Sandoval projected to have $1 billion less in budget, but he says he won’t raise taxes

CARSON CITY -- In 2011, Gov.-elect Brian Sandoval will have to build a new state budget with tax revenues that are $1 billion shy of what the current budget contains.

The Economic Forum estimated Wednesday that state tax revenues and fees will generate $5.33 billion in the two-year budget cycle that begins July 1.

That is more than $1 billion less than the current two-year spending level of $6.4 billion and represents a 17 percent decline in revenue. State agencies are seeking a combined $8.3 billion for the next two years.

Despite the deep divide between resources and demand, Sandoval quickly issued a statement declaring that he will not raise taxes because any increases would hurt the state's economic recovery.

"While the decisions which lie ahead will be trying, we must commit ourselves to them," the Republican said. "Nevada families and businesses are suffering, and our budget cannot worsen the problem. State spending cannot get in the way of economic growth by imposing new taxes."

Neither Senate Majority Leader Steven Horsford nor incoming Assembly Speaker John Oceguera, both D-Las Vegas, responded to calls for comment on the revenue forecast.

"We need to wait and see his (Sandoval's) proposal," said Senate Minority Leader Mike McGinness, R-Fallon. "We need to see the details."

It's been apparent for weeks that the forum would find a $1 billion decline in tax revenue. Even state Budget Director Andrew Clinger mentioned that figure in early November. Outgoing Gov. Jim Gibbons already has asked state agencies to prepare for a 10 percent cut.

Sandoval has said he does not favor across-the-board cuts. Reducing the budget by slightly more than $1 billion would be roughly equivalent to a 17 percent cut to all state agencies.

It also would be equivalent to reducing all support to Nevada's colleges and universities, which now receive a combined $1 billion in state funding.

Public schools receive $2.6 billion in state support. Cutting K-12 spending by 17 percent would mean that public schools would get $442 million less.

Last summer, Horsford said that he was expecting spending cuts of $1.5 billion and that tax increases of $1.5 billion would be necessary in 2011. In a more recent interview, Horsford did not mention tax increases, saying he wanted to first see the budget Sandoval prepares.

On top of the $5.33 billion in expected revenue, funds that can be used to create the 2011-13 budget will include about $70 million in reversions, or unspent funds from the current budget. That would bring potential revenue to slightly more than $5.4 billion.

State law requires the projections made by the forum, a group of five private business leaders, be used by Sandoval and Gibbons to create the proposed budget that will be presented to the Legislature on Jan. 24. The forum meets again May 1 to make a new estimate of tax and fee revenues. Those figures must be used in the final budget approved by the Legislature.

The $5.33 billion Economic Forum projection actually is an improvement over what some had predicted, according to Sandoval, who still anticipates making $1.2 billion or more in budget cuts.

It's already apparent the state needs to increase Medicaid spending by more than $200 million. Medicaid is the free health care program for the poor, blind, disabled and some elderly. More than 279,000 Nevadans are on Medicaid, and that number is expected to exceed 300,000 over the next two years.

During the six-hour meting Wednesday, Economic Forum members deliberately took a conservative approach to making their estimates of tax revenue.

The forum members rejected projections by Moody Analytics analyst Dan White that the state economy is about to boom, with big increases in employment and in tax revenue.

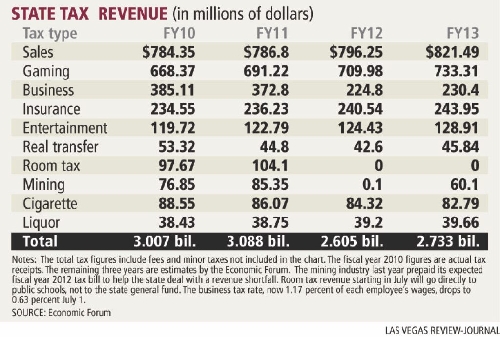

Instead, forum Chairman John Restrepo emphasized that members were "erring on the side of realistic conservatism." They projected a modest 3 percent growth in sales taxes and a 6 percent increase in gaming taxes during the July 1, 2011, to June 30, 2013, budget period.

Total state revenue in the current fiscal year is expected to reach $3.087 billion. That's a 2.7 percent decline from the previous year that ended June 30.

The forum's two-year revenue forecast was not that much less than the $5.5 billion in revenue it forecast in May 2009 for the 2009-11 budget period.

But during the month after the 2009 meeting, legislators approved temporary tax increases that were projected to bring in more than $800 million. Because the recession held down spending, the actual return on those increases was about $500 million.

All of the temporary tax increases -- a 0.35 percent increase in the sales tax rate, the near doubling of the business payroll tax, increased auto registration fees and the doubling of the annual business license fee -- expire June 30 unless reauthorized by the Legislature.

Legislators also put into effect a Nevada State Education Association initiative petition raising the room tax that brought in $200 million. That money went to the general fund last year but in the future can be used only for teacher salaries and education improvements.

Sandoval has pledged to veto any attempt to reauthorize the temporary taxes.

During the Economic Forum meeting, chief state economist Bill Anderson said the Nevada economy is close to bottoming out with its worst-in-the-nation 14.2 percent unemployment rate and population losses of 70,000 in the past year.

But he added he sees "no catalyst to put us on a growth cycle."

Moody's White came under fire from forum members, including Matt Maddox, chief financial officer of Wynn Resorts, for his rosy picture of Nevada returning to a boom cycle. White projected a 12 percent or more increase in gaming revenue in the 2012-13 fiscal year.

Maddox strongly disagreed.

"Net profits for this industry this year will be a $1.5 billion loss," he said. "They (casinos) will be very reluctant to hire more people, given these losses."

He added that Moody projects a full recovery within 24 months, even though Nevada casinos face international and increased domestic competition, and tourist spending is down.

Forum member Andrew Martin repeatedly urged other members to select the lowest possible growth numbers for sales and other taxes.

"I don't think people are going out and spending more," Martin said. "We must use caution. I don't want to be labeled Dr. Doom, but I see so much downward pressure."

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.