Nevada is a world-renowned destination – from the glitz and glamour of the Las Vegas Strip to the outdoor adventures of Northern Nevada. Consequently, the hospitality and tourism industries have long been the foundation of our state’s economy. However, our nearly exclusive reliance on these industries poses disproportionate challenges to the resiliency of our economy during economic downturns. In April 2020 after the COVID-19 shutdowns, Nevada’s unemployment rate was 30.1 percent. This was the highest rate ever recorded for any state, including during the Great Depression.

Diversifying the economy is the answer.

In recent years, we’ve seen significant growth in health care and technology companies. Many companies have relocated here and have bolstered our resilience. Many of the companies began with an entrepreneur’s idea and many years of dedication and sweat later, they are strong viable businesses. Startup success depends not only on the driving dedication of the founders and employees, but also the financial commitment of investors. Silicon Valley has no shortage of these investors. Nevada does.

Now, Nevada needs to foster the development of our own robust, inclusive, and diverse startup ecosystem. We need to create the conditions attractive for startup founders to pursue their dreams; raise capital; employ dozens (or hundreds) of Nevadans; grow their businesses; be acquired or go public; create wealth for themselves, their investors, and their employees; and add to our state’s economy.

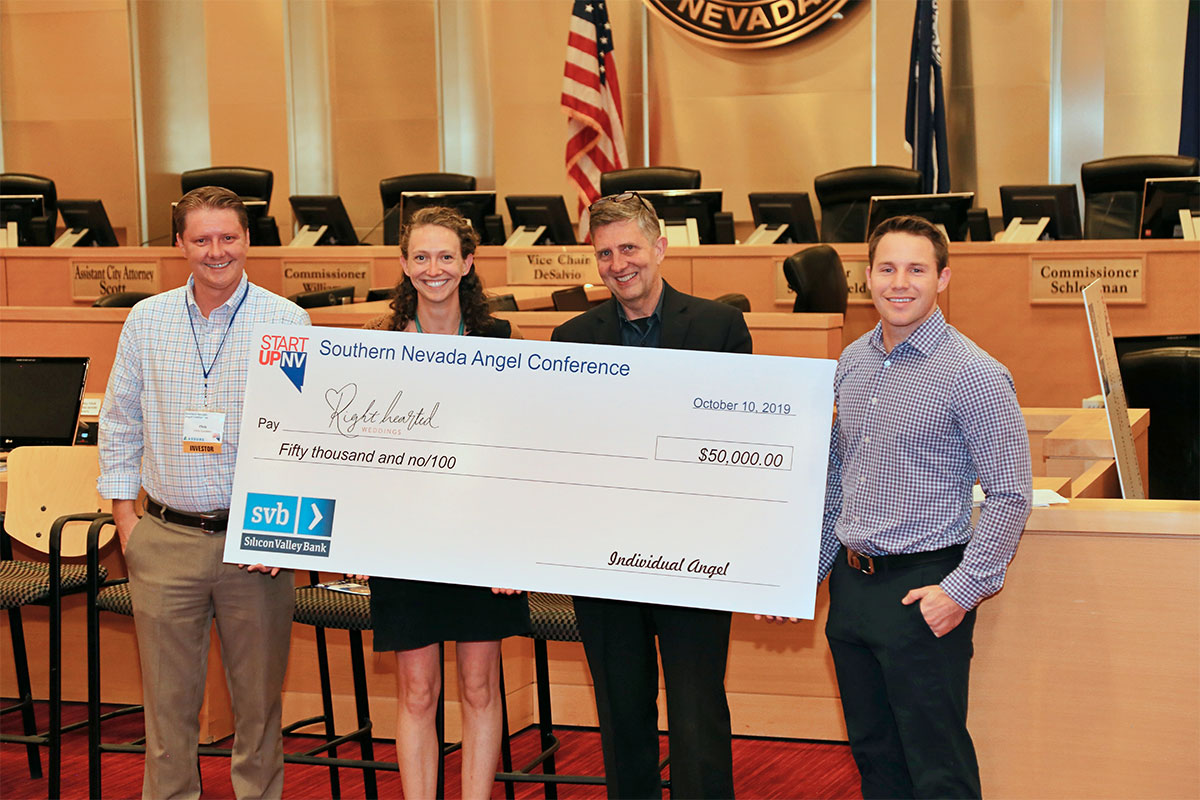

StartUpNV, a nonprofit statewide incubator and accelerator that provides expert mentorship and access to a network of capital partners for Nevada-based startup companies, has been tasked with this challenge. More than 500 startups have pitched their ideas to be part of the StartUpNV business incubator since its founding in 2017. Nearly two dozen companies have raised over $65 million in startup capital and are now worth more than $500 million. In less than four years, three of the startups have had successful exits via acquisitions or IPO’s. While that’s an impressive beginning, less than 1 percent of the startup capital raised has come from Nevada investors. That means Nevada investors are missing out on massive wealth creation opportunity.

Healthy startup ecosystems provide local early-stage capital – and reap both financial rewards and the community pride when hometown startups and founders succeed. StartUpNV is working to help our Nevada ecosystem on this issue with a weekly, hourlong investor boot camp – called AngelNV. Starting Feb. 24 and spanning 10 weeks, AngelNV teaches investors, sometimes called “angel investors” how to identify promising startups and provide investment capital in ways that minimizes risk and maximizes potential returns.

The program teaches investors how to “do well, while doing good” for local businesses and the community. In other words, angel investors can reap both financial and social rewards from investments that make an impact in burgeoning industries and can support founders in underserved communities, including women, minorities, and military veterans, who often struggle to attract investment from traditional sources. Some angels do even more and help founders with additional mentorship, advice, or connections – gaining even higher levels of satisfaction and accomplishment.

But – don’t you have to be a billionaire to be an “angel”? No, you don’t. “Regular people” can be angel investors with as little as $5,000 to invest with an angel group or in a startup mutual fund. It can be quite profitable with target returns for these groups and funds being 30-50 times over a 10-year period. Startup investing can be risky – and the key to success is in learning the skills. This education is what AngelNV provides.

As we start 2021, Nevada doesn’t have a vibrant startup ecosystem, nor have we provided early-stage capital sources to encourage it – but we can change that. It’s not that our community lacks the overall wealth to do it, we just haven’t coalesced together to do so.

We can create a robust local startup ecosystem and the sources of capital that drive a diversified, inclusive, growing economy that adds to our traditional industries. We can do it without putting much at risk individually – by working together to create the capital to fund our local startups. When we do, we reap the rewards together – in resiliency, wealth creation, and community pride.

2021 can be the year we not only recover from the pandemic – but also the year we truly embrace diversity in our economy, in our investments, and in our community. To learn more or join in this effort visit: www.angelnv.com.

Members of the editorial and news staff of the Las Vegas Review-Journal were not involved in the creation of this content.

![]()