Construction shows some life in sales tax figures

Well, finally.

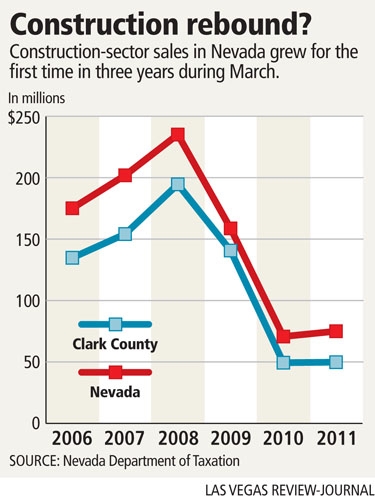

After three years of annual declines, taxable sales in Nevada's construction sector rose year over year in March, the state Department of Taxation reported Tuesday.

Construction sales rose 5.4 percent statewide in the month, though industry sales fell 0.3 percent in Clark County in the same period.

Local observers greeted the news with cautious optimism.

Brian Gordon, a principal in the research and consulting firm Applied Analysis, said it's tough to suggest a trend based on one month of data. Construction spending is more volatile than consumer spending because project timing can trigger unusually large one-time purchases that generate outsized numbers in a single month.

Construction sales also remain well below pre-recession levels: Transactions statewide totaled $75 million in March, down from $235.1 million in March 2008. Clark County's $49.8 million March total was down from $194.6 million in the same period of 2008. So March's statewide increase came at least in part from comparison to abysmal numbers in 2009 and 2010.

Still, Gordon called Nevada's construction-sales boost a "bright sign."

Clark County lagged the rest of the state in March because developers overbuilt homes and office parks at a much greater rate in Las Vegas than they did in other Nevada counties, Gordon said. Real estate oversupply remains significant here, and that's probably why local construction activity is still slow.

But Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas, said the center's research actually forecasts positive local construction indicators, thanks in part to small business growth and relocation.

A March report from the Ewing Marion Kauffman Foundation, an entrepreneurship think tank based in Kansas City, Mo., ranked Nevada No. 1 in the nation for its number of business startups. Another March study, from Applied Analysis and Nevada Secretary of State Ross Miller, showed an increase in new business entity filings in Nevada for the first time since mid-2006.

New businesses translate into fresh demand for office and store space, and bargain-basement rents have encouraged existing businesses to trade up on their offices, moving from Class B space into newer, higher-end Class A space.

Those trends mean growing demand for tenant improvements, renovations and other construction-related services, Brown said.

"The indicators we're looking at in construction are slightly favorable, but construction is at such a low level that even slightly favorable is not robust," Brown said. "I think trends may be positive from this point forward, but it will be modest growth, and from a really low base."

The broader Nevada economy fared better in March.

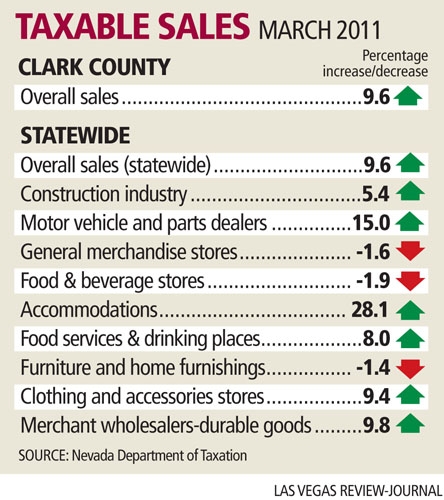

Taxable sales, which measure the dollar volume of tangible goods sold by Nevada's merchants, rose 9.6 percent statewide year over year in March, to $3.6 billion. Taxable sales in Clark County also gained 9.6 percent, increasing to $2.7 billion.

Clark County's improvement was its strongest pace of growth since mid-2006, Gordon said. It was also the sixth straight month of year-over-year increases here.

"All signs are that stabilization is occurring within the local economy as it relates to consumer spending,'' Gordon said. "The worst is likely behind us."

Statewide, bar and restaurant sales -- the biggest taxable-sales category at 18.3 percent of total sales in March -- rose 8 percent. Retail sales in hotels and motels jumped 28.1 percent. Cars and car dealers saw a 15 percent sales gain, while sales of clothing and accessories increased 9.4 percent.

A few categories posted slight declines, including general merchandise retailers such as department stores (down 1.6 percent), grocery stores (off 1.9 percent) and furniture stores (down 1.4 percent).

Sales numbers were favorable in March, considering continued weakness in the state's job market, Brown said.

"It mirrors what happened at the national level a few quarters back, which is that consumers got tired of waiting for the economy to pick up and they just started spending again," he said.

Gross revenue collections from sales and use taxes totaled $288.3 million in March, a 10.1 percent increased compared with March 2010. The general fund share of sales and use tax collections was $73.1 million in the month, up 10 percent when compared with a year earlier.

Revenue from taxable sales helps fund prisons and public schools, among other services.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.