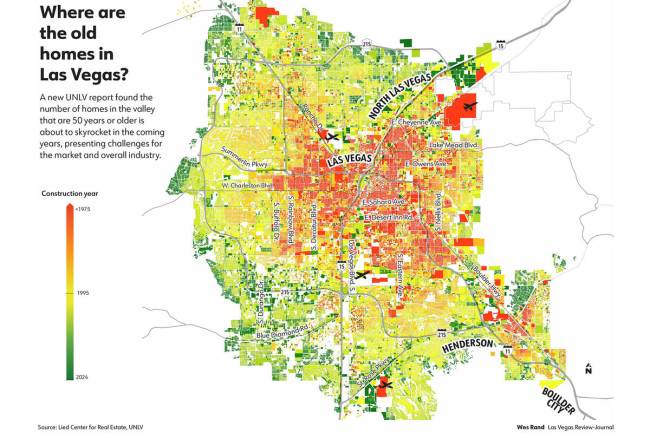

In 13 years, the number of old buildings in Clark County will jump 109%. Here’s why it matters.

The number of old buildings in Clark County is going to dramatically increase over the next decade, according to a new study.

Approximately 80,608 additional buildings in the valley will be 50 years or older within the next 13 years, according to a new study from UNLV’s Lied Center for Real Estate. That number represents a 109.4 percent increase in the total stock of old buildings that are more than half a century old.

That’s significant because buildings that are 50 years or older generally require a higher degree of renovations and are considered for demolition at a much higher rate because of deteriorating materials, said Shawn McCoy, director of the Lied Center for Real Estate and author of the study.

“Las Vegas is a town that grew up rather quickly,” he said. “Accordingly, it is a town that will age rather quickly.”

McCoy said this will create more opportunities for the adaptive reuse, or redevelopment, of older buildings in Clark County, and how well the industry is prepared for it “will matter for the overall health of our local housing market.”

McCoy said this data represents a bit of a doubled-edged sword for the valley’s building stock. Approximately 73,649 buildings in the country were built in 1975 or earlier, which makes up about 10.7 percent of all the properties in the valley.

“So what it appears we have going on here is something working for us and something working against us,” McCoy said. “On the one hand, our overall stock of 50-plus year old buildings is relatively low compared to metros like Pittsburgh. On the other hand, at 109.44 percent, the rate at which our stock of 50-plus year buildings is expected to grow over the next decade is high, which means the market for adaptive reuse projects may change. Minimally, these types of markets will likely be pressured to adapt and or be presented with opportunities to adapt.”

There are approximately 685,000 buildings in the county, said McCoy, adding that an even bigger wave of buildings hitting 50-plus year will hit the market in 2055 given the valley saw an unprecedented construction boom in the mid-2000s before the Great Recession. He said the valley is unique in that the city came about in a rather short period of time which is in contrast to older more established cities that have already seen periods of renewal regarding their building stock.

Bob Cleveland, the president and CEO of Rebuilding Together Southern Nevada, a nonprofit that helps people renovate their homes, said along with older homes will be older homeowners who will present new challenges regarding housing.

“The older the house generally the older the person that lives in that house. Younger people generally don’t buy older houses, and if you’re younger and you have a good job you usually just upgrade, but these older homes generally people have been in them for 20 or 30 years and they can’t afford to go anywhere else,” he said. “Some of our clients have been in their houses for 30, 40, 50 years in some cases, and there is just no way they can get their money out and go somewhere else with the way housing prices are going.”

Cleveland said decisions will have to be made for a lot of these homes as major renovations come up such as a new roof or an air conditioner for a lot of older homeowners who don’t have the funds to do the upgrades.

Construction on both the residential and commercial side has dropped significantly from a recent high-water mark during the pandemic when ultra-low rates fueled a financing and building boom for the overall industry. However new home builds in the valley are down in 2025 along with commercial projects as the industry grapples with a multitude of challenges, two of them being a lack of construction jobs due to a slowdown in work, and increased labor costs within the industry.

David Behar, the executive officer for the Nevada State Contractors Board, said they see the writing on the wall regarding a need to prepare for the future and are working to expand licensing for construction workers for residential projects while working with the government to bring more qualified workers into the overall local construction industry.

“The current and future demands for residential construction and home improvement projects has been on our radar at the Nevada State Contractors Board for several years as we continue to work with the industry to address workforce shortage concerns, expand licensing opportunities and prioritize public safety for consumers working with contractors,” he said. “In addressing workforce shortages, the Board works closely with local, state, and industry representatives to identify collaborative solutions.”

Contact Patrick Blennerhassett at pblennerhassett@reviewjournal.com.