Poll: Voters support higher taxes on gambling, mining industries

Somebody call Oscar Wilde.

Nevada's casino and mine owners could use the Irish writer to sell voters on his adage that everything popular is wrong.

By almost two-to-one, likely voters support raising taxes on the gambling and mining industries to avoid cuts to state programs and public employee layoffs.

That's according to respondents to a recent survey by the Las Vegas Review-Journal/8NewsNow.

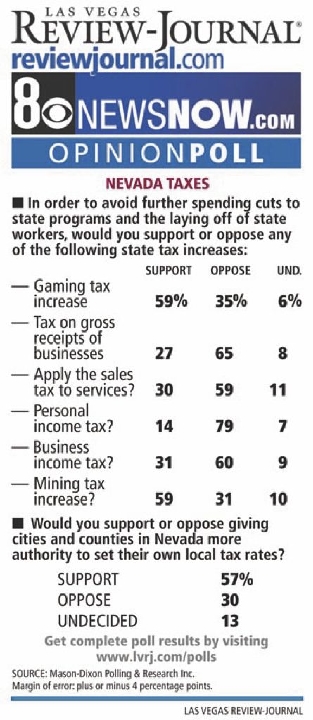

The poll conducted by Mason-Dixon Polling & Research showed respondents preferred higher gambling and mining taxes over higher taxes on gross business receipts, business income and personal income.

It's significant because even though many in the political class have called for Nevada to make ends meet by diversifying revenue sources, voters appear happy to raise funds through two longtime, core industries.

"They don't like taxes on them and small-business owners," said Brad Coker, managing director of Mason-Dixon, of the responses. "But go ahead, tax the gaming industry and mining industry."

In the survey pollsters read voters six choices for potential tax increases to avoid cuts to state programs and public employee layoffs.

The mining industry was their favorite target, with 59 percent of respondents in support of a tax increase, 31 percent opposed and 10 percent undecided.

For gaming 59 percent supported an increase, 35 percent opposed and 6 percent were undecided.

Respondents were strongly opposed to the other four choices:

■ Just 14 percent support a personal income tax with 79 percent opposed and 7 percent undecided.

■ On a tax on gross business receipts, 27 percent supported it, 65 percent opposed and 8 percent were undecided.

■ Broadening the sales tax to include services was supported by 30 percent, opposed by 59 percent and 11 percent were undecided.

■ When asked about a business income tax 31 percent were in support, 60 percent opposed and 9 percent undecided.

The pollsters interviewed 625 registered voters across Nevada. The margin of error of the poll was plus or minus 4 percentage points.

Bob Fulkerson, state director of the Progressive Leadership Alliance of Nevada, or PLAN, a group that has advocated higher taxes on mining to avoid cuts to education and social services, said the results show voters have responded to the group's outreach on the issue.

"A two-to-one support for a mining tax increase, that is a significant increase from this time last year," Fulkerson said.

PLAN sought to put a mining tax question on the ballot this year but failed to collect the required number of signatures by deadline.

"Even though we didn't get the signatures ... putting mining in the bull's-eye, it was worth it," Fulkerson said.

Jim Wadhams, a mining industry lobbyist, said the results show the mining industry hasn't done enough to educate the public about its business.

Although the Nevada Constitution caps mining taxes at no more than 5 percent of net proceeds, the industry says mining pays tens of millions of taxes on top of those proceeds. It also argues that while mining taxes look appealing when gold is selling at more than $1,000 per ounce, a tax increase could be crippling when the price drops.

"The big piece is that mining really hasn't had its story told in a long time," Wadhams said. "If you took mining out of our rural counties they would become poor counties and require more money from the remaining rich counties."

Billy Vassiliadis of R&R Partners, a lobbyist for gaming and other industries, argued during a special session of the legislature earlier this year that the state tax system is already overly reliant on gaming.

Exacerbating the imbalance, Vassiliadis said, "would definitely lead to layoffs."

State government is facing a revenue shortfall of about 40 percent, or about $3 billion, in the general fund budget for 2011-13. Democrat Rory Reid and Republican Brian Sandoval, the two leading candidates for governor, have said they won't raise taxes to close the gap, which leaves few options besides drastic cuts to services.

Fulkerson said he would prefer some sort of broad-based business tax, of which Nevada has none, but not a personal income tax or more sales taxes.

"There are some entities who are doing extremely well and they are the ones who are not paying their fair share," Fulkerson said. "To go after working stiffs, that is not fair."

Respondents to the poll also said they support by 57 to 30 percent giving cities and counties more authority to set local tax rates.

Nevada is Dillon's Rule state, which means local government have greatly restricted powers because they are limited only to what state law specifically authorizes, which means taxation, structural and other changes at the local level require support from the legislature.

Survey results suggest voters prefer what's known as a "home rule" system, at least when it comes to taxation.

Contact reporter Benjamin Spillman at bspillman@

reviewjournal.com or 702-477-3861.