Local home sales in June break 2004 record

Sales of single-family homes, condos and townhomes reached a record 4,702 in June, topping the previous record of 4,414 set in June 2004, the Greater Las Vegas Association of Realtors reported today.

The record was announced the same day a new survey showed more than half of potential homebuyers nationally say they’re still not prepared to jump into the market.

Locally, Realtors sold 3,785 single-family homes during the month, up 16.3 percent from May and up 70 percent from June 2008. Condo and townhome sales more than tripled from a year ago to 917.

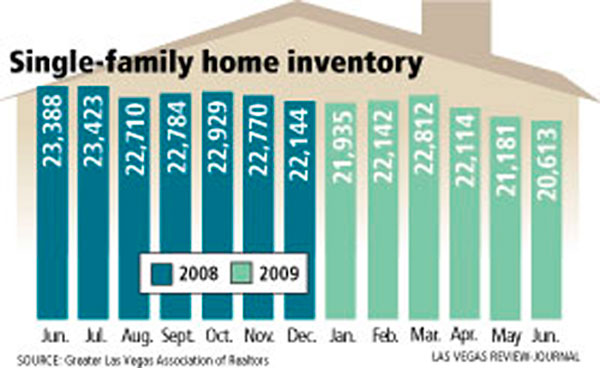

Inventory of homes for sale in Las Vegas shrunk to 20,613, a decrease of 11.9 percent from a year ago. Condo listings are down 2.2 percent to 5,416.

“I think it’s significant that we sold a record number of homes last month,” Realtors association president Sue Naumann said. “We’ve been closing in on this mark for a few months now.”

Median prices held steady at $140,000 for single-family homes, unchanged from the previous month and down 37.8 percent from a year ago. Condo prices inched up 1.5 percent from May to $66,000. It was the second consecutive month of condo price increases.

“We’ve been looking at prices declining for so long now, it’s refreshing to see them stabilize and some go back up,” Naumann said. “Inventory is down, so that’s a good thing.”

The numbers for June are quite impressive, broker David Brownell of Keller Williams Realty in Las Vegas said.

Closings are up 82.5 percent from a year ago, pending sales are up 82 percent and inventory — taking out pending sales — is down 40 percent.

His numbers are for the greater Las Vegas area, not including Pahrump, Mesquite, Boulder City and other outlying areas covered by GLVAR.

He said sales numbers would have been higher if banks had not placed a voluntary moratorium on foreclosures last year. The market should welcome the backlog of bank-owned homes that are expected to be coming soon, Brownell said.

“The reason I say that is in 90 percent of scenarios, we’re in multiple offer situations,” he said. “I had a client on Monday looking to buy a home and found one she wanted. It was on the market for less than 24 hours and we would have been the 19th offer.”

Brownell said there were six cash offers on the bank-owned home and just as many conventional loans. The bank will consider those offers before his client’s FHA financing, he said.

“When the market price is $230,000 and you have 19 offers and six are cash, I’m going to say the market is undersupplied,” he said.

Brownell showed 3,460 closings of real estate-owned, or bank-owned, homes in June, more than double the number from same month a year. Meanwhile, REO inventory has dropped 42 percent to 2,771, leaving less than one month’s supply. Another 5,340 REO closings are pending.

Naumann said she’s seeing strong demand from both investors and first-time buyers taking advantage of the $8,000 tax credit.

“They’re hearing rumors of interest rate increases and they could very well be priced out of a home if they don’t act now,” she said. “Plus, we’re seeing where parents want to help their children with gifts for down payments to get them out of apartments.”

Housing analyst Dennis Smith of Las Vegas-based Home Builders Research said the upward trend in home resales will continue for two to three years because of the affordability factor and also because new home builders can’t compete on prices.

“That’s the problem. As long as prices continue to go down, we can’t say the market is at the bottom,” Smith said. “We can say it’s getting closer.”

In the Realtor.com survey, to be released Thursday, nearly 53 percent of consumers who said they were planning to buy a home in the future cautioned they’re not ready to take such a large financial step right now.

Nearly a third of potential homebuyers surveyed cited concern about their jobs as the main reason they would shy away from the housing market. Worries about selling their current home are stopping 16 percent of the prospective buyers surveyed, while just under 8 percent said they fear home prices will keep falling.

Americans recognize there are great deals to be had in the housing market, but many are in too much of a financial pinch at the moment to even think about buying.

Among those consumers who are interested in buying, the survey found, some believe that prices aren’t going to fall further and others are looking to take advantage of government incentives designed to kick-start sales.

Nearly one in five potential buyers said they were interested in a deeply discounted foreclosed home, while nearly 15 percent said they want to receive a new $8,000 tax credit for first-time buyers or other state incentives. More than 15 percent said they don’t expect prices will fall further, but many are still taking their time.

GLVAR statistics are based on data collected from the Multiple Listing Service and does not necessarily account for new homes sold by builders, sales by owner and other transactions not involving a Realtor.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

The Associated Press contributed to this report.