Economic rebound in Nevada could run out of gas

CARSON CITY -- Gov. Brian Sandoval might want to talk to people like Tony Genevese before betting Nevada's future on a gambling and tourism revival.

Turmoil in the Middle East is driving up the price of oil and threatening to undermine Nevada's fragile recovery from a deep recession that has wiped out nearly 200,000 jobs and evaporated state dollars set aside for schoolchildren, low-income parents and disabled residents.

The rising cost has Genevese and other would-be Nevada visitors reconsidering how much money they can spend in hotels and casinos, which is bad news for a governor who is counting on sales and room tax revenue to continue beating expectations.

"I want to spend money on the vacation itself and not the transportation costs," said Genevese, 28, a Folsom, Calif., insurance actuary.

Money he puts in the tank to go to Lake Tahoe or drops on an airline ticket to Las Vegas means less cash to spend in a Nevada casino because a higher cost to leave home "just sucks the life out of" vacation fun.

Sandoval administration officials aren't sweating the possibility that by summertime rising oil costs could cause $4-per-gallon gasoline and fewer available airline seats to Las Vegas.

They are planning to balance the 2011-13 budget without new taxes by cutting money for schools, colleges, services for the sick and poor and capping general fund spending at $5.8 billion. Those plans don't include an oil-induced slump in Nevada visitation .

Asked recently about the negative indicators, Sandoval's chief of staff, Heidi Gansert, brushed off the question by reiterating sunny sales and room tax projections.

Senior policy adviser Dale Erquiaga quipped, "Where is your degree in economics from?"

TAX REVENUE FEARS

But Las Vegas customers and some tourism businesses see storm clouds gathering and are already making plans to cut back, which could mean less money for Sandoval and the Legislature to spend on education and social services.

"You may not see that in tax revenue just yet; give it another 60 days and you may start seeing it," said Andrew Levy, president of Allegiant Travel Co.

The Las Vegas-based airline sells airfare and hotel rooms to hundreds of thousands of visitors each month.

Levy, who for more than a decade has analyzed the effect of fuel costs on airline travel, said Mideast turmoil and broader inflationary fears are causing rapid increases in prices for commodities such as oil, gold and wheat.

Quantifying how much of the price spikes are attributable to unrest in oil-producing nations is difficult for Levy, who has a degree in economics from Washington University in St. Louis. But the bottom line for Las Vegas and state and local government, is simple.

"Vegas was already in a very difficult spot. I think fuel prices going up is making it much, much tougher," Levy said. "And I don't think it is something the community has come to grips with."

Levy said fuel prices are a leading indicator for airlines, meaning the cost of fuel today won't show up in the economy until weeks or months later.

When prices shoot upward, Allegiant and other airlines need to decide how to react, usually by raising prices, flying fewer planes into the market or both.

"Every day fuel prices go up we look at this and think about it," Levy said. "Our goal is to remain highly profitable and that is the only way to do it."

That reaction also means lower tax collections for state and local governments, because fewer people will come to Las Vegas. And those who do visit will have more of their budget eaten by airfare, which doesn't generate as much tax revenue for Nevada as gambling, dining and hotel room spending.

ANOTHER TRIP IN THE CARDS?

Ross Faranda, 23, a student at Kean University in Union, N.J., said he is worried rising airfares could snuff out plans for his next Las Vegas vacation.

Faranda, who has visited Las Vegas twice, works part time and is saving for a third trip. He likes to gamble, go to restaurants and go sightseeing on the Strip.

"I just feel like I can go to Vegas and go to a fancy place every night if I want to," he said. "The buffets are incredible."

An airfare increase of $100 would eat up one day's gambling budget, Faranda said. An increase that pushes his ticket above $525 or so could wipe out his vacation plans altogether.

"For the most part of it, that money would be saved," he said. "I'm just a low roller guy."

Every time Faranda or anyone else decides to cut back on or skip entirely a Las Vegas vacation it will have a direct impact on money available for government services in the 2011-13 budget.

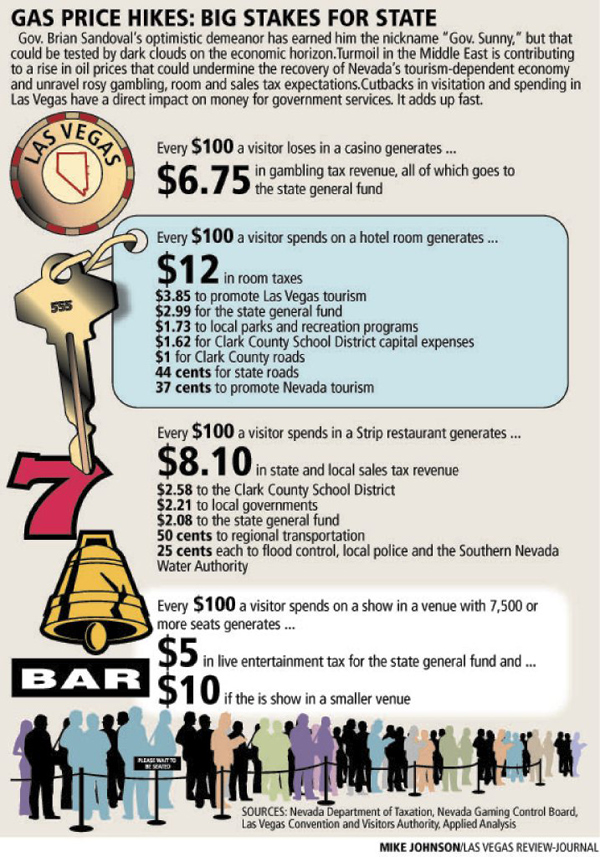

For example, when a consumer doesn't lose $100 in a casino, the state general fund loses out on $6.75. If the customer skips a $100 dinner in a restaurant on the Strip, that's $2.08 that won't go to the state general fund and $6.08 local governments will never see.

And if a customer saves $100 by cutting a visit one night short to reduce hotel room costs, that's $2.99 that won't go to the general fund, $1.62 that won't go to the Clark County School District for construction and $1.73 that won't get to local parks and recreation programs.

Those little decisions add up, especially if high fuel prices drag on for weeks or months.

"If you saw sustained gas prices for three consecutive months, you would start to see effects on consumer activity," said Jeremy Aguero, a principal at the Las Vegas economics research firm Applied Analysis. "We are certainly vulnerable in that regard."

lower hotel rates

Hotels can offset downward pressure on visitation by lowering room rates to attract more customers.

That's what South Point owner Michael Gaughan does to maintain demand for the nearly 2,200 rooms at the hotel.

Gaughan said he maintained about 80 percent occupancy in February with an average daily rate of about $67.

Those numbers have been trending up slowly as the nation claws out of recession. But Gaughan said if gasoline prices jump as high as some forecasters predict, it could reverse the trend.

"Next month is looking pretty good, but I don't know what the gas prices will do," Gaughan said. "As gas moves up, the people will wind up with less money."

Lowering rates might fill rooms, but reduced prices spread over the approximately 148,000 rooms in the Las Vegas area can have a big impact on local and state government tax collections.

At 80 percent occupancy, for example, the difference between an average daily room rate of $88 and $115 amounts to about $400,000 per day in room tax collections for Clark County.

John Restrepo, a Las Vegas-based economist and member of the state Economic Forum, the five-member panel that makes tax revenue projections that the governor and Legislature use to build the budget, said he is aware of the potential havoc rising fuel costs could wreak on the recovery. But it's too early to say exactly what it means for the budget.

"If the worst case were to happen, it could have a potentially significant impact on the recovery of the economy," Restrepo said. "It is just one more issue we have to deal with."

Contact reporter Benjamin Spillman at bspillman@reviewjournal.com or 702-477-3861.