sufficient to show the new-home segment has stopped declining.

The median price for a new home in March was $220,000, down 21 percent from a year ago but just $100 less than the previous month, Home Builders Research reported.

Robyn Yates, vice president of Windermere Real Estate in Las Vegas, said home sales will continue to be strong as long as the foreclosure inventory exists. She expects to see more short sales, or homes sold for less than the mortgage balance, as bank-owned homes are taken off the market.

The Mortgage Bankers Association forecasts a steady increase in home sales beginning in the second quarter. Annual sales will go from 4.34 million units in the first quarter to 5.11 million by the end of the year. The median price is down 15 percent from its 2006 peak. Most forecasts show median home prices will continue to fall in the second quarter then turn slightly positive.

"We won't know we're at the bottom until we're on the other side, but it feels like we're there," Yates said. "Buyers are coming out of the woodwork. Banks are getting multiple offers on any REO (real estate-owned) home under $300,000."

New-home building permits remained under 500 for the seventh straight month at 233, Home Builders Research Reported. The first-quarter total of 551 permits is down 51 percent from a year ago.

Smith said he expects to see monthly permit numbers rise a little by the middle of summer.

The slowdown in building is not necessarily bad since there is still too much new-home supply on the market, according to a report from Hanley Wood Market Intelligence.

"Builder sentiment perked up significantly in April which leads us to believe that conditions may be improving in the new-homes market," the report said. "However, slower economic activity will continue to weigh on a housing recovery going forward. Additional foreclosure activity could also weigh heavily on home prices going forward."

With home prices at $135,000 and 30-year mortgage rates below 5 percent, Murphy wonders how anyone can doubt that it's a good time to invest in residential real estate.

"Experienced investors realize that you don't have to buy exactly at the bottom of a market, you only have to buy near the bottom, which is undoubtedly where we are today," Murphy said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.