New-home starts struggle again in May

Local housing starts slipped in May, data show, reflecting a national trend.

The Commerce Department reported that new-home construction fell nationwide during the month as home builders struggled with the subprime lending crisis and rising mortgage rates.

In its monthly Las Vegas Housing Market Letter, Home Builders Research reported that there were 1,724 new-home permits in the Las Vegas Valley in May. The 2007 tally is at 7,934, a year-to-year decrease of 4,154, or 34.4 percent, the company said.

The average permit count per month through May is 1,586, Home Builders Research added. So, following the trend, if Southern Nevada averages 1,600 permits per month for the rest of 2007, the annual total would hit 19,134, the company said. That would be a year-to-year decrease of 4,085 permits, or 17.6 percent.

"I think we’re going to see permits staying flat, at best, until late 2008 or early 2009," Home Builders Research President Dennis Smith said. "We’d like to see things turn around faster, but unless we see resales start to move some inventory, I don’t we’ll see it change."

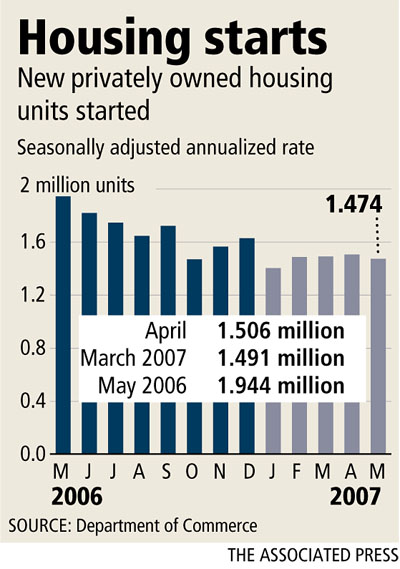

Meanwhile, the Commerce Department said Tuesday that construction of new homes and apartments dropped by 2.1 percent last month to a seasonally adjusted annual rate of 1.474 million units, 24.2 percent below the level of a year ago.

The May decline was in line with expectations and reflected weakness in the South and West, which offset construction gains in the Northeast and Midwest.

Permits, considered a good barometer of future activity, rose by 3 percent in May but that followed a 7.1 percent plunge in April. The strength last month came from a rebound in permits for apartment construction, which can be volatile. Applications for single-family homes fell by 1.8 percent and have been down four of the past five months.

"The downward trend remains firmly in place and there is no prospect of any near-term relief, given the huge inventory overhang in the new home market," said Ian Shepherdson, chief U.S. economist for High Frequency Economics.

Home builders, struggling to reduce record levels of unsold homes, are slashing prices and offering a variety of sales incentives, such as kitchen upgrades and free decks, to do so.

However, they are facing new problems with the recent jump in mortgage delinquencies, which means that more homes are being dumped on the market, and a steady rise in mortgage rates over the past month, with Freddie Mac’s national survey for 30-year mortgages hitting an 11-month high of 6.74 percent last week.

The National Association of Home Builders reported that its survey of builder sentiment sank in June to the lowest level in 16 years, a reading of 28, down from 30 in May. The three major components of the index — sales, sales expectations and buyer traffic — all fell. It was the lowest showing since February 1991, a period that covered the last major housing recession.

"The tightening in lending standards is having quite an impact," said David Seiders, chief economist for the home builders.

He predicted home sales would likely fall further in coming months; he didn’t see a sustained rebound occurring until 2008.

Seiders said expected construction of new homes and apartments to dip 22 percent this year after having fallen 13 percent in 2006.

The housing slump seemed near hitting bottom at the end of last year. But problems in the mortgage industry have triggered a renewed drop. The level of late payments and foreclosures on subprime mortgages hit record highs in this year’s first three months, a Mortgage Bankers Association survey shows.

The percentage of payments that were 30 or more days past due for subprime mortgages — loans made to borrowers with weak credit histories — rose to a record 15.75 percent in the January-March quarter.

Housing had boomed for five years, fueled by the lowest mortgage rates in four decades and soaring home prices that drove investors into the market. That boom ended in 2006. Since then, sales of new and existing homes and home prices in the hottest markets have fallen.

Construction of single-family homes dropped 3.4 percent last month while construction of apartments rose by 3.1 percent.

By region, construction activity fell by 19.7 percent in the West and 1.6 percent in the South. Construction was up 15.7 percent in the Northeast and 15.5 percent in the Midwest.

Housing’s slump has weighed on the overall economy, dragging growth to a 0.6 percent rate in this year’s first quarter. Analysts believe growth in the current quarter has rebounded to a rate of 3 percent or better, despite the problems in housing.

The Associated Press contributed to this report.