Housing at under $200,000

The year 2003 ushered out the Siegfried & Roy show, the Maxim Hotel brand and the Guggenheim Las Vegas.

And with the end of 2003 went another well-known Las Vegas standby: the affordable, new single-family home.

As the local housing market took off in 2004 and 2005, new construction led the way, with freshly built single-family homes surging toward a median price of $350,000. Local real estate research companies could find virtually no new single-family construction below $200,000 by 2005, said Dennis Smith, president of Home Builders Research.

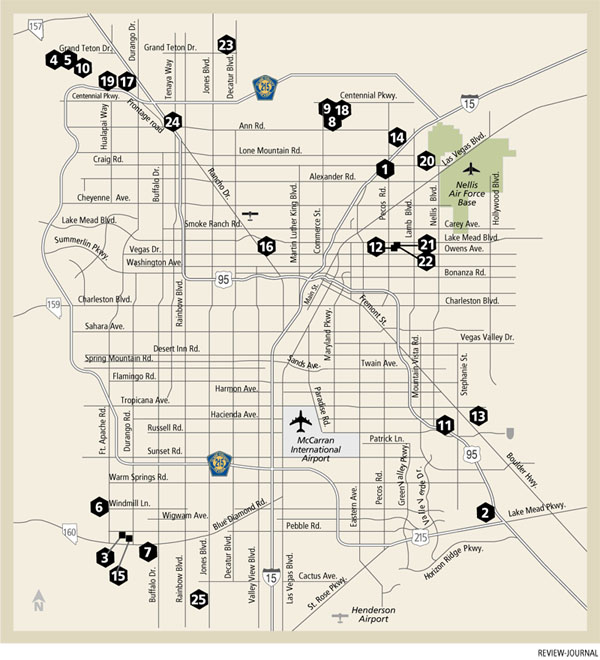

Now, 25 new-home subdivisions in Southern Nevada are selling single-family houses with starting prices below $200,000, according to an analysis of reports from local tracking firms and sales numbers found on builders' Web sites.

That's as little as $110 per square foot in some communities. Compare that cost to expenses at the market's apex in 2004 and 2005, when roughly $185 per square foot would have been the least-expensive price in the Las Vegas market, Smith said.

Back then, the only new homes consumers could find locally for below $200,000 were condominium conversions, added Larry Smith, president of SalesTraq. New single-family homes in the $100,000s became so rare that, in 2005, Murphy no longer had any such properties to track.

Today's smattering of sub-$200,000 communities isn't exactly a death blow to high housing prices in the Las Vegas Valley: With more than 500 actively selling new-home neighborhoods in the region, the majority of communities remain above the $200,000 mark.

Still, the lower prices mean a bit of relief for working-class Las Vegans who can't afford the city's $312,639 median new-home price.

The less-expensive communities are all over town, from the southwest valley to North Las Vegas. Buyers can even find them in upscale master plans: KB Home's Montecito, priced from $199,990, is in Mountain's Edge, and the builder's Cambridge Crossing and Cambridge Villas, where prices begin at $174,990, are in Providence.

Ken Perlman, vice president of Sullivan Group Real Estate Advisors, said the return to pre-spike prices is a building-industry response to tough times for entry-level home buyers.

"Builders are recognizing that buyers are struggling with the price points in the marketplace, and they're struggling with lending requirements," Perlman said. "This is an attempt by builders to create product that's a little more attainable. The key to the whole market is getting the entry-level buyer into the home-buying cycle, getting them to purchase a home, gain equity and move up. If these are the price points needed to do that, then this is the right thing to do."

Big, public builders dominate the affordable list, with KB Home and Richmond American claiming the most subdivisions on the list. That's partly because the builders simply have more neighborhoods than other builders here. KB has nearly 30 actively selling new-home subdivisions locally, while Richmond American has more than 40 current communities in the area.

But the two builders' heavy presence in the sub-$200,000 realm is also a function of both the economies of scale and the investor pressures that come with a large operation, Smith said. A massive company can afford a few loss leaders with slimmer profit margins if those lower prices will generate a sales volume that satisfies Wall Street. And in KB's case, the affordable prices also underline the company's historical emphasis on building entry-level homes outside master plans, Murphy added.

Several builders contacted for this story did not return phone calls by press time to discuss whether the lower prices would visit additional subdivisions in coming weeks and months. But analysts disagreed on whether consumers could expect many more subdivisions priced below $200,000 to reach the market.

Prices on vacant land in Las Vegas have softened in recent months, dropping from $718,500 per acre in the second quarter to $677,300 per acre in the third quarter, according to research firm Applied Analysis.

Further price breaks on land could help more builders swing affordable construction, Perlman said. Builders will also develop on smaller lots and get creative with floor plans to keep prices attainable.

"It's going to be tough to do that and generate big (profit) margins, but it's important to get those entry-level buyers in the marketplace," Perlman said.

Other experts said the re-emergence of the affordable single-family new home will be short-lived.

The housing slump has discouraged builders from preparing new lots for construction, and once the current supply is gone, replacements will be hard to find, Smith said.

More importantly, though, is that there's little to no money in selling houses in Las Vegas for bargain-basement prices. Given the costs of land and construction, $110 per square foot is about as low as builders can go here, Murphy said.

"There's zero motivation for anyone to build more houses at these prices," he said. "I don't think anyone will ever pull (building) permits if they know $110 per square foot is the price they'll get. We've got to be pretty darn close to the bottom. I see builders packing up and leaving town before they lower prices any more."

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or (702) 380-4512.