Las Vegas developer closes $80M deal for Strip parcel

After the coronavirus outbreak upended daily life, turning the Strip into a ghost town of shuttered casinos and boarded-up buildings, Las Vegas developer Brett Torino said he started talks to buy a site for another project in the eerily quiet resort corridor.

A year or so later, Torino has now acquired a small plot in CityCenter for a huge sum with plans to build a retail complex. And with vaccines rolling out, and daily life starting to return to normal, Southern Nevada’s once-crushed tourism industry has started rapidly coming back to life.

“You’re seeing this recovery play out really quickly in this market,” Torino said.

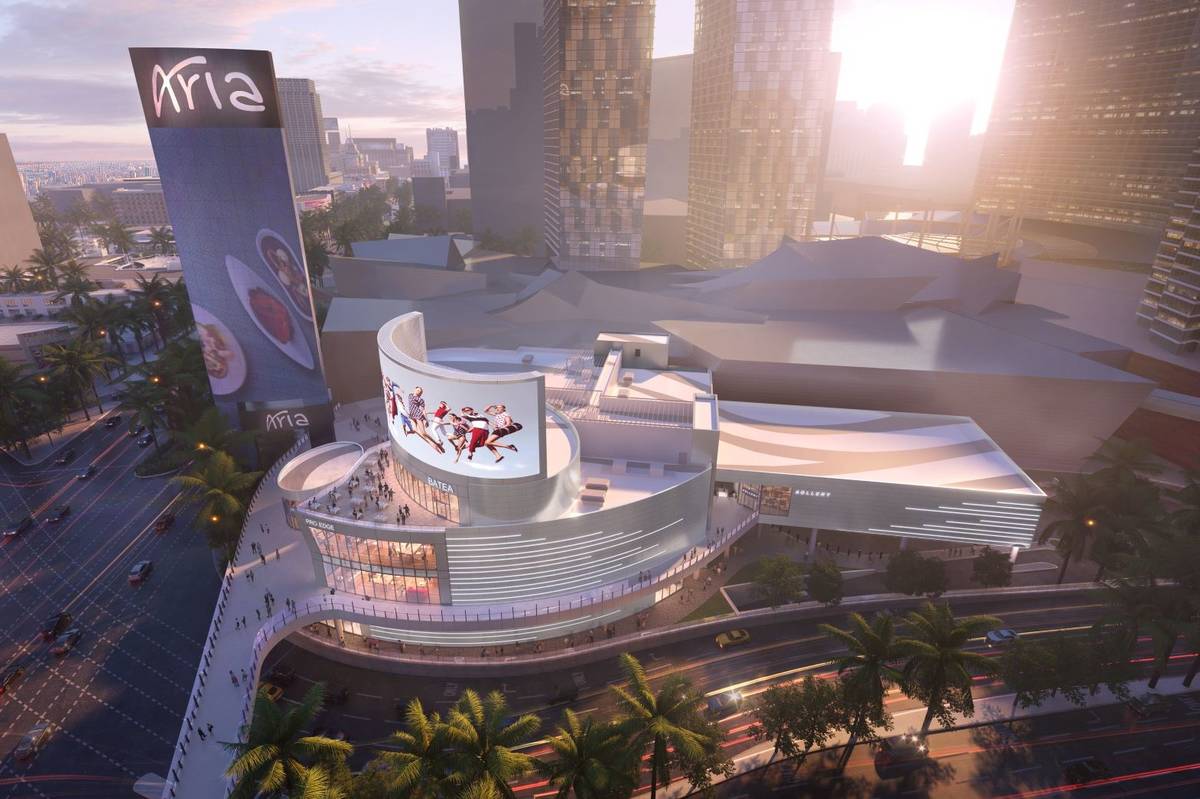

Torino and New York developer Flag Luxury Group partnered on a deal, announced April 26, to acquire 2 acres at the southwest corner of Las Vegas Boulevard and Harmon Avenue, next to luxury mall Shops at Crystals, for around $80 million.

The sale — by MGM Resorts International and its partner in the sprawling CityCenter complex, government-owned holding company Dubai World — closed June 8, property records indicate.

The site was home to the now-dismantled, structurally flawed Harmon hotel tower and is across the intersection from Harmon Corner, a three-story retail complex that Torino and Flag Luxury developed about a decade ago.

Torino, owner of Torino Companies, said in an interview Tuesday that the new four-level project would span around 200,000 square feet and that he expects to open it by September 2022.

He is calling it Project63, saying he and Flag Luxury boss Paul Kanavos were both 63 years old when he named it but noting it could change.

Torino, who started working in Las Vegas’ real estate industry when he moved here in the early 1970s, sat down with the Review-Journal to discuss his newest plans for the Strip.

The interview was edited for length and clarity.

Did MGM put any restrictions on what you can do at the site?

We actually designed it hand in hand with all the folks at MGM and their partner, the Dubai group. CityCenter is a beautiful complex; they just wanted to be sure that what was on their doorstep was complementary to the rest of the facility. We bought it for that reason, and we completely respected it for that reason.

What else got you interested in the site?

I’ve been doing business on the Strip now for almost 30 years. Once you learn the business down there, it’s intriguing. It’s one of the most competitive real estate markets in the world. You’re dealing with people who are razor sharp. When COVID hit — I’ve known (MGM President and CEO) Bill Hornbuckle for 40 years now — I asked Bill, is there an opportunity to do something on your site? He put me in touch with their partner at Dubai World, and we started a discussion. I never thought MGM would sell it. I just figured it was part of the CityCenter complex, and I thought they would want to retain control of it.

Obviously, you didn’t get a discount on the deal; it was around $40 million an acre, which might be a record for a vacant property on the Strip. Talk about the purchase price and what that reflects.

Truth be told, there’s not a usable 2 acres on that site. However, the offset is, you have the whole underworld of CityCenter below that property. So, yes, a lot of money, yes, you’re not getting a usable 2 acres, but you have a whole bunch of infrastructure on the ground level – distribution facilities, trash facilities, parking, utilities. It’s part of a massive complex that we were getting plugged into.

Listing broker Michael Parks told me that not only can you lease out retail space at the site, but you can sell advertising space outside the building, like you do on the big LED screen at Harmon Corner. Is that something you plan to do at this project?

The existing board at Harmon Corner is about 18,000 square feet. This board, at Project63, will be between 5,000 and 6,000 square feet. The vision was, we’ll have two spectacular LED screens, so we have the ability to leverage our national customers and run advertising that’s parallel.

So you can sell space at the same time on both corners?

Absolutely.

Can you talk about the tenants you hope to get at Project63? Would they be luxury retailers, like at Crystals, or more affordable shops?

It’s going to be one step up from Harmon Corner and probably a step down from Crystals. Harmon Corner is and was very successful for the tenant base that we have in there. Project63 is going to be an upgrade, but we don’t want to compete with Crystals. We’re over 50 percent preleased on 63 already, but I can’t start going into the names.

Long before the pandemic, brick-and-mortar retail was having a pretty hard time around the country, including in Las Vegas. Why does the Strip seem so different? Is it just because you have some many people walking around every day?

That’s one aspect of it. Retailers want flag opportunities on the Strip. They want that exposure; they’re willing to pay for it. During COVID, if you went into Crystals and looked at the luxury brands, there were lines of people waiting up to an hour, an hour and a half to get in the stores to shop. The average Las Vegas customer is going to come here, they’re going to spend those retail dollars. It’s just the nature. Las Vegas isn’t going away. COVID didn’t change it.

It certainly shut it down for a while.

Sure did. Absolutely. All our tenants stayed open on the Strip, but of course we had to give them help and we wanted to do whatever we could for them. But they’re coming back strong. In the worst of times, they were somewhere between a third and a half of their usual sales. Now their sales are back up to 2019 levels.

Did you ever take a walk or a drive along the Strip when everything was shut down just to see what it looked like? What do you remember thinking?

I hope we don’t see another one of these. It’s eerie. In a very surreal sense, it’s very beautiful, but as a businessperson, it isn’t very beautiful. I rode my bicycle up and down the Strip; it’s just a very eerie event.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.