Local economic index edges down 0.3 percent

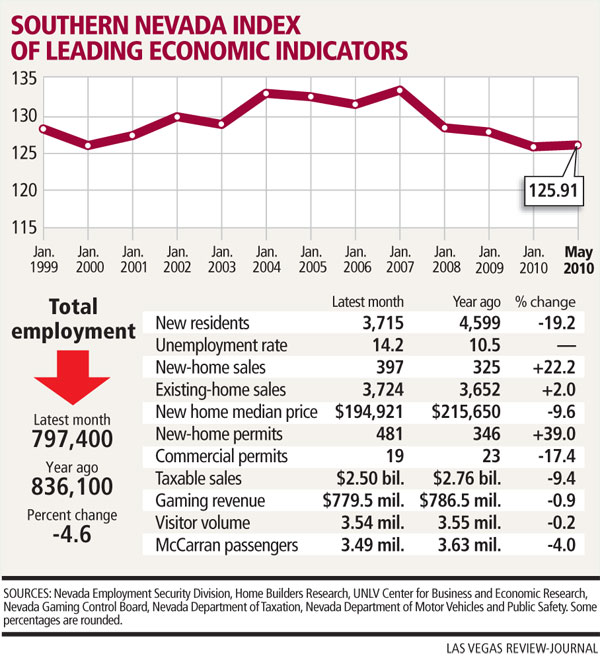

The Southern Nevada Index of Leading Economic Indicators dropped by less than 0.3 percent in May to 125.91, the UNLV Center for Business and Economic Research reported.

The index has been hovering around that level for the past year after peaking near 135 in 2007. It's down from 126.83 in the same month a year ago.

That the index remains flat suggests that it may be some time before the local economy sees a general increase in activity, said Mary Riddel, executive director of the research center and economics professor at University of Nevada, Las Vegas.

"We appear to have reached bottom, but there's no suggestion we're going to turn up from the bottom," Riddel said Tuesday. "We're out of the recession in terms of gross domestic product, but the unemployment rate is very high in the United States. A lot of people don't have jobs and just aren't spending."

Commercial building permits, taxable sales, gasoline sales, gaming revenue and convention attendance all dragged the Southern Nevada economic index down.

Offsetting those were modest month-over-month growth in residential building permits, McCarran International Airport passengers and visitor volume. Residential permitting activity increased 53 percent to 740 units in March, though it remains down 3 percent from a year ago, Riddel noted.

The economic index, compiled by the UNLV research center, is a six-month forecast from the month of data, based on a net-weighted average of each series after adjustment for seasonal variation. May's index is based on March data.

The accompanying chart includes several of the index's categories, along with data such as new residents and employment and housing numbers, updated for the most recent month for which figures are available.

The U.S. economy has registered a reasonable growth pace for three straight quarters, following four straight quarters of economic decline, said Jeff Thredgold principal of Clearfield, Utah-based Thredgold Economic Associates and economic consultant for Nevada State Bank.

Constraining a more impressive economic growth rate are sluggish residential and commercial real estate valuations and soft demand, historically high unemployment and consumer anxiety about ever-expanding government and mind-boggling budget deficits, he said.

Perhaps the greatest challenge to be addressed over the next 24 months is how to reduce deficits averaging $1 trillion annually during the next eight years, which are simply unaffordable, he said.

"Global financial anxiety about irresponsibly high budget deficits across southern Europe must be a wake-up call to Congress as well," Thredgold said.

The Clark County business activity index, also compiled by the UNLV research center, dropped to its lowest level since the 2001 recession. Taxable sales are down 9 percent from March 2009 and Clark County's total employment has fallen 5.5 percent. Gross gaming revenue is down nearly 6 percent from February.

The continued decline in taxable sales and gaming revenue paints a bleak picture for state revenues, Riddel said. Southern Nevada provides more than half of the state budget, and contraction in business activity suggests that the state's fiscal problems are more likely to worsen than to improve in the coming months, she said.

Las Vegas has seen a 1.5 percent bump in visitor volume through the first quarter, but it's a different kind of visitor, one that's tight with the pocketbook, Riddel said.

"I think people are much more cautious about what they spend on," she said. "People were spending free money from their mortgages and they would come to Las Vegas and spend it. Visitors are just not spending as much."

The research center director will present her Midyear Economic Outlook on June 15 at Palazzo.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.