Developer buys 25 acres to build $50 million shopping center

Developer Hank Gordon is fully aware that Las Vegas is overbuilt with retail centers, including about 40 that he built over the past 23 years, but he couldn’t pass up an opportunity to acquire 25 acres in the northwest valley for a planned $50 million shopping center.

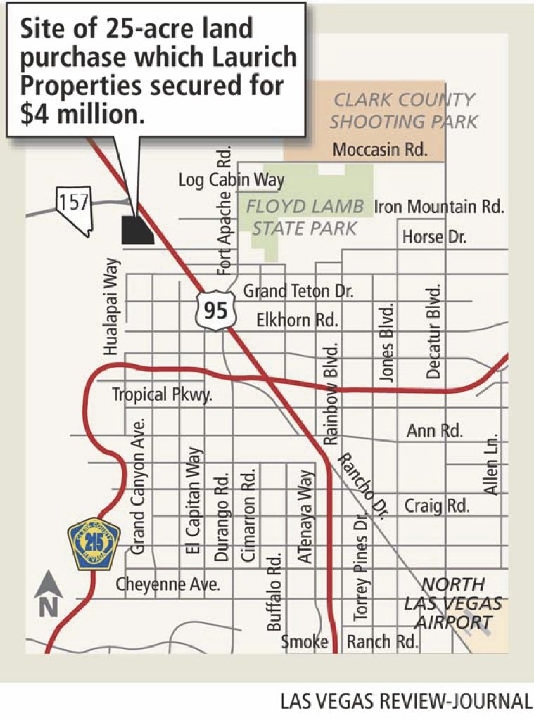

Gordon, chairman of Las Vegas-based Laurich Properties, paid $4 million cash for the land at U.S. Highway 95 and Horse Drive, an area that’s mapped for 9,000 new homes.

Key Bank foreclosed on the land in April. The bank held a $14 million note on the property, which was purchased by Montecito Cos. for $18 million in 2004.

Gordon said it’s the best shopping center site he’s come across since he entered a ground lease agreement with Clark County in 2005 for Arroyo Market Square at the Las Vegas Beltway and Rainbow Boulevard.

It’s better than the land Triple 5 Development had purchased for the Great Mall of Las Vegas a little to the south, which had no access to the freeway, he said. Triple Five defaulted on a $27.6 million loan with Key Bank last year.

"We have a four-way ramp to the 95," Gordon said. "I don’t think you can show me a regional mall in Las Vegas that is not on a freeway access, except for the Boulevard Mall that was built before freeways."

While vacant land has accounted for the bulk of commercial mortgage defaults in Las Vegas over the past 18 months, Gordon said his purchase price was low enough to allow him to carry the property for a number of years until it’s ripe for development.

"We know who we will build for once the trade area is occupied with homes, so it is not too much of a guessing game," he said. "Since we paid cash, we don’t have any loan interest to carry during that time. It is a risk that we were willing to take and we rarely take them."

Gordon also bought Triple Five’s foreclosed parcels at Flamingo Road and Grand Canyon Drive from Key Bank. Again, those are risk-free.

"Since we do not sell any assets, we have to be careful on what we buy since it will be a long-term family investment," he said.

Nearly 75 percent of land sales in the first quarter involved a lender or trustee, though that changed in the second quarter with 68 percent traditional "arm’s length" transactions, Las Vegas business advisory firm Applied Analysis reported. The average price for raw land in the second quarter was $154,665 an acre, down nearly 40 percent from a year ago.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.