Analyst details housing slump

The housing slump in Las Vegas has been a tough pill to swallow for a lot of people and there's no way to sugarcoat it, housing analyst Larry Murphy said Thursday.

Sales volume plummeted 45 percent in 2007 and median home prices declined for the first time since 1993. Businesses tied to the housing industry have seen sales and revenue drop by 40 percent, he said.

"The good news is it won't continue to get much worse," Murphy told about 500 real estate professionals attending his 2008 Crystal Ball seminar at Texas Station. "I think we are very near the bottom of the decline in prices."

Median existing-home prices fell 4.3 percent to $275,907 based on nearly 24,000 sales, though December's median is down 11.2 percent from the same month in the previous year at $253,000, Murphy said. The median price could drop to $240,000 before it starts to climb again, he said.

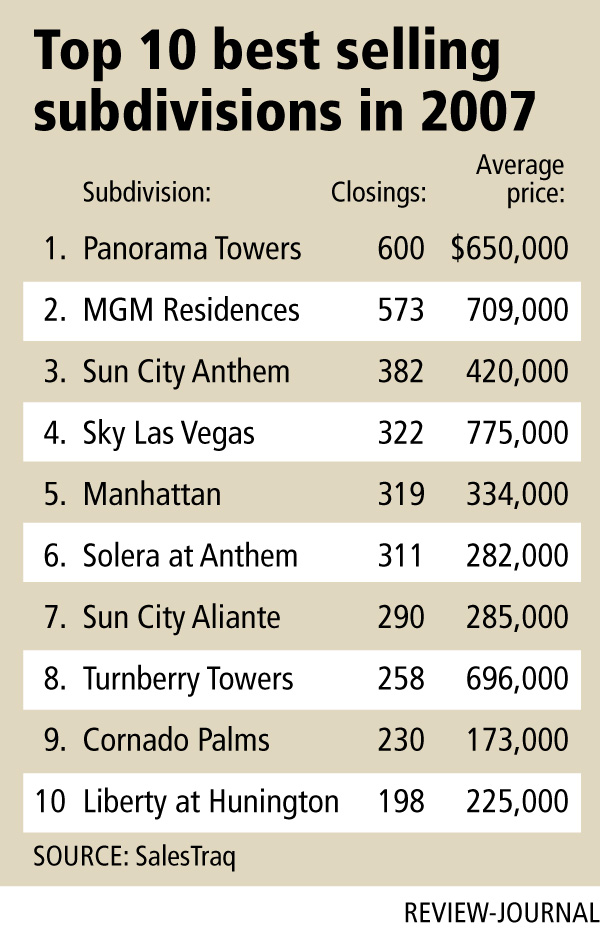

Murphy noted that five of the 10 best-selling subdivisions were mid-rise or high-rise projects, led by Panorama Towers with 600 closings in 2007 at an average price of $650,000.

"Ladies and gentlemen, this is a sign of the changing times in Las Vegas," Murphy said. "Three of the 10 are age-restricted, so the nature of our market is changing."

Murphy admitted he hasn't always been right in his market assessments. After 40 percent appreciation in the first six months of 2004, Murphy said it couldn't go on forever and correctly predicted that prices would plateau. What he did not see coming was another surge in prices in January 2005.

Now he sees another plateau, this time on the bottom side.

"We're pretty much right on track had none of this happened in 2004, 2005 and 2006," he said. "If you didn't buy or sell a home during this period, if you owned in 2002, guess what? You're right on schedule."

Homes for sale on the Multiple Listing Service tapered off at the end of the year and home builders pulled 38.9 percent fewer permits in 2007, though Las Vegas still has a 21-month supply of inventory, Murphy noted.

Over the last four years, Murphy has tracked 173,000 final map lots from the Clark County assessor's office and 122,000 escrow closings, leaving more than 50,000 available lots. Some are finished and ready for building, some are being graded and others are simply "paper" lots, he said.

Apartment conversion volume is down 62 percent while mid-rise and high-rise closings are up 17 percent, Murphy reported. One out of every $4 was spent on vertical product, he said.

About 13 percent of the units at MGM Residences, Turnberry Place and Panorama Towers are listed on the MLS.

"There is an emerging high-rise resale market," Murphy said. "Those who bought in the early phase have done pretty well. Those who bought as friends and family made money. People who bought later in the program are going to have more difficulty and may need to hold longer. Some people also found that condo-hotel units are not producing the cash flow they thought."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.

SINGLE-FAMILY EXISTING-HOME PRICES DOWN

WASHINGTON -- Sales of existing single-family homes fell in 2007 by the largest amount in 25 years, closing a year in which median prices fell for the first time in at least four decades.

The National Association of Realtors said Thursday that sales of single-family homes fell by 13 percent last year, the biggest decline since a 17.7 percent drop in 1982. The median price of a single-family home fell to $217,800 in 2007, down 1.8 percent from 2006.

The results marked the first annual price decline on records that the Realtors have going back to 1968. Lawrence Yun, the Realtors' chief economist, said it was likely the country has not experienced a decline in home prices for an entire year since the Great Depression.

Private economists said the size of the sales plunge and the drop in prices underscored the housing slump's severity. Last week, the government reported that construction of new homes fell by 24.8 percent in 2007, the second biggest decline on record, exceeded only by a 26 percent plunge in 1980.

The year ended with total sales of both single-family homes and condominiums dropping by 2.2 percent in December to a seasonally adjusted annual rate of 4.89 million units.

Standard & Poor's chief economist David Wyss said he thinks sales of existing homes will keep falling until midyear.

The report showed the inventory of unsold homes fell 7.4 percent to 3.91 million units in December, but part of that probably reflected disappointed homeowners just taking their houses off the market.

The 13 percent drop in single-family home sales last year followed an 8.1 percent drop in 2006 that occurred after sales had set record highs for five straight years.

That housing boom fueled a speculative frenzy in many parts of the country, luring many investors into the market hoping to buy homes and flip them for quick profits as home prices in those areas soared at double-digit rates. The boom's abrupt end has been a severe drag on the economy. It has also resulted in record levels of mortgage defaults.

MARTIN CRUTSINGER/THE ASSOCIATED PRESS