Home sales still dropping

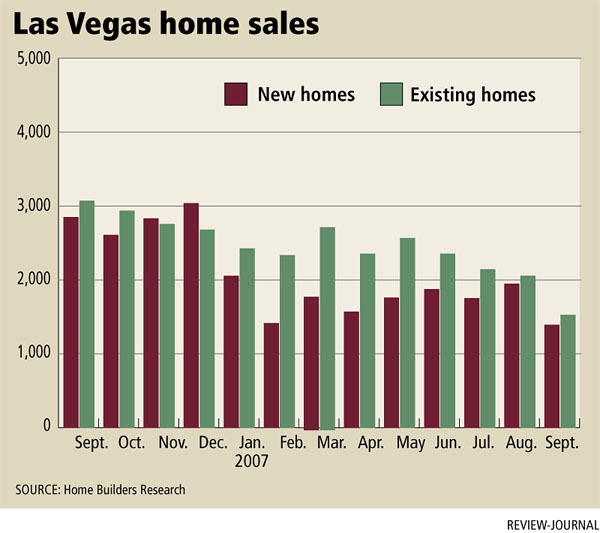

Home sales continued to plummet in September to their lowest levels in years, and median prices for both new and existing homes edged downward from a year ago, Las Vegas housing analysts reported Tuesday.

“Our September numbers are in and they’re not pretty,” Home Builders Research President Dennis Smith said.

He counted 1,399 new home sales, the lowest monthly total since January 2000. The year-to-date total of 15,475 is down 44.3 percent from a year ago.

Larry Murphy of SalesTraq showed 1,328 new home closings during the month, a 52 percent decline from the same month a year ago. The median price was $312,639, down 3.3 percent.

Existing home sales were down 50 percent to 1,466 in September and existing median home prices declined 8.9 percent to $263,075.

Murphy said his minister at Shadow Hills Baptist Church on Sunday invited real estate agents, mortgage brokers, residential construction workers and anyone else affected by the housing downturn to a night of free hamburgers at the church.

“That’s the perception of the public, and perception is reality,” Murphy said.

Home builders are offering substantial incentives ranging from bonus commissions for Realtors to $50,000 to $100,000 in free upgrades and custom options, he said.

A number of builders have slashed prices, starting with KB Home and Meritage earlier this year. Lennar Homes dropped prices by 25 percent in about 30 new home subdivisions and Pulte was advertising a 15 percent cut in prices over the weekend.

Tom McCormick, president of Las Vegas-based Astoria Homes, said he sold 30 new homes during the weekend of Oct. 12-14 after discounting prices by 10 percent to 27 percent in eight neighborhoods. The homes went for as low as $170,000, or $112 a square foot.

“People were very curious about whether there were any buyers in the market. We found there are actually buyers in the market,” McCormick said. “Price fixes everything and maybe we found the price where homes sell at a good clip. We were the first to rise, the first to fall and we’ll be the first to come out of this and maybe this is a turning point.”

The effects of these price reductions will be reflected in the coming months, Murphy said.

“We have not yet reached the bottom of this market in either new homes or existing homes,” he said. “The short-term outlook for this market is not good. It will take another 12 to 18 months before we will see any significant improvement, in my opinion.”

He noted that the resale inventory is at an all-time high of 27,000 homes and nearly half of them are sitting vacant. For most of the year, inventory represented a 12-month supply. Looking at the dismal 1,065 closings on the Multiple Listing Service, Murphy now calculates an inventory of nearly two years.

Foreclosures are four times higher this year compared with 2006. As the banks take back these properties, they will be added to the already swelling inventory.

However, the housing market stands to benefit tremendously from the $30 billion development boom on the Strip, Murphy said.

Rick Waltjen is one of those buyers who’s waiting for the housing market to bottom out. He’s been watching it closely for two years, specifically inventory levels that have risen almost weekly for the past six months.

“There is absolutely no sign of the market bottoming out yet,” Waltjen said. “Everyday there are more price reductions. The inventory continues to climb. When the inventory begins to decrease, that’s when I’ll be persuaded to buy.”

The sad thing in Las Vegas is people won’t accept reality, Debi Averett of Phoenix-based Housingdoom.com said. They buy houses they can’t afford, put payments on credit cards and pray the market will come back or live in hope that an uneducated buyer will come by and pay more than market price for their house, she said.

“The sun comes up, it goes down. House prices go up, house prices go down,” Averett said. “If you know and understand what’s happening, it’s not a negative, just a reality to be dealt with, and, with luck, profited from.”

The “albatross” that’s going to be hanging around the neck of Las Vegas for a long time is the number of vacant homes on the market, broker Bob Reeve of Red Rock Canyon Realty said.

“I think that a key piece that people conveniently ignore when telling us that we are at the bottom or close to it is that we have never been in a market where 40 percent of the homes are vacant,” he said. “Just drive around. Why would any buyer buy a boarded-up mess with a dead yard?”

The experts talk about burning off the oversupply of resale inventory, but a huge portion of that vacant inventory is going to be permanent, Reeve said.

Smith of Home Builders Research sorted through 1,544 recorded resales in September, bringing the yearly total to 20,563, a 38.7 percent decrease from a year ago. He reported the resale median at $262,377, down 8 percent.

“The resale segment is still looking for the bottom of this cycle,” he said, “but we are encouraged that there appears to be some stabilization in the lending community, which should help consumer confidence.”

Builders have continued to cut back on new home permits, pulling just 620 in September. It’s been a steady decline since May 2004 when 4,501 permits were issued. For the year, permits are down 39.3 percent at 11,526, Smith reported.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.