Police union paid top dollar for new offices

The Las Vegas Police Protective Association purchased a new office building in Sun City Summerlin for $6.5 million when older, neighboring properties in the upscale, suburban area were sold or appraised for far less.

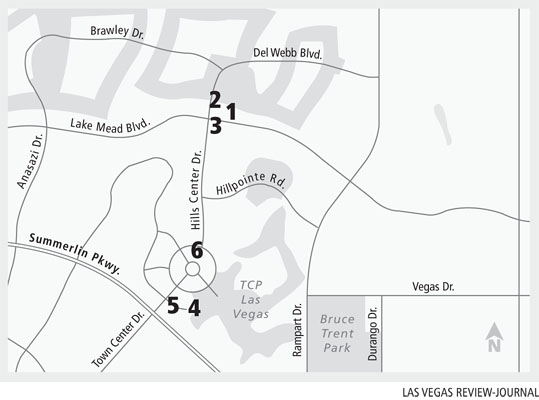

The union, which represents nearly 2,500 Las Vegas police and corrections officers, in April 2008 purchased from developer R. Dean Bryan an 18,328-square-foot building situated at the back of a lot at West Lake Mead and Del Webb boulevards. Surrounded by a tree-lined thoroughfare, the two-story building sits in a small commercial corner overlooking a guarded subdivision and the golf course at Palm Valley Golf Club.

The purchase price is more than double the $2.7 million taxable value the Clark County assessor's office placed on the nearly one-acre property, while nearby properties sold for 7 percent to 67 percent more than the 2009-2010 assessor's taxable value. On a per-square-foot basis, some sold for less and some for more than the PPA building.

Police officer Chris Collins, executive director of the Police Protective Association, wouldn't answer questions about the property. Armed with a 141-page private appraisal, and after speaking with the assessor's office about its valuation, Collins said he is comfortable with the price the union paid for its new building.

Collins wouldn't share with the Review-Journal the appraisal, the identity of the union's appraiser or the name of the appraiser he spoke with at the assessor's office.

"I have no problems with the numbers after speaking with the county. ... We pay less in mortgage than we did in rent. This building saves the PPA money every month."

Bryan said, "I don't have any comment on that. They (the union leadership) know why they purchased it."

The union's board of directors voted in the spring of 2007 to purchase the land and go ahead with construction, according to union literature. That decision was made two years after Bryan acquired the raw land for $635,000.

With Las Vegas Mayor Oscar Goodman and then-City Councilman Larry Brown in attendance, the union broke ground on the Summerlin property in June 2007.

Four months later, a nearby one-story, 12,669-square-foot office building built in 1992 on 1.6 acres was purchased for $2.75 million, according to Clark County property records, far less than half of what the union paid for its new building. The assessor's 2009-2010 taxable value for the property is about $2.57 million. The union's neighbor paid $217 per square foot six months before the union paid $356 per square foot.

The police union is not a government agency, and was not required to put its building proposal out to bid in pursuit of the lowest possible price. The union is a nonprofit agency which collects dues from Las Vegas police and corrections officers.

When the police union took ownership of its property, the county assessor dispatched an appraiser to examine the new building and establish for it a taxable value. By state law, the taxable value must not exceed the market value of a property.

The assessor's taxable value includes the assessor's estimate of the market value for the acreage coupled with the construction costs for all buildings and other "improvements" as dictated by the Marshall and Swift cost manual and as required by state law.

With 5,700 different "market areas" for real estate in Clark County, there are no set parameters or averages for the variance seen between the taxable value and the market value on developed property, according to the assessor's office. In other words, they can't say whether the taxable value should be 10 percent, 25 percent, or 50 percent less than the purchase price on a recent sale.

After asking his staff this past month to review its appraisal on the union's property, longtime Assessor Mark Schofield said his office used the same appraisal methods on neighboring parcels, and he stands by the appraisal of the union's property as accurate.

"It's difficult to discern what the motivations any individual buyer may have had as it relates to what they are willing to pay for a piece of property that they are interested in, and I would never question that motivation. That is between the buyer and the seller," Schofield said. "I am comfortable that the data we use to value property -- as required by Nevada Revised Statute and Nevada Administrative Code -- is an accurate reflection of taxable value."

Throughout 2007 and 2008, in its regular newsletter to police officers, members of the Police Protective Association's executive board wrote glowingly about their decision to construct the new building for themselves in Summerlin; how it was far better for the union to develop equity in a property than to continue paying rent; how leasing out much of the building will help pay off the mortgage; and how the union's long-term financial position is stronger with the acquisition.

In the May-June 2007 edition of the newsletter, Vegas Beat, Collins writes, "The best news is that we will no longer be paying rent for leased space, but paying off a mortgage and building equity in the membership's building."

Corrections Officer Kenneth Lochner, treasurer for the police union, explained in a newsletter PPA would pay a mortgage of $24,800 per month on the loan, but that it expects to take in $14,800 in monthly lease revenue to help cover that cost.

Lochner's article goes on to state, "After doing all this, it still left us with $1.9 million on hand and another $2.2 million in investments and we have $3 million equity in the members' new building."

Union leadership did not solicit proposals from land owners or developers when it decided to build its own headquarters, according to the union newsletter. Instead, it decided to purchase the land and new building from Bryan after having worked with him on an earlier, failed proposal to build the union headquarters downtown.

According to a national construction consulting company, Reed Construction Data, the price paid by the police union for its new office space in Summerlin far exceeds national averages for construction costs.

According to data from Reed's Web site, the national average cost for construction of a three-story, 20,000-square-foot office building constructed with union labor in 2008 would have been about $3 million, or about $149 a square foot.

A handful of Las Vegas real estate attorneys and brokers either didn't return calls from the Review-Journal, or declined to discuss the police union's purchase without taking time to research it further.

Tio DiFrederico, a private real estate appraiser and member of the county's Board of Equalization, wouldn't comment on the variance between the police union's purchase price and the assessor's appraisal for tax purposes.

"I don't know if the assessor's numbers are accurate," he said. "If you are asking me if they (police union) were overcharged, I don't know."

Wes Christian, an attorney from the Houston-based firm of Christian, Smith and Jewell who said he has handled "hundreds" of real estate cases since 1978 in Georgia, Texas and Florida, said it costs about $100 a square foot to build a typical office building, even though prices of steel and other building supplies have jumped in recent years.

After considering the square footage of the police union building, the acreage it sits on and its age, Christian said the assessor's appraisal for tax purposes seems a more accurate reflection of the property's value than the price paid by the union.

"That kind of building construction should not cost more than $100 a square foot to build, unless there is some sort of sophisticated communication or security system involved," Christian said. "The assessor's numbers are in line. One hundred dollars a square foot for construction of a two-story building gets you a very nice building."

Contact reporter Frank Geary at fgeary @reviewjournal.com or 702-383-0277.