Nevada labor market stabilizing as jobless rate falls

Nevada's official jobless rate fell for the fourth straight month in April, but recent gains in another key unemployment measure hint that full recovery in the state's jobs market may be years away.

The combined statistics reveal a few flashes of promise amid broader sustained hard times.

"The outlook is still delicate, but in the aggregate, stabilization characterizes the current environment in the job market," said Brian Gordon, a principal in the local research and consulting firm Applied Analysis. "We certainly have a long way to go to reach back to some level of normal."

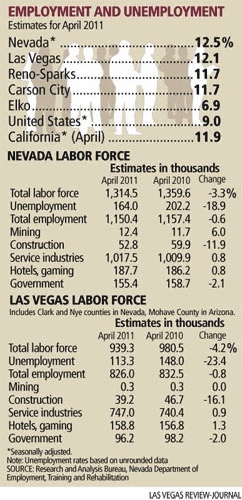

Nevada looks to be inching slowly back toward its historical norms: The state's unemployment was 12.5 percent in April, down from 13.2 percent in March and 14.9 percent in April 2010, the state Department of Employment, Training and Rehabilitation reported Friday. In Las Vegas, joblessness came in at 12.1 percent in April, down from 13.1 percent in March and 15.1 percent in April 2010. Despite the big drops, joblessness remains well above a pre-recession norm of less than 5 percent.

But recent U.S. Bureau of Labor Statistics numbers show a bleaker picture.

The bureau publishes a quarterly unemployment average that includes discouraged workers who haven't actively sought employment in at least a month, as well as underemployed part-timers who'd rather have full-time work. Add in those folks, and joblessness in Nevada actually averaged 23.7 percent from the second quarter of 2010 through the first quarter of 2011. That's up from 20.4 percent in the same period a year earlier.

"With almost a quarter of Nevadans dealing with a stressed employment situation, the state's residents are facing phenomenal difficulty," Gordon said.

The higher federal rate is an average over a year, so it does lag month-to-month improvements in the job market, said Bill Anderson, chief economist for the employment department.

Still, the rate rose even as official unemployment dropped dramatically in the first quarter, and that may suggest Nevadans are merely shifting from one statistical category into another, rather than finding new jobs.

Friday's numbers show 55,700 Nevadans, including 41,200 Las Vegans, quit the labor force in the year prior to April, either leaving the state to seek work elsewhere, or staying here but ending their job hunt. That 4.1 percent drop in the state's labor force is mostly what's behind recent steep declines in official monthly unemployment rates.

It's also likely pushing up the state's quarterly total unemployment rate, as increasing numbers of discouraged workers give up and are moved from official unemployment to the quarterly average, said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

Throw in the latest income figures, and the state's labor pains are all the clearer, Gordon said.

Nevada's average weekly wage was $660.33 in March, down 10.7 percent from a peak of $739.29 in June 2008, according to the Bureau of Labor Statistics.

That's not to say Friday's jobs report didn't bear glimmers of hope.

Nevada's employers did add 3,600 jobs in April, mostly in hotel-casinos, bars and restaurants, and retail.

"Consumers appear to be moving into a better financial position," Anderson said. "Lower household debt loads and waning job uncertainty are allowing consumers to burn off some pent-up demand."

In Las Vegas, leisure and hospitality employment was up by 7,000 year over year, Gordon said. And with a shortage of new resorts opening, much of that growth came from higher demand for workers as visitor volumes ticked up, he added. As the tourism market continues to recover and discretionary spending expands, expect more new jobs in the sector.

What's more, though Nevada still tops the nation in unemployment, the gap between joblessness here and in other markets has dropped precipitously in recent months, Anderson noted.

"Nevada's recent improvement is at last beginning to align with national trends. As expected, Nevada lags the recovery, but the gap, at least measured by the unemployment rate, is beginning to narrow," he said.

But construction continued to struggle, shedding 2,100 jobs statewide in April and erasing all of the sector's gains in February and March.

Employers in the financial industry and the wholesale sector also cut jobs in the month.

Combine those pockets of sluggishness with stagnant wages and an increasingly discouraged labor force, and you'll be measuring recovery in years, not months, experts agreed.

That 23.7 percent total jobless rate took three years to materialize, and cutting it down to pre-recession levels could take at least that long again, Gordon said.

And for now, job formation isn't even keeping pace with internal growth in the labor pool, as adults graduate from high school or college and enter the work force. Total unemployment won't begin to come down noticeably until job creation begins absorbing that natural increase, Brown said.

"This is the weakest recovery in U.S. history since the 1930s, and Nevada is one of the weakest states in that recovery," Brown said. "In some respects, we're in uncharted territory. In the absence of some light bulb turning on in the economy somewhere and creating sudden acceleration, I think it'll be years before we work through that rate."

Contact reporter Jennifer Robison at

jrobison@reviewjournal.com or 702-380-4512.

How do they get those numbers?

There's confusion over how federal and state agencies compile their jobless numbers. And for good reason -- the Bureau of Labor Statistics' explanation on how it tabulates jobs data runs seven pages.

Here's the simple version: Both the state Department of Employment, Training and Rehabilitation and the Bureau of Labor Statistics begin with data from the Current Population Survey, which asks Americans about their job status. The agencies throw in responses to the Current Employment Statistics survey, a monthly questionnaire sent to businesses to ask about their work forces and compensation. Finally, they include first-time claims for unemployment benefits.

One statistic the agencies don't count is the number of people who have exhausted their jobless benefits and fallen from the benefit rolls.

The official unemployment rate, which the Bureau of Labor Statistics classifies as the U-3 rate, is the "headline" statistic that leads news reports each month. April's U-3 rate was 9 percent nationwide, and 12.5 percent in Nevada.

Each quarter, the Bureau of Labor Statistics computes a yearly jobless average that includes discouraged workers who are no longer seeking jobs, as well as underemployed part-timers who want full-time work. That rate, called the U-6 rate, was 16.5 percent nationwide in the first quarter, and 23.7 percent in Nevada.