Homeowners get insurance break

More than 500 homeowners in flood-prone areas will have a reason to smile when it rains, and when their property-insurance bills come.

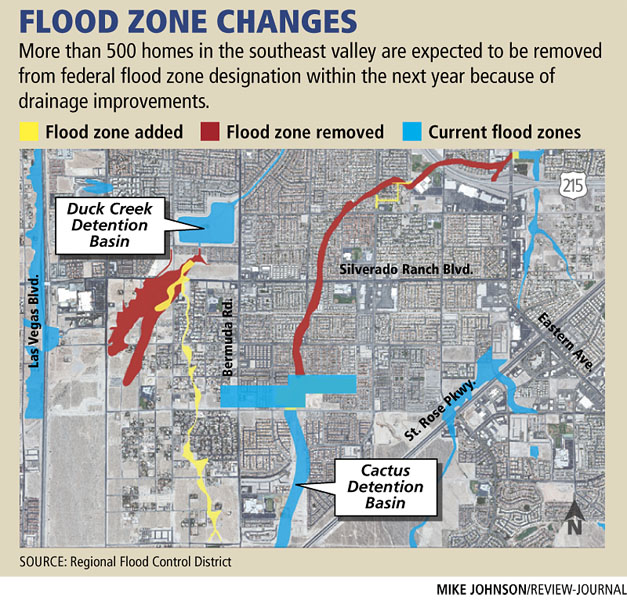

Improved drainage in two parts of the southeast valley is enabling the Regional Flood Control District to remove 530 homes from federal flood zones, a move that will let these property owners reduce or eliminate their flood insurance.

"They are no longer mandated to buy flood insurance as part of the (home) loan," said Kevin Eubanks, the district's assistant manager.

A $7 million concrete-lined canal, now being built, will funnel runoff away from houses south of the Duck Creek detention basin. And a gravel pit that's being converted to a 49-acre, 50-foot-deep drainage pond, dubbed the Cactus detention basin, will catch stormwater before it reaches most neighborhoods.

Water in both traps will be channeled to the Las Vegas wash to the east, and eventually to Lake Mead.

Aside from reducing coverage, homeowners can receive a rebate of up to one year on insurance they've already paid.

But while some residents can worry less during a 100-year storm, the district notified 107 households that the latest research showed they are within a flood zone and should shop for insurance to cover potential high water.

Of these, only seven are likely to be required to get flood insurance, Eubanks said. The rest were simply told via certified letters that they should consider adding flood insurance to their homeowners' coverage.

The Federal Emergency Management Agency is expected to designate as flood plains a section below the Cactus basin in two months and an area below the Duck Creek basin in a year, said Gale Fraser, the district's general manager.

FEMA requires an area be designated a flood plain if runoff can reach a foot deep in a residential area, and that affected homeowners be notified, Fraser said.

However, homeowners aren't compelled to insure for flooding unless the foot-deep water will touch their houses, not just their yards, Fraser said.

The district does recommend that owners who live near a flood-prone area insure their houses against high water, just in case an exceptionally nasty storm swoops in.

The insurance is priced according to how much a rainstorm will affect a residence, Eubanks said. People who don't live in a flood plain would, of course, pay the least for a flood policy.

For that reason, it's better to take out insurance now, before FEMA officially tags those areas flood zones, Fraser said. Insurance rates will go up substantially when the areas become flood zones, and owners who already have the insurance might get grandfathered in.

Sixty houses will be added to Duck Creek's flood zone, while 130 homes will be removed from the listing.

In the Cactus basin area, 47 homes will be added to the zone and 400 will be scratched off the list. Developers who needed gravel to augment home sites agreed to pay the cost of turning a quarry near Cactus Avenue into a basin and installing a drainage channel.

Although FEMA's local flood-plain map was first drafted in 1979, the district didn't form until the mid-'80s. With the aid of a quarter-cent sales tax, the district has dug 75 detention basins and 450 miles of drainage canals.

And there's still much more work to do, Eubanks said. "We're only halfway there."

Contact reporter Scott Wyland at swyland@reviewjournal.com or (702) 455-4519.