Mining tax hike talk rises with gold prices

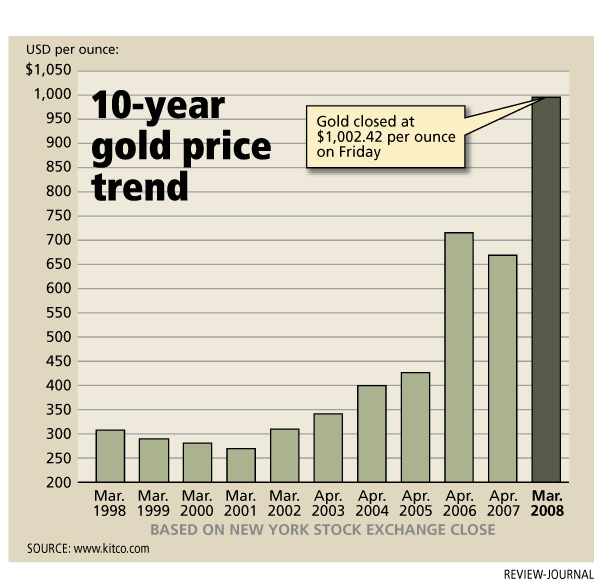

CARSON CITY -- With gold closing Friday on New York markets for more than $1,000 per ounce for the first time in history, no one should be surprised that some people want to extract more in mining taxes to help cope with the state's financial woes.

The Progressive Leadership Alliance of Nevada intends to lobby state lawmakers in 2009 to do just that.

"Mining doesn't work for Nevada," said Bob Fulkerson, state director of the liberal-leaning PLAN. "Mining works for mining."

PLAN has hired an economist who will study Nevada taxation and recommend what type of additional taxes should be levied on mining and other businesses.

Fulkerson said the funds are needed to keep up with Nevada's growing public school population, which would cost an additional $300 million -- $100 million if per pupil expenditures were kept at the current level, and $200 million more if teachers were given a 3 percent pay increase.

Gov. Jim Gibbons must find ways to pay for those new students when the Legislature convenes in February. He already has had to cut state spending by $565 million because of declines in sales and gaming tax revenue, brought on at least partly by the precipitous drop in real estate sales. And there is no guarantee the state will climb out of its economic downtown by early 2009.

PLAN says mining is not taxed as much as other industries in Nevada.

The industry reaped $5 billion from the sale of precious metals in 2006, with more than 90 percent of it coming from gold, silver and copper. It paid $62 million in net proceeds of mineral taxes that year, of which state government's share was $30 million.

Casinos, the state's biggest industry, paid a lot more. During the last fiscal year, they paid $870 million in taxes on winnings of $12.7 billion.

One reason for the difference is mining has a tax advantage gaming doesn't have.

Under the mining tax, placed in the state constitution at statehood in 1864, companies can deduct most of their production expenses before calculating what they owe the state and local governments.

In contrast, the 6.75 percent gaming tax paid by casinos is a gross tax from which no deductions are made.

GIBBONS OPPOSES NEW TAXES

Gov. Jim Gibbons says mining taxes won't be increased in 2009.

"The economy in our mining cities is good now. Try to find a home in Elko, Nevada. But it is a cycle. Other times they are at the short end.

"These companies invest billions in the state before they take one penny out. I don't want to do anything to jeopardize that investment in the state," said the governor, who has worked as an exploration geologist and a lawyer in mining.

"Mining offers some of the best paying jobs in the state. Truck drivers earn $65,000. I want to make sure to keep it that way."

The average mining job in Nevada paid $70,023 in 2006, the highest of any industry. But just 13,800 people out of the state's 1.2 million workforce was employed in the industry.

Gibbons and Nevada Mining Association President Mark Amodei say they are willing to look at the deductions mining companies claim and see if they are legitimate. But Amodei wonders if they will find anything, noting that even dues mining companies pay to his association are not deductible.

State law also prevents mining companies from claiming lobbying, advertising and related expenses as deductions. Exploration expenses, except near existing mines, also are not deductible, but most other expenses are.

Gold and silver mines reported sales of $4.3 billion in 2006. Their allowed deductions, however, were $3 billion, leaving slightly more than $1 billion on which to calculate the gross proceeds taxes.

Gibbons says taxing mining isn't the way to move Nevada out of its economic doldrums. He said state government needs to become "more efficient."

State economist Paul Anderson predicts a Nevada recovery in 2009 when jobs in the state should grow by 3 percent, followed by 5 percent growth in 2010.

But state spending in Nevada is controlled by the Economic Forum, a group of five private business people. On Dec. 1, it will determine how much Gibbons will have available in tax revenue to use in creating the two-year budget he submits to the Legislature in January.

If the economy has not rebounded much, forum members could take a conservative approach and project only small revenue increases. Then the governor and legislators would have to decide if they really can avoid tax increases and still cover student population, prison inmate and other growth fueled by Nevada's status as the fastest growing state.

THE BATTLE AHEAD

Fulkerson readily admits it will not be easy winning support for a mining tax increase in an era with a constitutional requirement that tax proposals need two-thirds support in both houses of the Legislature.

"But mining is the most clear cut example of corporations using Nevada as their bank account," Fulkerson said. "They take public wealth out of Nevada and put it in their private bank accounts. We absolutely have to find revenue from somewhere or kids will be packed into classrooms like sardines."

That could occur sooner rather than later. Jim Wells, the state's deputy superintendant of administrative and fiscal services, said his latest projections show public school enrollment will increase by 13,750 students in the 2009-11 budget period.

Fulkerson said the mining industry isn't the only business sector that should pay more in taxes. He said the Nevada State Education Association petition to increase gaming taxes is a "start." The economist they have hired to look at Nevada taxation will examine all major businesses, he added.

If the Legislature ever changes the mining tax, then Amodei recommends a flexible tax that would collect far less when gold is selling at $300 an ounce than when it sells for $1,000.

A longtime Republican state senator from Carson City, Amodei noted that just a few years ago gold was selling for less than $300 an ounce and many mining companies earned no money.

"No one in mining would disagree that they shouldn't pay their fair share as any other industry in Nevada," Amodei said. "At the same time, we want them to keep going so they can keep paying folks $70,000 a year."

MINING TAXATION HISTORY

Nevada history shows that people like Fulkerson who wanted to take more tax money from the mining industry generally have failed.

State Archivist Guy Rocha said Nevada's statehood was held up about 10 months because the founding fathers first wanted to place a gross tax on mining revenue.

Voters in 1863 rejected a constitution that included the gross tax.

In response to unhappy mine owners, a new constitution was drawn up that taxed only the net proceeds of minerals.

That constitution overwhelmingly was approved by voters, many who worked in Comstock Lode mines, and Nevada became a state on Oct. 31, 1864.

In 1989, then-Assembly Ways and Means Chairman Marvin Sedway, D-Las Vegas, found out how difficult it was to take on mining.

He decried how foreign-based companies were carting away Nevada's limited resources and leaving behind holes in the ground and unemployment when the inevitable busts occurred.

Most mining companies, were headquartered in Canada or cities like Denver.

By a 3-1 margin, voters in a special election that May backed constitutional changes that allowed the net proceeds of minerals to be taxed at a higher 5 percent rate.

When the dust cleared, however, the change meant state government received just $13 million more in mining taxes in 1990.

Sedway had wanted a $20 per ounce state tax on gold, a rate that would have brought in $130 million in 2006.

Then-Gov. Bob Miller also backed mining tax increases in 1989, but he said they were rejected largely because of the opposition of rural legislators.

"I took their slogan 'Mining works for Nevada' and said, 'That's true, but it is not working hard enough,'" recalled Miller in a recent interview.

Now a member of the board of directors of Newmont Mining Corp., Miller said the industry later supported his business activity tax and other taxes levied on all businesses.

"They stepped up to the plate. The problem today is everyone is looking for a single industry -- gaming, mining or whoever -- to fix all our financial problems," Miller said. "You can't put everything on the back of a single industry."

While gaming's gross revenue has endured three tax increases since 1989, mining's net proceeds tax rate has not been changed.

Contact reporter Ed Vogel at evogel @reviewjournal.com or (775) 687-3901.