U.S. loses AAA rating

WASHINGTON -- Better -- and worse.

The job market beat expectations, and the stock market managed a modest gain -- not great, but good enough after a turbulent week.

But when they come back on Monday, investors will have to absorb another body blow: Late Friday, ratings agency Standard & Poor's downgraded the United States' debt for the first time, saying the government's debt-reduction plans fall short. The downgrade could lead to higher interest rates and further hamper the economic recovery.

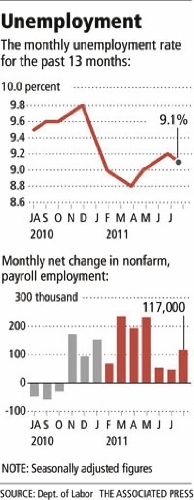

The nation added 117,000 jobs in July, the government said Friday, far from what happens in a healthy economy and only good for a reduction of one notch in the unemployment rate, to 9.1 percent.

But the jobs number beat the forecast of economists, who were expecting no more than 90,000. And it was an overwhelming relief for investors, who just lived through two of the most brutal weeks in Wall Street history.

"Nothing to pop Champagne corks over," said Diane Swonk, chief economist at Mesirow Financial, "but a much-needed shot in the arm for confidence at a time when we have so little."

"While our economy continues to struggle and millions of Americans remain out of work, it is encouraging that private-sector employers did better than most economists predicted by adding more than 150,000 jobs last month," said Sen. Harry Reid, D-Nev.

"Any news of job growth is welcome news. Unfortunately, the fact remains that economic growth in our nation continues to be anemic," said Sen. Dean Heller, R-Nev.

"While today's news is encouraging, far too many Nevadans need jobs, and there is much work to be done," said Rep. Shelley Berkley, D-Nev.

"Not good enough: That's the simple truth about our economy right now," said Rep. Joe Heck, R-Nev.

The Dow Jones industrial average finished Friday with a gain of 60.93 points and closed at 11,444.61. It made up a fraction of the losses from Thursday, when the Dow dropped 512, its worst since the financial crisis of 2008.

Friday was not exactly quiet for the market, either.

At the start of trading, investors were thrilled with the unemployment report, and the Dow rose 171. Ten minutes later, the gains were gone. Investors focused on Europe, which is struggling to keep Italy and Spain from being consumed by a growing financial crisis, and the Dow fell 243.

"The fear was that they had no plan to deal with the situation," said Randy Warren, chief investment officer at Warren Financial Service.

Later in the day, Italy promised to work toward a constitutional amendment to balance its budget. It was trying to calm investors around the world, who are worried that financial problems are spreading in Europe.

The Dow's gain was only its second in the past 11 trading sessions. The average has lost about 10 percent of its value in that time. The Standard & Poor's 500, a broader measure of the market, finished just under 1,200, down a fraction of a point.

It was the Dow's worst week, down 5.8 percent, since March 2009. The S&P, down 7.2 percent, and the Nasdaq composite index, down 8.1 percent, had their worst weeks since November of that year.

Further clouding the economic horizon, S&P said that with Friday's downgrade by one notch -- from AAA to AA+, for the first time since granting it in 1917-- it is issuing a negative outlook, meaning that there is a chance it will lower the rating again within the next two years. It said such a downgrade to AA would occur if the agency sees less reductions in spending than Congress and the administration have agreed to make, higher interest rates or new fiscal pressures during this period.

S&P first put the government on notice in April that a downgrade was possible unless Congress and the administration came up with a credible long-term deficit reduction plan and avoided a default on the country's debt.

After months of wrangling and negotiations with the administration, Congress passed this week a debt reduction package that averted a possible default.

S&P said that it had changed its view "of the difficulties of bridging the gulf between the political parties" over a credible deficit reduction plan.

S&P said it was now "pessimistic about the capacity of Congress and the administration to be able to leverage their agreement this week into a broader fiscal consolidation plan that stabilizes the government's debt dynamics anytime soon."

Meanwhile, the gain of 117,000 jobs for the U.S. economy looked even better considering that 37,000 public jobs disappeared during the month. Most of those were from a temporary government shutdown in Minnesota.

Subtracting those government layoffs, the private sector added 154,000 jobs for the month. And the economy added 56,000 more jobs than first thought in May and June.

Workers were paid more, too. Average hourly wages showed the biggest monthly gain since 2008. More jobs and better pay means people have more cash to spend, helping the economy grow.

And manufacturing companies added 24,000 jobs, which suggests that the supply disruptions caused by the Japan earthquake might be almost over. Makers of cars and other products found themselves short of parts after the disaster.

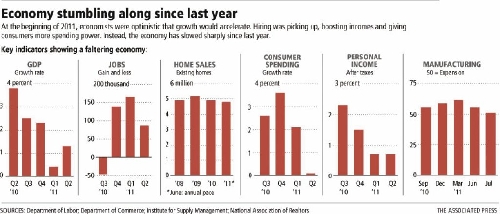

All told, the figures suggested a slower-growing economy -- but not one on the verge of a new recession, as some had feared. Some economists were impressed that the economy managed to add more than 100,000 jobs in a month when companies feared the government might default on its debt.

Other economists noted that corporations remain highly profitable, stocked with cash, and can hire when needed. They're waiting for customer demand to come back in force.

The economy is still too weak to produce the 250,000 new jobs a month that it takes to bring down the unemployment rate quickly. The rate has been above 9 percent in every month except two since the recession ended in June 2009.

Other recent data show the economy struggling. In June, consumers cut back on spending for the first time in 20 months. Manufacturers are barely increasing their output. The economy barely grew in the first half of the year.

The weakness has raised pressure on the Federal Reserve to take more steps to support growth. After they meet Tuesday, Fed policymakers could make clear that short-term interest rates will stay low indefinitely. But analysts say the Fed probably won't signal any new action.

The July job gains ranged broadly across industries. Retailers, factories and health care companies were among the many sectors that added workers.

President Barack Obama used the jobs report to press Congress to extend this year's Social Security tax cut that put an extra $1,000 to $2,000 in most workers' pockets. He also called for a renewal of emergency jobless benefits, which provide up to 99 weeks of support.

The tax cuts and extra benefits are scheduled to expire at year's end. Economists have cautioned that the end of the two programs could weaken growth in 2012.

Stephens Washington Bureau reporter Peter Urban contributed to this report.

MIXED PICTURE

THE GOOD

• The economy created more jobs. Employers added a net total of 117,000 in July, much more than in May or June and more than the 90,000 economists had expected for July.

• Companies did even better. Businesses added 154,000 jobs, and the gains were widespread across many industries.

• People with jobs made a bit more money. Average hourly wages moved up 10 cents, to $23.13 from $23.03, the biggest monthly gain since 2008.

THE BAD

• There are still 13.9 million people unemployed. That is down from about 14.1 million the previous month but is far higher than the 7.6 million unemployed when the recession began.

• The unemployment rate is 9.1 percent. That is also down, from 9.2 percent in June, but is still high given that the recession officially ended two years ago. The rate has been above 9 percent every month but two since then.

• Fewer Americans have jobs. The proportion of the population that has a job fell in July to the lowest level in 28 years: 58.1 percent. Millions of Americans have given up looking for work. These people are not included in the unemployment rate.