Tax activists gear up again

CARSON CITY -- Nevada's property tax revolt is about to be revived, and this time supporters are flush with a $200,000 contribution to help ensure a measure qualifies for the November 2008 ballot.

"We're in a big fundraising mode right now so that we will be ready," said Sharron Angle, chairwoman of We the People Nevada.

The group wants $400,000 in the bank by Sept. 1 so a California-style Proposition 13 property tax limit can be filed on the first day for signature gathering.

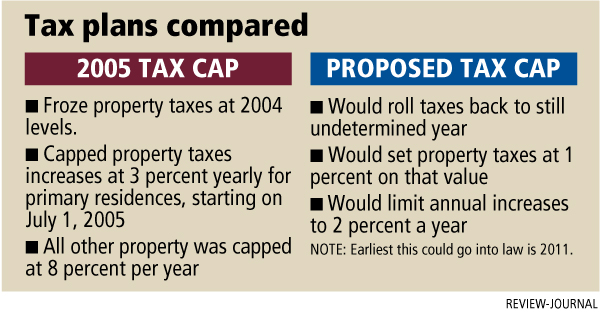

The constitutional amendment would roll back home values to a set date that is still to be determined and impose a 1 percent property tax rate on that value. Thereafter, property taxes would increase by no more than 2 percent a year.

The measure would provide more tax relief than the state's existing tax cap approved by the 2005 Legislature. The amount of that savings, though, could not be determined because proponents have not picked the rollback date and because property values have fluctuated so much in the past few years.

"It's the same thing we've always pursued," said Angle, a former Republican member of the Legislature who ran unsuccessfully for Congress in 2006. "We want stable, predictable property taxes. Our measure will look no different than it has before."

The $200,000 from a thus-far anonymous contributor, which is already in the bank gathering interest, will allow the group to hire professional signature gatherers rather than rely solely on volunteers, she said.

But the cost estimate to get the necessary signatures is about $400,000, which is why a serious solicitation effort is now under way to match the $200,000, Angle said.

Two previous efforts to qualify a measure for the ballot failed when an insufficient number of valid signatures of registered voters were collected. The efforts were both done primarily with volunteers.

The group will need just under 59,000 valid signatures, which means collecting closer to 90,000 to be on the safe side, Angle said.

The concept has had strong support in independent polls all across the state, she said. The problem has been getting the signatures to get it on the ballot, Angle said.

Muddying up the process is a new measure passed by the Legislature requiring signatures to be collected in all 17 counties, she said. The measure is probably unconstitutional, but the group will have to follow the law until and if it is ruled as such by a court, Angle said.

A legal challenge is expected.

A previous requirement that signatures be collected in 13 of 17 Nevada counties to qualify a ballot measure was found unconstitutional by a federal appeals court.

Angle is optimistic that the group will be successful this time around because of the huge financial contribution. To solicit money from Nevada residents with the large donation already in hand is easier, she said.

Las Vegas resident Gerry Lock, a self-described escapee from the San Diego area, said he supports the proposal and has donated $100. The Locks benefited from Proposition 13, which took effect in 1978.

"There were people at the time who were being priced out of their homes," Lock said. "People in Nevada don't realize how important it is for voters to control the property tax issue."

Property tax limits might not mean much to younger families who are in the process of buying and selling homes as they move up in the market, but for retirees who plan to stay in one place, the limits provide financial security, he said.

Assembly Speaker Barbara Buckley, D-Las Vegas, who worked on the Legislature's 2005 answer to soaring property values, questioned the need for a new tax cap proposal.

"Nevada came up with its own solution to soaring property values which led to the increase in property tax bills," she said. "We came up with a bipartisan solution which gave longtime homeowners relief.

"We passed a comprehensive measure protecting our schools and protecting Nevada homeowners," Buckley said. "Why do we need to come up with another measure that some out-of-state financier wants to import to Nevada."

The lawmaker was referring to the $200,000 donation, although the source of the money has not been disclosed yet.

"We have to maintain a balance," Buckley said. "We want to keep taxes low and stable, but we want to make sure we're not going to hurt our schools. I think that is what we did."

Carole Vilardo, president of the Nevada Taxpayers Association, said she would have to review the language in the new measure before taking it to her board for review. The association opposed the 2006 measure for several reasons, she said.

One concern with the 2006 measure was Angle's use of terminology, which in several cases was open to more than one interpretation, Vilardo said.

Such ambiguities can lead to extensive litigation, as happened with Proposition 13 in California, she said.

Another concern is that unlike in California, Nevada voters have approved the use of property tax increases to pay for government operations, such as the hiring of new police officers, Vilardo said. Cutting the revenue source for operating budgets could lead to problems in maintaining the services, she said.

Any amendment to the state constitution would have to be approved by voters twice, in 2008 and 2010, before it could take effect.

A committee of the group is still determining what rollback date to use, Angle said.

The 2006 proposal used a 2003-04 date to start, but the committee is considering an earlier starting date to account for the big run-up in property tax bills earlier this decade, she said.

The Legislature in 2005 enacted a statutory property tax cap limiting annual increases to 3 percent a year for primary residences and at 8 percent for other property.

Angle said the cap could be changed by the Legislature at any time. It could also be overturned in court because it is not equal for all property, she said.

She objected to that "split roll" and called it unconstitutional. "This is very unfair to commercial property owners and their tenants," she said in a statement.

A constitutional amendment would ensure that only the voters could make changes to the proposed cap, she said.

ON THE WEB We the People Nevada