No rest for the stressed

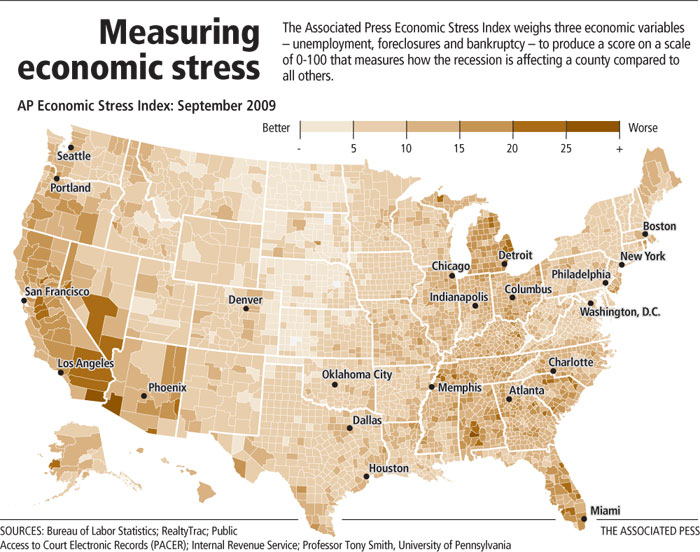

The nation's economic recovery is proceeding unevenly in its early stages, with Nevada and other states hurt most by the housing slump still lagging, according to The Associated Press' monthly analysis of economic stress in more than 3,100 U.S. counties.

Counties in the Southwest, the industrial Midwest and the Southeast continue to struggle and have improved the least, the analysis of September data found. The northern half of the nation is stabilizing or improving faster than the southern half. Northern counties generally didn't suffer as much from the housing bust.

Even as the nation's overall Stress Index score fell from 10.3 in August to 10.1 in September, Nevada's rose from 21.32 to 21.95, securing the Silver State the No. 1 spot on the list of most-stressed states.

Following Nevada were Michigan, with its battered auto industry, at 17.75; California, at 16.2; Florida, at 15.4; and Arizona, at 14.26.

California, Florida and Arizona, like Nevada, enjoyed high-flying housing markets from 2004 to 2006, and that means the housing bust hit those Sun Belt states especially hard.

The Associated Press calculates its index on a scale of 1 to 100 using unemployment, foreclosure and bankruptcy rates. A region qualifies as stressed when its score surpasses 11. Analysts attributed nationwide improvement in stress scores to stabilized bankruptcy and foreclosure numbers.

Nevada claimed three of the nation's five most-stressed counties in September, up from two of the top five in August.

Lyon County outside Reno ranked No. 3 among the worst county economies, with a September score of 24.72. That's up from 24 in August. Clark County came in at No. 4, with a stress score of 23.83, up from 23.19 in August. Nye County, home to Pahrump, landed at No. 5, with a stress score of 23.72, compared with 23.3 in August.

Clark County ranked No. 6 in August.

Economists say Lyon and Nye counties have struggled more than average during the recession because they're home to suburban bedroom communities serving the state's larger cities. They relied on housing expansion for their growth; today, a moribund real estate market has left both counties with the highest jobless rates in Nevada.

The top two most-stressed counties were Imperial County, Calif. (33.51), and Yuma County, Ariz. (25.82).

"There is going to be a longer process for those economies to get back into the swing of things," said Michael Pakko, chief economist at the Institute for Economic Advancement at the University of Arkansas at Little Rock.

Stephen Miller, an economics professor at the University of Nevada, Las Vegas, said recovery in Nevada depends on improvements in discretionary spending, and it's difficult to peg a time frame for a revival in slumping visitor volume and spending.

"The current recession was largely in the areas of leisure and hospitality, finance and construction, and we've got two of those areas big-time in Nevada," Miller said. "Given the nature of our economy, until the tourists return and start spending, we're going to continue to have difficulties."

Nevada's housing travails are also likely to continue for some time, Miller said, because the state has a high percentage of newer residents who moved here during the boom. That gives the state a big share of homeowners under water on their mortgages.

The housing situation is far less bleak in states with the lowest Stress Index scores. Those states were North Dakota (4.07), South Dakota (5.01), Nebraska (5.71), Montana (6.6) and Wyoming (6.9).

"Housing still is at the epicenter of this crisis around the country, and places where the cycle was most egregious are also now places that are seeing some of the highest rates of unemployment," said Sean Snaith, an economist at the University of Central Florida.

Midwestern and Plains states such as Oklahoma, Nebraska, North Dakota and Iowa avoided the worst of the housing and financial crises. And Oklahoma and North Dakota have recently benefited from rising oil prices. The region also has been helped by a weaker dollar, which has made agricultural commodities cheaper for foreigners to buy.

Areas of the Northeast, such as Pennsylvania and upstate New York, are benefiting from economically stable industries like higher education and health care. Those are the two industries that have added jobs during the recession.

Pittsburgh, for example, is no longer an old-line industrial city. The city's largest employers are the University of Pittsburgh's Health Center and the West Penn Allegheny Health System, a network of hospitals, noted Steve Cochrane, an economist at Moody's Economy.com.

That's in contrast to much of neighboring Ohio, which still has auto-related manufacturing that has been hit hard by the downturn, Cochrane said. In September, Ohio suffered from a Stress score of 12.48, while Pennsylvania's was only 9.49.

About 36 percent of counties in September had a score of 11 or higher, down from 39 percent of counties in August. Twenty-nine states saw some improvement in their Stress scores from August to September.

Since the start of 2009, 12 states have improved their Stress scores: Alaska, Arkansas, Colorado, Indiana, Maine, Minnesota, Mississippi, Montana, Nebraska, North Dakota, South Dakota and Vermont.

Review-Journal writer Jennifer Robison contributed to this report.

STRESSED OUT

A list of the 20 most economically stressed counties with populations over 25,000 and their September 2009 Stress scores, according to The Associated Press Economic Stress Index:

1. Imperial County, Calif. 33.51

2. Yuma County, Ariz. 25.82

3. Lyon County 24.72

4. Clark County 23.83

5. Nye County 23.72

6. Merced County, Calif. 23.39

7. Yuba County, Calif. 23.29

8. San Joaquin County, Calif. 22.69

9. Lauderdale County, Tenn. 22.68

10. Wayne County, Mich. 22.5

11. Lapeer County, Mich. 22.44

12. St. Clair County, Mich. 22.42

13. Riverside County, Calif. 22.37

14. Dallas County, Ala. 22.17

15. Stanislaus County, Calif. 22.16

16. Macomb County, Mich. 22.02

17. Chester County, S.C. 21.48

18. Marion County, S.C. 21.4

19. Union County, S.C. 21.19

20. Lee County, Fla. 21.18