Support dips for teachers’ tax plan

CARSON CITY -- Although support has dropped, Nevadans by more than a 2-1 margin back the teachers union petition to increase the gaming tax rate, a Review-Journal poll shows.

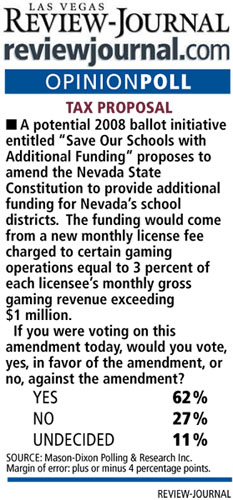

Sixty-two percent of respondents favor the Nevada State Education Association's petition that calls for increasing the gaming tax rate, now 6.75 percent, to 9.75 percent in 2011. The higher tax would apply to all casinos that earn more than $1 million a month in gaming revenue.

The tax plan was opposed by 27 percent of people questioned and 11 percent were undecided.

That compares with 76 percent support in a poll conducted for the Review-Journal in October and 68 percent support found in a poll for the Reno Gazette-Journal last month.

NSEA President Lynn Warne said the poll results still show solid public support, even though the gaming industry has begun a campaign against the tax hike.

"We are out gathering signatures and have encountered no problems," she said.

Pollster Brad Coker, of the Washington, D.C.-based Mason-Dixon Polling and Research Inc., does not see significant erosion in support for the tax increase.

"There is still a lot of support," said Coker, whose company conducted the poll. "I don't think it is that big of a free-fall."

Coker attributed most of the drop to changes in how pollsters asked the question. When his employees questioned people for their views on gaming taxes in October, the teachers union had not yet filed its petition with the secretary of state's office.

As a result, pollsters guessed on how the question would be phrased. But in asking 625 people by telephone Dec. 1 through last Wednesday, they used actual language of the filed petition. The results have a margin of error of plus or minus 4 percentage points.

Despite the numbers, Coker said the gaming industry clearly has the resources to convince a lot of people to oppose the tax increase.

Nevada Resort Association President Bill Bible said citizens may be starting to realize the "fundamental unfairness" of singling out one industry for a tax increase. The gaming industry also has been emphasizing that it already pays more than one-third of the revenue going to public education.

Bible also pointed out the first poll was conducted before reports were released that show state tax revenue has dropped below projections because of the slowdown in home sales.

Gov. Jim Gibbons is expected to cut state spending by at least 8 percent in January. Public schools have been exempted from the cuts.

"Some voters may be cognizant that it isn't a good time for these fee increases," Bible said. "They may be concerned about protecting funding for child welfare and other state programs."

Under the teachers' initiative, all the revenue generated would be spent on public education.

At least 40 percent of the revenue generated through the increase would be used to boost the pay of teachers and other school employees, except for administrators. Another 40 percent would be used to increase days of instruction, reduce class sizes and implement anti-dropout programs. Remaining funds would be spent on incentive pay and to compensate teachers for out-of-pocket expenses.

The teachers association has estimated the tax will bring in more than $250 million a year, although it likely would provide much more revenue when it goes into effect in 2011.

The proposal carries a clause that requires changing the tax rate each year to reflect changes in inflation.

Robert Uithoven, spokesman for The Venetian, predicted support for the tax plan will drop as people realize it will not bring real education reform or force teachers to be more accountable for student performance.

"People are taking a second look at this," he said. "Parents, teachers and taxpayers want to see more accountability. The teachers proposal fails in that regard."

Uithoven expects a lot of groups, not just gaming companies, eventually will unite in opposition to the teachers plan.

Already, AFL-CIO secretary-treasurer Danny Thompson has registered his opposition.

The AFL-CIO and the teachers association often have been allies, even uniting earlier this fall to oppose a property tax initiative advanced by former Assemblywoman Sharron Angle, R-Reno.

Las Vegas lawyer Kermitt Waters said he is not concerned by the drop in support for the tax plan.

He intends next week to file his own petition that would increase the gaming tax rate to 20.2 percent, the average rate charged among states with casino gaming.

He proposes to use the higher taxes to fix roads, expand solar and geothermal programs, fund the court system and possibly to eliminate most property taxes.

People will support his petition when they learn just how low of a gaming tax rate is charged in Nevada compared to other states, Waters said. He wants to include a chart showing state-by-state gaming taxes with his petition.

Both Waters and the teachers association need to gather 58,628 valid signatures on petitions by May 20.

Then the proposal would be placed before voters in the November 2008 election. If approved by voters then and again in 2010, the higher tax would be put into effect in 2011.

Review-Journal Polls