Affordable housing is easier to find

The Southern Nevada housing market is continuously evolving. Home prices have been on a pendulum, decreasing and increasing according to supply, demand, construction costs and market trends.

When valley home prices soared in 2005 and sales were recorded in record numbers, housing affordability came into question and some home-buyer-wannabes were priced out of the market.

Since then, the Southern Nevada housing market has swung in the opposite direction and become a buyer's market. With more than 22,000 houses listed for sale on the Multiple Listing Service in December, an influx of foreclosures, a slowing sales pace and tightening of the subprime mortgage lending market, prices of both new and existing homes have decreased.

The Greater Las Vegas Association of Realtors' most recent sales statistics for December 2007 report the median sales price of a single-family, detached, resale house was $260,000, a 15 percent decrease compared to December 2006. The median sales price of an attached, resale condominium/townhome was $185,000, a 5 percent price reduction from the previous December. Of the 879 houses sold in December, 228 were repossessed.

Dennis Smith, founder of Home Builders Research Inc., reported the median sales price of a new home, which includes single-family detached, condominiums, townhomes and high-rises, was $280,085 last month. That's down from last year's median sales home price of $337,781.

Shoppers can find lots of bargains on the market, if they know where to look.

Lowest-priced new houses

In early February 2007, with the assistance of the housing research firm SalesTraq, the Las Vegas Review-Journal's Real Estate section researched the valley's lowest-priced, new-home neighborhoods and reported that only three single-family neighborhoods were offering houses priced under $200,000 -- with the lowest priced of those being $198,990. Almost a year later, a search of SalesTraq's database on Jan. 4 showed that 25 neighborhoods in the Las Vegas Valley and surrounding communities such as Pahrump and Mesquite offer brand-new houses under $200,000, with one as low as $153,990.

Devin Reiss, 2007 GLVAR president and owner of Realty 500 Reiss Corp., described the lowering of home prices as part of a housing cycle.

"Definitely housing has become more affordable. We've gotten back to an affordable price range now. Certainly, we (the GLVAR) have been stressing that this is an opportune time to buy," Reiss said.

"This is part of the housing cycle. It is an opportunity cycle right now that buyers should really be capitalizing on before it's too late and they are priced out of their price range again," he said.

According to data compiled Jan. 4 by SalesTraq, two of the single-family neighborhoods that offered homes below $200,000 in February 2007 were the two lowest-priced new-home, detached neighborhoods in the valley.

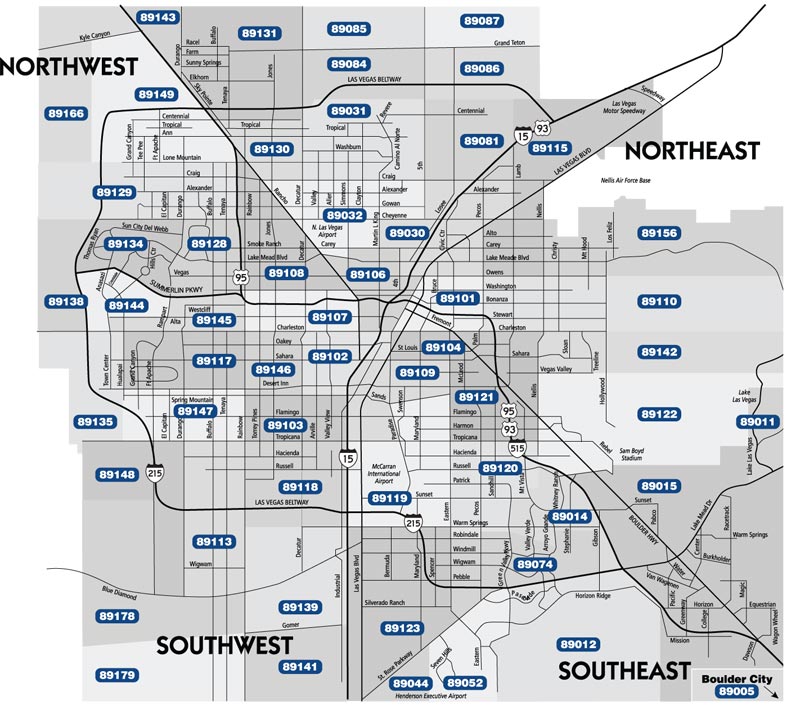

Sapphire Springs by Richmond American topped the list by offering a 1,136-square-foot, two-bedroom, 21/2-bath home in the northern valley for $153,990. In February 2007, SalesTraq reported the same size of floor plan available at that neighborhood for $198,990. The price reduction in just under one year amounts to 22.6 percent.

Placing second was Encantos by Storybook Homes. Located in the eastern valley, the neighborhood listed a 1,271-square-foot, two-bedroom, 11/2-bath house for $169,965; in February 2007, its lowest-priced floor plan was a 1,199-square-foot home for $199,240.

Rounding out the list of the five lowest-priced, new single-family neighborhoods was:

-- Villas at Cambridge by KB Home in the northwestern valley at $174,990;

-- Entrata by William Lyon in Pahrump at $177,000; and

-- Avenues at Tapestry by Astoria in the northwestern valley at $179,990.

Condo, townhome prices

The Southern Nevada housing market consists of more than just single-family houses. Condominium and townhome developments as well as apartment/condominium conversions are available.

During the same time frame, SalesTraq data showed steady prices among the lowest-priced new condominium and townhome projects.

The lowest-priced condominium/townhome development, Fort Apache Square in the northwestern valley by D.R. Horton, offers a 1,000-square-foot, two-bedroom, two-bath unit for $167,900 -- a slight price increase from the lowest-cost model priced at $163,190 last year.

Four condominium/townhome complexes made the lowest-priced list for both years. Two of these developments, Esplanade Metro by Warmington and Nevada Ranch First Light by D.R. Horton, reduced the cost on their lowest-priced units. During the same period, the listing prices slightly increased at the other two complexes: First Light at Hollywood Ranch by D.R. Horton and Sky Pointe by Pulte.

A lower-cost homeownership option is a unit at an apartment/condominium conversion -- condominium complexes that were previously used as apartments. According to SalesTraq, the lowest-priced condo-conversion unit is a 700-square-foot condo at Coronado Palms in the southwestern valley for $123,900, which is slightly lower than the $126,000 reported as last year's lowest-priced apartment/condominium-conversion project.

A separate search of midrise and high-rise developments resulted in just one property with a unit priced under $200,000; Verge, a midrise development near downtown Las Vegas, is offering a 609-square-foot studio for $149,900.

Current market conditions

Smith said builders have roughly one to two months of inventory unsold, consisting of about 1,000 traditional units (excluding high-rises). The number changes daily due to new contracts and cancellations. He said the Multiple Listing Service excludes homes for sale by owner.

Monica Caruso, director of public affairs for the Southern Nevada Home Builders Association, said the reduction of new-home prices is not surprising and is part of a cyclical market.

"Pricing and sales are coming down from a boom period between 2004 and 2006 and it does not surprise us (Southern Nevada Home Builders Association). It's part of the business cycle," Caruso said.

"We had an unusual high in terms of the cycle between 2004 and 2006. ... There are a number of reasons why we saw that huge burst of sales activity. That was an anomaly in and of itself and that was the high point of the cycle," Caruso said.

"We believe that we will begin a new cycle in 2008 and 2009 when the prices and sales will move back up."

Caruso said the price change will benefit potential buyers.

"More people are now able to buy a home. This is a great time to get out there on the weekends and to look for a new home. We have not seen this type of pricing for quite a number of years," Caruso said. "... In 2006 people were talking about affordability and now there are plenty of opportunities. We know that the mortgage industry is getting back to normal. It is getting back to the system of people needing to have a down payment, the income that supports the payment, and good credit."

Keith Schwer, director of the Center of Business and Economic Research at University of Nevada, Las Vegas, said there are many reasons why builders may have lowered their prices.

"There are so many pieces to the housing market. There are the foreclosures, there are so many units on the market, the prices are depressed. The builders are trying to sell their homes in the market at the same time as other people who are trying to sell. There is competition, but there is always competition between a builder selling a new house and the resell market," Schwer said.

"The issue is housing adjusting to imbalances and that housing prices have always been slow to adjust compared to other assets," Schwer said. "This is a substantial drop (in prices) and people are realizing that they have to drop home prices to make them sell.

"These are builders and first purchases so a lower price will be advantageous to more people to buy. The question is, with the prices going down will more people be able to finance it? There may be more people who are definitely able to buy that home," Schwer said.

Tightening mortgage-qualification practices may impact potential borrowers with less-than-stellar credit histories.

"Very clearly, some people ... will be turned down (for a mortgage). I'm not talking about all of the shenanigans that are ongoing. There are people who sincerely want to buy but they may not be able to because the standards are tightening," Schwer said. "We need to make a distinction between those who have good credit scores versus those who do not. And we are not talking about those people in the speculative business, they will be sifted out."

Reiss said buyers with good credit histories will continue to qualify for mortgages.

"People can get loans especially if they have good credit and they have a little bit of money down. Right now, I see just as many opportunities for mortgages as there were before. Obviously, if you take away some of the subprime lending and you substitute in the FHA loan that is a more secured loan and a low-down payment, you have a healthier market. There are as many opportunities for borrowers as there used to be," Reiss said.

"I think one misconception is that 'stated loans' do not exist anymore. They do exist. The only difference being is that the lender has to take a little greater step to make sure that the numbers that borrowers state are accurate ... The lenders just want to be a little more self policing."

In an effort to attract buyers, some builders offer incentives.

"I've seen anything from the typical down payment assistance to offering trips and a drawing for a car," Reiss said. "This is not new. It is typical stuff that builders will do to try to get someone to look at their product."

Likewise, rumors have circulated that sales prices are not necessarily set in stone at some new-home neighborhoods.

"I've heard quite a few stories with home prices (at new-home neighborhoods) being negotiable. I'm sure that it depends on the builder, their inventory, their motivation. It would be difficult to call it across the board, but I've heard that some builders have been negotiable with their prices. It varies. It certainly doesn't hurt to ask," Reiss said, adding that home shoppers may want to contract with a Realtor to represent them as a buyer's agent.