Nevada’s jobless rate remains at 13 percent

As if Nevada's unemployment rate wasn't high enough, fresh statistics show even bigger job woes for specific demographic groups.

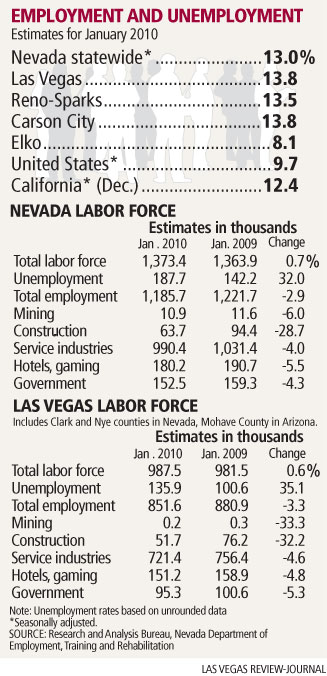

The Silver State's jobless rate remained unchanged from December to January, staying at 13 percent, the state Department of Employment, Training and Rehabilitation reported Monday.

But the agency's latest numbers show that men and minorities have experienced especially tough times during the recession.

Joblessness among Nevada's male population averaged 13.4 percent in 2009, while female unemployment averaged 9.4 percent in the same period. A year ago, men and women in Nevada shared roughly the same unemployment rates.

Blame the unemployment discrepancy on job distribution.

The male-dominated construction sector ranks among the hardest-hit industries in the downturn, said Bill Anderson, chief economist for the employment department. Health care and educational services, which skew more toward a female labor base, have actually added jobs in the recession, both nationwide and in Nevada.

The jobs picture looks even worse for some ethnic groups. Blacks in Nevada faced a jobless average of 18.2 percent in 2009, while Hispanics here saw unemployment average 17 percent in the year. Joblessness among white Nevadans averaged 11.4 percent in 2009.

The employment department also substantially boosted earlier job-loss estimates. Instead of losing 76,100 jobs from 2008 to 2009, Nevada actually dropped 115,100 jobs, or 9.1 percent of its jobs base.

Officials said the difference came from a U.S. Bureau of Labor Statistics methodology that uses limited feedback from local analysts, weak sample responses to employment surveys and the application of inflated business birth-and-death factors.

Based on the revised numbers, Nevada's jobs base has dwindled to 2004 levels, said Brian Gordon, a principal in local research firm Applied Analysis. The losses probably won't reverse and turn into growth anytime soon, he said.

"We're looking at a period of correction that will likely result in continued job loss through the balance of 2010," Gordon said. "While those losses will be fewer, it's unlikely the economy will start to report any material expansion during this year."

Anderson agreed, adding that he expects Nevada's jobless rate to bounce around in the next half a year, with some months showing declines in the jobless rate and others bringing increases.

"We're kind of treading water right now, and I think it will stay that way in the near term," Anderson said. "We certainly aren't seeing any return to growth and improvement, but at the same time, we are seeing some signs that the rate of decline is beginning to ease."

For hints at those smaller dropoffs, consider seasonal hiring trends.

Nevada's employers pared 25,300 jobs from December to January, well below the 40,300 positions they slashed in the same period a year ago and just 450 more than the average December-to-January decline of the past decade. Retail employment fell by 4,600 jobs from December to January, as stores eliminated temporary holiday positions. That was the shallowest rollback in the last 10 years, though the smaller cuts came at least partly because retailers hired fewer seasonal workers in the first place.

State government fell by 5,100 jobs due to a break between university semesters. The construction sector, which usually dwindles during January because of winter weather, was off by 3,200 jobs.

Officials with the employment department said in a statement that the job losses didn't exceed pre-recession patterns, but the cuts were significant nonetheless "in light of an already struggling workforce."

The Las Vegas market lost 17,100 jobs from December to January.

Unlike the state's jobless level, the local market's unemployment rate jumped noticeably, rising from 13.1 percent in December to 13.8 percent in January. That January total nearly matches the market's jobless record of 13.9 percent, set in September.

An estimated 187,700 Nevadans are unemployed and actively seeking positions. The vast majority -- 135,900 -- live in the Las Vegas area.

Randy Garcia, chief executive officer of Las Vegas wealth-management firm Investment Counsel Co., said the newest employment figures point to a protracted economic rebound.

"We believe that the recovery is going to be more prolonged and more moderate than we would like to see," Garcia said. "The longer it takes for recovery, the more these (jobs) numbers are going to disappoint."

Garcia added that the state's hotel-casinos have lost their pricing power in the recession, and economic revival will require not only gains in the numbers of tourists who visit, but also a new resort-operating business model that can restore profitability based on the way consumers spend today.

Nor should Nevadans expect the housing market to rebound and generate growth soon, Garcia said.

Previous real estate downturns resulted from high interest rates, he said. This time around, the bubble burst because values jumped too much. And overpricing issues turn around more slowly than interest rates.

Anderson also predicted a relatively sluggish recovery.

Visitor volumes have risen for four straight months, and sales of existing homes have jumped. But the recession hit Nevada so hard that it's going to take some time for the state to get back on its feet, Anderson said. Plus, consumers will likely continue to spend cautiously, and that could mean a sustained slump for the state's spending-reliant economy.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.