Las Vegas to recover faster, stronger than expected, analysts say

Experts expected Las Vegas would recover, but not this quickly.

A number of positive trends have emerged in recent weeks, with analysts reporting that resort foot traffic and occupancy rates are quickly closing in on pre-pandemic levels. Various gaming experts say they are bullish on a speedy recovery in Las Vegas.

“January, there were some improvements. February, probably OK. But March appears to really be seeing strength in Vegas, as well as across the country, at least anecdotally from companies,” according to Barry Jonas, an analyst with Truist Securities.

The signs of recovery aren’t hard to spot. Various shows have returned to the stage, occupancy limits on casino floors are back to 50 percent and the Strip is seeing much larger crowds.

Las Vegas occupancy rates are hovering around 95 percent on the weekends, according to a Monday report from Morgan Stanley. Midweek occupancy rates are 50 to 60 percent, a major improvement from 30 percent in February.

The report noted that the market was busy “even midweek.”

“While we thought it was because of Spring Break &March Madness, numerous market participants told us their bookings were stronger than current occupancy, booking windows were expanding and continued to build,” the note said.

Union Gaming analyst John DeCree told the Review-Journal he thinks the industry will recover “quicker and stronger than expected.”

“There is significant pent-up demand for entertainment from the U.S. consumer, and Las Vegas is the entertainment capital of the U.S.,” DeCree said.

Things should continue to improve into the summer, especially with casino floor occupancy restrictions set to ease as soon as next month. Raising capacities for large events and airlines should also help accelerate Las Vegas’ recovery, DeCree said.

International travel will be slower to return, but DeCree said that’s not all bad news for Las Vegas, since travel restrictions across borders make Las Vegas an “easier and more convenient destination” for domestic travelers.

“With limited entertainment options over the past year, and national savings levels at record highs, coupled with robust stimulus from the federal government, we believe consumer entertainment such as Las Vegas will be the recovery leader,” he said.

Positive metrics

Foot traffic is up on the Strip, reaching nearly 60 percent of pre-pandemic levels last month compared with just over 40 percent in February, according to a Sunday report from Jefferies analyst David Katz.

Volume was even higher the last weekend of March at nearly 70 percent of pre-pandemic levels, Katz said.

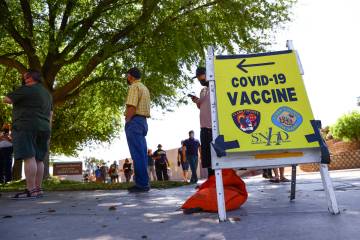

“We continue to believe that with accelerating vaccine rollout across the country, destination markets should see robust pent-up demand in the back half of the year,” he said in the note.

That demand is already showing up in room rates, Jonas said. He published an analysis March 25 showing weekend room rates have climbed in recent weeks at MGM Resorts International properties. Truist uses MGM room rates as a stand-in for the broader Strip market and does investment banking with the gaming company.

The analysis found April room rates were up 6 percent on a March 28 poll from a March 21 poll, and up 19 percent from a Feb. 28 poll. Weekend rates drove the increases through a 10 percent rise from March 21 and a 29 percent upswing from Feb. 28.

Weekend rates for April climbed from $125 to $161 based on surveys conducted each week from Feb. 28 through March 28. Midweek rates creeped from $75 to $81 during the same time period.

Hotel-casinos were focused on getting heads in beds through incentives and low room rates when they first reopened in June, Jonas said in a Wednesday interview. That’s no longer necessary, at least on weekends. Those rooms are already filled.

“There becomes less of a need to give the room away and more ability to manage rates and to drive higher-worth players into your room,” Jonas said.

Room rates for April remained about one-third cheaper than they were in April 2019, the analysis found.

Challenges ahead

Analysts are optimistic, but that doesn’t mean Las Vegas’ recovery will be smooth sailing from here.

DeCree said the biggest risk to the city’s recovery is a resurgence in the pandemic.

Health experts have voiced concerns over new variants of the virus that are more contagious and quickly spreading across the country. Nevada’s two-week coronavirus positivity rate increased for the third straight day on Wednesday, hitting 4.5 percent as new cases and fatalities remained above average.

“As crowds return to Las Vegas, casinos will need to maintain safety standards and protocols while also providing an exciting guest experience,” DeCree said. “It’s important to keep the reopening moving forward safely.”

Jonas said the next step for recovery could potentially come in May. That’s when Nevada regulating agencies will be allowed to set their own rules on capacity limits and other COVID-19 restrictions.

Notably, the Gaming Control Board sent a notice to licensed casino operators on Friday, saying it would consider increasing floor occupancy only for licensees that have taken “measurable and material steps to vaccinate, and thereby, protect their workforce, visitors, and the community.”

Midweek occupancy and room rates will probably continue to stagnate until business and convention travel returns, Jonas said. The annual World of Concrete show scheduled for June — set to be the first major trade show in Las Vegas since the pandemic began — is a “big test” for that segment’s recovery, he said.

“Our belief is the midweek convention business at some point will return, as we think there’s real value in offering conferences and conventions,” Jonas said. “But clearly that the pace of that recovery is going to be much slower than the leisure traveler who’s been stuck in their homes for the past 12-13 months.”

Even with the return of conferences, Jonas adds, simply hosting them does not mean business travelers will come as they once did. Safety concerns remain, and cost savings will probably factor into how many people a company sends to a convention, Jonas said.

“An office who typically sent everyone to CES may say, ‘We only really need to send our top 10 employees or just our sales folks,’ ” Jonas said. “And watching the way casino companies are seeing improved operating margins through cost efficiencies, other companies across the U.S. and beyond likely want those same operating cost efficiencies, which could have longer-term ramifications on business travel in general.”

He noted casinos’ desire to play by the rules and avoid potential setbacks.

“Everything sort of needs to stay on track in terms of managing COVID and not driving outbreaks,” he said. “So, sort of steady as she goes.”

Contact Bailey Schulz at bschulz@reviewjournal.com. Follow @bailey_schulz on Twitter. Contact Mike Shoro at mshoro@reviewjournal.com or 702-387-5290. Follow @mike_shoro on Twitter.