Bumper crop of billionaires for Southern Nevada

The past year has been good to billionaires with business ties to Las Vegas.

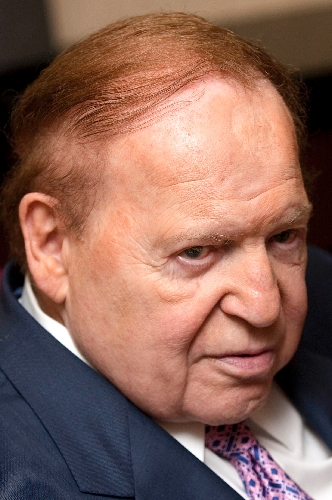

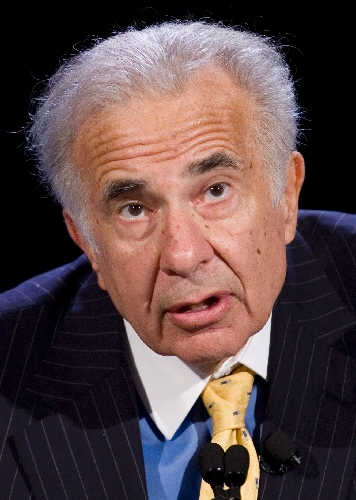

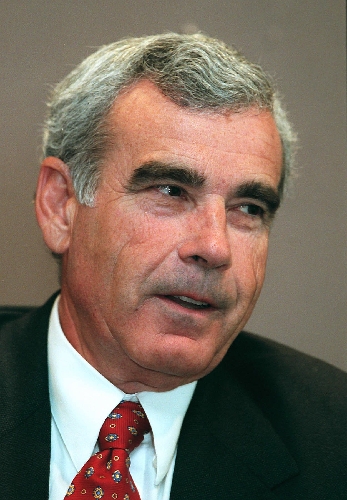

Consider Las Vegas Sands Corp. owner Sheldon Adelson, Fontainebleau owner Carl Icahn and Wynn Resorts Ltd. head Steve Wynn, who saw their net worth rise a collective $16.7 billion, according to Wednesday numbers from Forbes magazine's list of the world's billionaires.

Also note the new and returning local faces on the roster: Elaine Wynn debuted on the list at No. 879, with a net worth of $1.4 billion -- her share of a big casino business she built with ex-husband Steve Wynn.

And brothers Frank and Lorenzo Fertitta appeared on the Forbes list for the first time since 2008. The Fertittas own bankrupt Station Casinos, and though the locals-gaming company won't re-emerge from its reorganization until late 2011, the brothers' Ultimate Fighting Championship "throws the Fertittas back into the billionaire ring," Forbes wrote.

Frank Fertitta ranked No. 1,057, with a net worth of $1.1 billion, while Lorenzo Fertitta ranked No. 1,140, with net worth of $1 billion.

In all, the Forbes list included 1,210 billionaires worldwide with a combined wealth of $4.5 trillion. Sixteen of those billionaires live or do business in Las Vegas.

The best-performing portfolio by far belonged to Adelson, whose company operates casinos on the Strip and in Macau. Adelson's net worth totaled $23.3 billion in February, up from $9.3 billion in February 2010. Adelson's assets remain below their 2007 peak of $28 billion, but the year-to-year improvement was enough to push Adelson into the No. 16 spot worldwide, up from No. 73 a year ago.

Icahn also saw his wealth improve significantly. Icahn's assets rose to $12.5 billion, up from $10.5 billion a year earlier. His rank dropped, though, from No. 59 to No. 61, partly because so many billionaires ahead of him also experienced solid asset gains in the year.

Steve Wynn saw his wealth rise as well, his portfolio growing to $2.3 billion, compared with $1.6 billion in 2010. He surged from No. 616 to No. 512.

So will those local billionaires funnel their improved assets into new development in Las Vegas?

Probably not, analysts say.

For casino owners such as Adelson and Wynn, much of their newfound wealth comes from improving stock prices. That means their asset growth consists mostly of "paper" gains tied up in existing projects, and it's thus unavailable for immediate investment, said Brian Gordon, a principal in local research firm Applied Analysis.

Nor has the Las Vegas economy revived enough to warrant major new investment, Gordon said.

Bill Lerner, principal of research firm Union Gaming Group in Las Vegas, agreed: The city has too many rooms and not enough growth to justify additional projects.

"If I'm the Las Vegas Sands Corp. or Sheldon Adelson, with a fiduciary duty to my shareholder base, I would much rather reinvest capital in Asia, where the return profile is much higher," Lerner said. "Investing incrementally in Las Vegas is not a strategically sensible thing to do."

There could be a few exceptions revolving around philanthropy, or investment in community needs.

Lerner pointed to Elaine Wynn, who said she'd focus on charity work after her divorce. And that she has, donating millions to causes ranging from the Three Square food bank to the Smith Center for the Performing Arts downtown.

"Elaine Wynn is putting her capital to work from a charitable perspective here. She's a standout in that respect," Lerner said.

MGM Resorts International's largest shareholder, Kirk Kerkorian, will also likely focus more on community investments, Lerner said. Kerkorian, whose Forbes rank moved from No. 310 to No. 307 as his net worth jumped from $3.1 billion to $3.5 billion -- will probably continue to donate millions to local groups such as the Nevada Cancer Institute and the University of Nevada, Las Vegas, Lerner said.

As for the Fertittas, Lerner said he suspects the brothers have "big plans" for gaming strategies locally and overseas. But those plans aren't likely to include new casinos in Las Vegas.

"Developing a new locals casino here in the next several years would be like breaking into jail," Lerner said.

Other Forbes billionaires with local ties include:

■ John, Jacqueline and Forrest Mars, East Coast residents and owners of Ethel M Chocolates in Henderson, at No. 81, with a net worth of $10 billion each.

■ eBay founder and Henderson resident Pierre Omidyar, at No. 145, with a net worth of $6.7 billion.

■ Arkansas-based investment banker and Stephens Inc. head Warren Stephens, at No. 459, with a net worth of $2.5 billion. (The Las Vegas Review-Journal is a property of Stephens Media, a Stephens Inc. unit.)

■ Donald Trump, New York real estate investor and owner of the Trump International Hotel Las Vegas, at No. 420, with a net worth of $2.7 billion.

■ Ed Roski Jr. of Los Angeles, owner of the Silverton and an investor in a stadium planned near UNLV, at No. 564, with a net worth of $2.1 billion.

■ Treasure Island owner Phil Ruffin, at No. 595, with a net worth of $2 billion.

■ Thomas Barrack, Las Vegas Hilton owner and investor who helped take Station Casinos private, at No. 833, with a net worth of $1.5 billion.

Contact reporter Jennifer Robison at

jrobison@reviewjournal.com or 702-380-4512.