Many late tax filers say pay down national debt

If they had a choice, Southern Nevadans would like to see their taxes used to pay down the nation's $14.3 trillion debt.

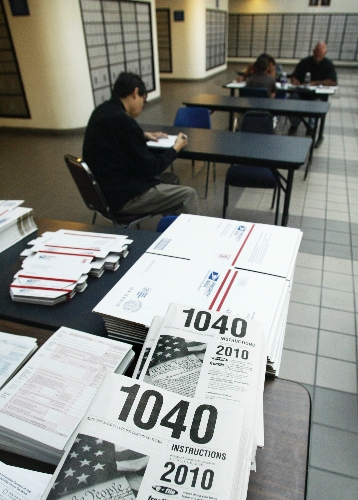

At least, that was the general theme captured on Tax Day, Monday, at the U.S. post office on Sunset Road

But others had different wish lists for their hard-earned tax dollars:

Ensure Social Security remains solvent: Poor people and senior citizens need a safety net.

Prosecute the wars on terror: Our troops need more than moral support.

Rebuild the nation's roadways and bridges: Fix a crumbling infrastructure and put thousands of idle Americans back to work.

Allow more deductions on medical expenses: And mitigate just a tiny bit the highest-priced health care system in the world.

But the nation's debt, with growing numbers flying by like they do on a gasoline pump, seems to be on everyone's mind regardless of tax brackets or political ideology.

"I always think my taxes are too high," said Edward McHale, 51, an employee at the Golden Nugget.

He completed his tax forms at the post office at almost the last possible moment, not because he is a world-class procrastinator, but because he wanted to include every possible receipt for his ongoing medical bills that he could before the filing deadline hit at midnight.

"I'd like to see more deductions on medical," McHale said. "I have to pay about $3,000 out of pocket before I can even start deducting, and I still have to pay for all my other medical expenses. I don't have money to go out to dinner, and that's just the way it is."

Presley Osborne, 54, spoke out on the national debt.

"Pay down the debt load. I think the feds should have a balanced budget. That way they can't sell us to China," Osborne said, referring to the biggest buyer of U.S. treasury securities.

Osborne, a union carpenter who hasn't worked more than a few days at a time since 2009, said he's getting back less this year than he has in previous tax seasons, but he's not complaining.

"Everybody I know is paying taxes because they didn't have any (taxes) taken out of their unemployment insurance checks," he said.

Vern St. Clair, 36, held the envelope containing his check to the IRS as if it were radioactive.

"I pay my share and I don't care what they do with it. I just hope my taxes go where they're supposed to go," he said.

Inez Garcia said the nation's debt needs to be reduced.

"Everything is too expensive because our debt is too high," she said. "We should put a housewife in charge of the budget. Somebody in Washington has to learn how to say no."

Harris Shockey, 66, has a lot of ideas on what the IRS can do with his taxes, but few are printable in a family newspaper. One of those is this thought: "Rebuild the roads, the interstates."

"They are broken. The bridges are broken. The freeways are congested and falling apart," Shockey said. "Let's fix them and put people to work at the same time.

U.S. Postal Service employee Pat Glasper said Tax Day 2011 was a little busier than normal but not necessarily because of the filing deadline.

"We've had as many people here to get passports as to pay their taxes," Glasper said in the early afternoon. "But I expect it will get busier later, when people get off work."

The Sunset office was scheduled to remain open until midnight to allow late filers to get their tax returns stamped with an April 18 date.

On Monday, the line was long but the wait was short for people using the post office's two drive-through lanes. Car after car pulled up, and the drivers slipped an envelope into the mailbox and drove away.

You could almost hear them sigh with relief.

Contact reporter Doug McMurdo at dmcmurdo@review journal.com or 702-224-5512.

ELECTRONIC FILING RISES

The number of Nevada taxpayers who have filed federal income tax returns electronically increased 11 percent over the week ending April 15, according to the IRS.

A total of 811,000 Nevadans had filed individual tax returns electronically as of Friday, up from 733,000 a week earlier.

Those numbers don't include returns filed on paper through the U.S. Postal Service. A total of 1.2 million Nevadans filed individual tax returns for the previous year.

JOHN G. EDWARDS / REVIEWJOURNAL