Property owner has will to stay in downtown Las Vegas

Las Vegas city officials have been willing to vacate street and park space, buy entire blocks and even move out of their own city hall in the name of reviving downtown.

But they haven't been able to move Russell Gullo.

The 88-year-old owner of a dilapidated property on Sixth Street is fighting a city lawsuit aimed at pushing him out of his longtime home, albeit with a $1.7 million payoff for his troubles.

"I wouldn't give them it if they offered me a trillion dollars," Gullo said during a recent visit to the house that property records show he has owned since 1980. "In my will, it goes to the Vatican."

Whether or not the pope gets a chance to take title to the houses and debris-strewn yards on Gullo's property remains to be seen, as a court recently ruled in favor of the city, a ruling his lawyer says will be appealed.

The city's legal campaign seeks to force Gullo to close a deal originally agreed to in November 2010 with Resort Properties Group, a company controlled by downtown deal maker Andrew Donner and attorney Todd Kessler.

Donner also helped negotiate the deals to bring online retailer Zappos from Henderson to downtown Las Vegas.

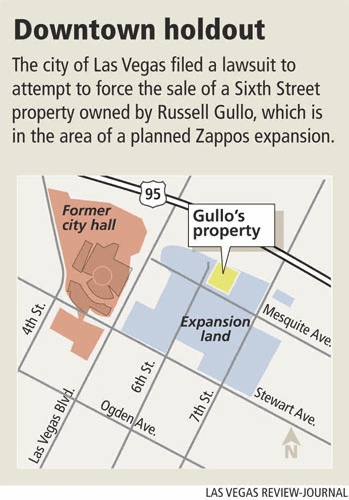

City Hall LLC, a subsidiary of Donner's Resort Gaming Group, bought the former City Hall building at Las Vegas Boulevard and Stewart Avenue for $18 million to lease to Zappos as a headquarters.

That deal includes an option to buy about 10 more acres, including the land where Gullo's house is located, for $9.3 million.

But Resort Properties Group never closed the deal with Gullo and instead assigned the contract to the city, a move that appears to have agitated Gullo and contributed to his desire to back out.

"I never approved of the city being in this deal," Gullo said.

Donner said he wouldn't comment on the transaction with the lawsuit pending.

When asked why the city took the lead in the deal and if it paid Resort Properties Group for the contract, Scott Adams, the city's chief urban redevelopment officer, would only say, "We won't comment until the litigation is complete, but there are answers to those questions."

Minutes from the June 15, 2011, meeting during which the city acquired the purchase agreement say, "Adding this parcel to the city's assemblage and subsequently the option agreement provides a greater opportunity for Zappos.com to develop a more cohesive corporate campus."

According to court documents and interviews, the legal dispute with Gullo boils down to whether the city lived up to the terms of the purchase agreement.

The original agreement called for Resort Properties Group to close the sale in March 2011 and make monthly deposits of $25,000 deposits to Gullo.

After making the deposits as planned, Resort Properties and Gullo amended the deal in February 2011 to shift the closing date to Aug. 31, 2011.

The revised deal added another $100,000 to the purchase price and included a series of monthly $50,000 deposits for Gullo.

After Resort Properties assigned the contract to the city, city officials sought to speed up the close by depositing the entire sales amount into escrow on July 1, 2011, according to court records.

"The City has fully performed its obligations and is ready, willing and able to complete the purchase of the subject property," Deputy City Attorney Philip Byrnes wrote in a motion for summary judgment. "The court should award specific performance requiring Gullo to convey the subject property."

But Gullo, who only recently hired an attorney, argues in court documents the deal wasn't ready to close July 1, so the city should have made its monthly deposit on schedule.

"The City's failure to do so constituted a material breach of the real estate purchase and sale agreement entitling Mr. Gullo to cancel the sale," Gullo attorney Brian Berman wrote.

In a ruling from the bench July 6, District Judge Carolyn Ellsworth indicated she agreed with the city and granted the summary judgment to force the sale.

Berman says he's waiting to review the written order and expects to appeal.

"We're prepared to take the case up on appeal to the Nevada Supreme Court; that's the current plan," Berman said.

In the meantime, Gullo lives in poverty despite the deposit money available to him.

"I never touched a nickel of it," said Gullo, who was raised in Cleveland by Italian immigrant parents and still owns some undeveloped property in Ohio. "I've been buying and selling property since 1946. I know you don't touch escrow money."

Gullo no longer has tenants in the rundown properties on Sixth Street. He says he forced them out several years ago at the urging of the city, which was beginning to buy properties in the area to make way for a potential arena or the expansion of City Hall.

Gullo said the tenants' departure drastically reduced his income.

He doesn't have air conditioning or a functional kitchen and uses a small, gas-powered scooter for transportation. He also has been attacked by thugs moving through what once was a neighborhood of small homes and now is mostly vacant, bulldozed land.

But he remains unwilling to accept the offer on the table, saying he could remain on the property until he dies, leaving it to the Catholic church to convert to a shrine or way station for travelers. Gullo isn't religious, but he said one of his brothers dreamed of becoming a monk.

He also would consider higher offers for the property, which he says has increased in value since the original offer.

Although property values around the valley have been falling or stagnant, there is evidence they have increased in the downtown area.

Hamid Maghamfar, owner of the Pump and Snack station on Las Vegas Boulevard across from the former city hall, says he accepted a city offer of $6.2 million for the property. But Maghamfar said he was unwilling to agree to multiple requests to postpone the sale and the deal didn't close.

Now Maghamfar said the property is worth more and the recent $7.9 million sale of the 7-Eleven gas station just south of the Pump and Snack suggests he may be right. The 7-Eleven buyer was 208 Las Vegas Blvd. LLC, which lists as managers companies related to Donner and to Zappos CEO Tony Hsieh, who in addition to supporting his company's move downtown is investing about $350 million in startup businesses, social and cultural projects downtown through his Downtown Project venture.

Maghamfar says he is still willing to sell for the right price, but that the city could have acquired his and Gullo's property for less had it acted more decisively earlier.

"They are going to end up paying so much money because they made everybody educated and smart," he said.

During a recent visit, Gullo reflected on his past, which he said included fighting in Europe in World War II, getting married and moving out West before settling in Nevada.

Gullo said he and his wife, who has died, were separated, and he has little contact with any other family.

Gullo was one of five sons of Carmello and Mary Gullo. His father was listed as a cigar maker in the 1940 census, and Gullo said he ran small corner stores and rolled cigars, with extensive help from the kids.

"I didn't get an education because of it," he said of the work. "We worked 16 hours a day."

During conversation Gullo's sentiments seemed to shift between hope that he will get a chance to sell the property on the open market to resignation that he may never close a deal to his satisfaction.

"I'm very disgusted, and I don't think I'll ever get my property back," Gullo said.

Later, Gullo said he wishes his attorney would argue the case more passionately, invoking the former Soviet leader Nikita Khrushchev whose oratorical theatrics famously included a 1960 speech at the United Nations in which he was reported to have banged his shoe on a desk during a passionate address.

"Where's my Khrushchev?" Gullo asked.

Contact reporter Benjamin Spillman at bspillman@reviewjournal.com or 702-383-0285.