Nevada taxable sales dropped 12.7 percent from year before

Well, we can officially declare that taxable sales won't decline anymore in fiscal 2009.

But that's only because the fiscal year ended June 30. And totals released Friday through the state Department of Taxation show that fiscal 2009's taxable sales ended not with a bang or a whimper, but with the painful yelp that accompanies nearly a year's worth of double-digit drops in activity statewide.

Taxable sales, which measure purchases of tangible goods, came in at $42.1 billion for the year, down 12.7 percent compared with $48.2 billion in fiscal 2008. Taxable sales also fell 12.7 percent in Clark County, slipping from $35.9 billion in fiscal 2008 to $31.4 billion in fiscal 2009. It's a poor showing that experts say portends further budget woes for Nevada, and it also indicates that the state's consumers continue to struggle with an unrelenting recession even as national indicators point to economic stabilization.

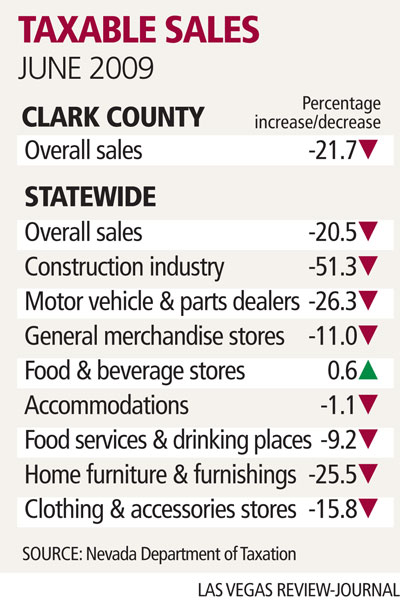

June's taxable sales show just how quickly losses accelerated toward the fiscal year's end. Nevada merchants sold $3.3 billion in goods in June, down 20.5 percent when compared with $4.2 billion in June 2008. Clark County stores moved $2.5 billion in merchandise, a 21.7 percent decline from $3.1 billion a year earlier.

It was the second consecutive month of sales declines above 20 percent, and the eighth straight month of double-digit decreases.

The newest numbers look especially bleak when you consider they came on top of sales drops in 2008, said Brian Gordon, a principal with local research firm Applied Analysis.

"The pace of decline locally in consumer spending is fairly dramatic and has continued to be down year over year," Gordon said. "These are comparisons to periods in the prior year that were also down. The change in sales that we have witnessed over the past couple of years has been substantial."

Gordon added that consumers remain "extremely cautious" with their discretionary dollars, and they've even begun to cut back on essential expenses.

Gov. Jim Gibbons said in a statement that the newest numbers reveal a "deepening recession."

"Over the last fiscal year, the slow housing market, volatility in the stock market, increasing unemployment rate, decline in business activity and drop in consumer spending portray the overall weaknesses in both the state and national economy," Gibbons stated.

Of all the state's major industries, construction once again took the biggest beatdown, plummeting 51.3 percent year over year in June. Wholesalers of durable goods such as appliances saw sales erode 39.1 percent, while furniture retailers experienced a 25.5 percent falloff.

Dealers of cars and car parts posted 26.3 percent slide in sales, though that trend could start to reverse when July's data come out in September. The federal government's Cash for Clunkers program launched on July 27, and Gordon said the extra business might have generated a "modest pickup" in transactions for car dealers.

Some economic sectors enjoyed higher sales. Industries with the biggest gains include telecommunications, chemical manufacturing, rail transportation, food and beverage stores and the combined category of performing arts and spectator sports.

As with Nevada, some lines of business at Barking Dogs Bakery and Boutique have held up well, while others have struggled amid the recession, said store owner Kathy Patterson.

Sales at Barking Dogs, which opened in 2007 as the recession dawned, have stayed stable overall. But purchases of luxuries such as pet clothes and beds have slumped recently, as consumers skip straight to essentials such as food.

"People are prioritizing. People still care about their pets, but they're focused more on keeping their dogs fed with healthy food and fun treats," said Patterson, who just opened a dog-grooming store on Cimarron Road. "It's not so much about the clothes and glitter jewelry."

Barren cash registers for retailers statewide mean emptier government coffers and fewer dollars for services such as prisons and schools.

Collections from taxable sales fell 18.8 percent year over year in June, to $249.9 million. Collections dropped 12.9 percent for fiscal 2009.

The general-fund portion of sales and use taxes continued to slide below budget forecasts, finishing the fiscal year 1.58 percent, or $13.5 million, below projections.

Gibbons has said faltering revenue collections would probably force him to call a special session of the state Legislature sometime before the next regular session in 2011.

A recent poll commissioned by the Review-Journal showed that Nevada citizens would prefer legislators cut state spending rather than boost taxes to handle revenue shortfalls. The statewide survey of registered voters found that 51 percent of respondents favor spending cuts, and 35 percent back tax increases.

Gordon said taxable-sales reports are unlikely to reflect any noticeable turnaround in spending and revenue collections through the end of the calendar year.

With unemployment at 12.5 percent statewide and 13.1 percent in Las Vegas, consumers just won't have the confidence -- or the cash -- to hit the malls. Any improvements in taxable sales will have to wait for a stronger job market and a vibrant housing recovery.

Said Gordon: "It's a difficult environment out there. Certainly, these conditions aren't expected to correct overnight."

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.