Clark County teachers union proposes sales tax hike to raise $1B

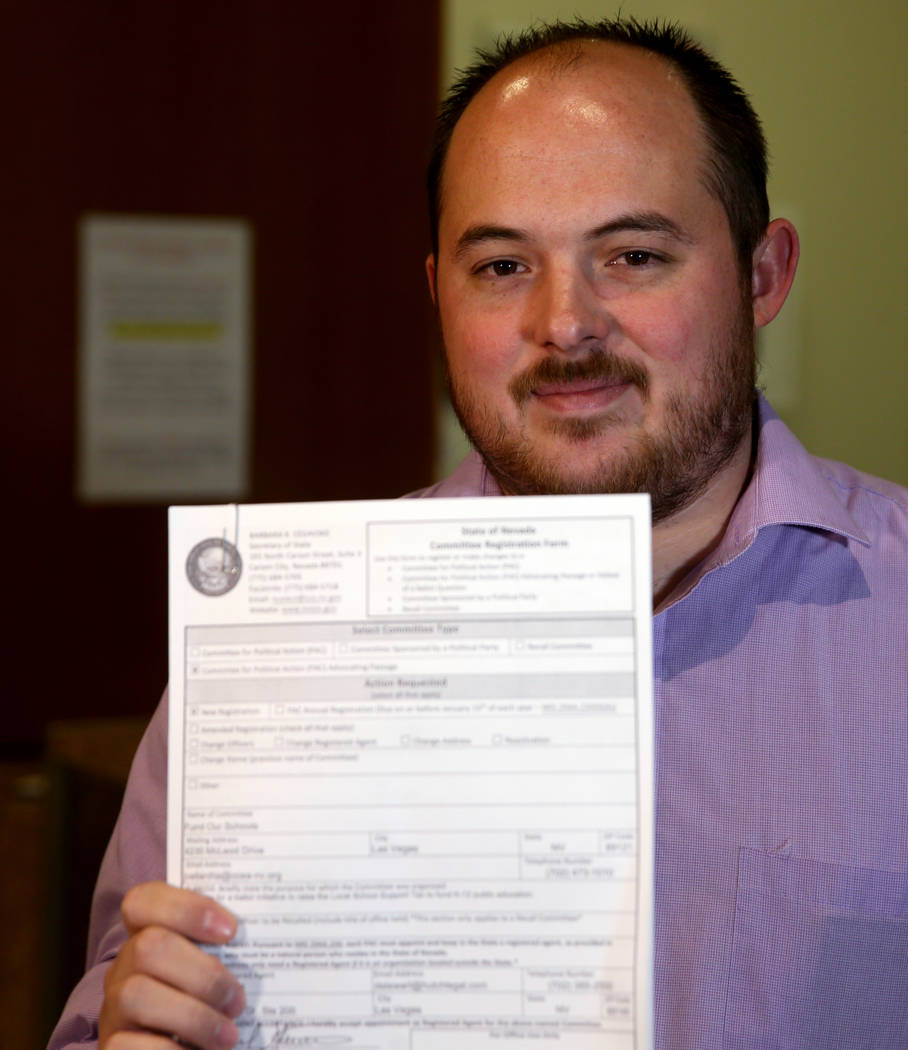

The Clark County teachers union unveiled a second voter initiative Wednesday afternoon that would hike the state’s sales tax, raising more than $1 billion per year for Nevada schools.

The measure would raise the Local School Support Tax, a component of the state’s sales tax, by 1.5 percentage points from 2.6 percent to 4.1 percent. If approved, the sales tax in Clark County would rise to nearly 10 percent.

Clark County Education Association Executive Director John Vellardita said the union’s leadership selected this tax to increase because the revenue from it is already earmarked for education. He said 47 percent of all money for public schools comes from the tax.

“The scale of the challenge is well over a billion dollars,” Vellardita said. “We want to put before the voters an opportunity to fund needed programs in schools.”

The union has until November to gather the necessary 97,598 valid signatures from registered Nevada voters to send it to the Legislature for consideration during the 2021 session. The Legislature could pass it, but if lawmakers fail to act or reject the tax, it will appear on the 2022 ballot.

Vellardita added that the union expects a legal challenge to the initiative.

He said before the briefing that the $1.1 billion the tax is expected to generate could be used to address a laundry list of underfunded priorities in Nevada, including reducing class sizes and caseloads and combating teacher attrition.

Reducing class sizes to state-mandated levels alone could cost as much as $370 million, Vellardita said. He added that the money could also present a lifeline for the state’s new proposed funding formula under last year’s Senate Bill 543, which seeks to create a weighted system for student groups, with additional funds allocated to at-risk student groups.

Sales tax rates in Nevada vary, depending on whether jurisdictions have added local taxes. In Clark County, the sales tax would increase from the current 8.375 percent to 9.875 percent. That would raise the sales tax for a $30,000 car from $2,512.50 to $2,962.50, adding $450 to the cost of the vehicle.

In recent years, sales tax increases have come from legislative votes rather than voter initiatives. The 2019 Legislature gave local governments the authority to raise sales taxes to pay for education and social services, which the Clark County Commission did. In 2010, voters in Clark County approved an advisory question to raise the sales tax to hire more police officers. That measure was passed by the Legislature and enacted, in pieces, by the Clark County Commission.

In 2014, a 2 percent margins tax on business proposed by the Nevada State Education Association was voted down, 79 percent to 21 percent. But the following year, the Legislature passed a commerce tax on business revenue of more than $4 million, in part to fund education initiatives.

Bryan Wachter, senior vice president for government and public affairs at the Retail Association of Nevada, and a candidate for Clark County School District trustee, said raising the sales tax rate to more than 9 percent could leave Clark County with one of the highest sales tax rates in the country, impacting day-to-day budgets for locals and revenue from tourists.

“Why would you pay more sales tax on vacation when you can avoid that by buying at home?” Wachter said. “We want to bring people out of intergenerational poverty and all the other great things education does, but we’re asking everyone to shoulder these costs, even on things like back-to-school purchases.”

The Clark County Education Association’s filing for the sales tax increase comes the day after the union filed its first initiative to raise taxes on the gaming industry to raise more than $300 million in revenue, parts of which would go to public education. The tax increase proposed Wednesday would go directly to K-12 education.

The proposed gaming industry tax would target the highest-earning establishments, adding a fourth tax tier of 9.75 percent levied on all monthly gross revenue of more than $250,000. The current highest tax rate of 6.75 percent would apply to earnings between $134,000 and $250,000, while the two lower tiers would remain unchanged.

Contact Aleksandra Appleton at 702-383-0218 or aappleton@reviewjournal.com. Follow @aleksappleton on Twitter.