COMMENTARY: Lawmakers target limits on mining, energy production

The United States is creeping closer to opening its lands for energy and mineral development, aimed at decreasing the nation’s reliance on rival countries.

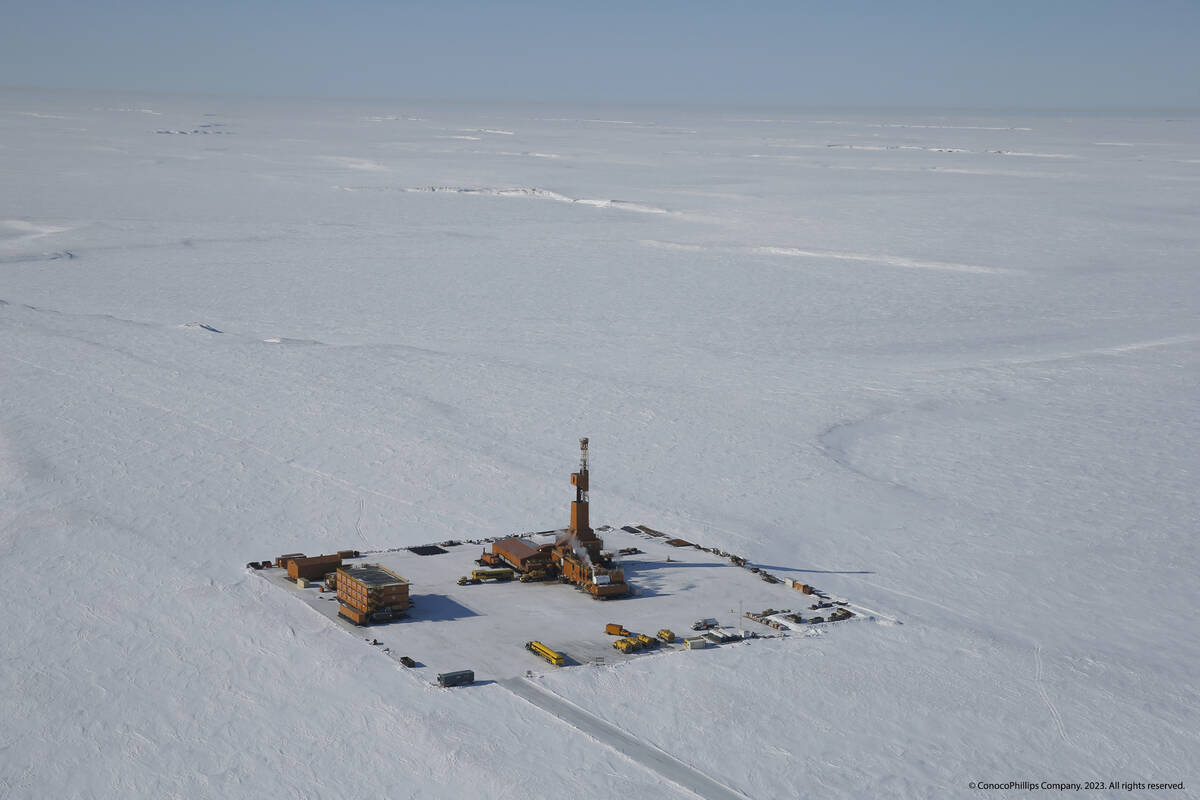

The House of Representatives recently approved two House-initiated measures and one sent over by the Senate to overturn actions taken under the Biden administration that closed federal lands to development. The measures reversed Bureau of Land Management decisions restricting development in Wyoming’s Powder River Basin, the Alaska Coastal Plain, and the National Petroleum Reserve–Alaska.

“When the Biden administration locked up millions of acres of resource-rich lands throughout Alaska’s North Slope, it undermined America’s energy independence and hurt Native communities that rely on the revenue stemming from energy production in the area,” said House Natural Resources Chairman Bruce Westerman, R-Ark.

The measures are part of a push the White House started in March through a series of executive orders aimed at eliminating “overbearing federal regulations” that stymied development, particularly of critical minerals. The order directed agency heads involved in permitting to provide lists of mineral projects to the National Energy Dominance Council, along with recommendations for immediate approval or expedited permitting.

The directive also gave the secretary of defense the authority to boost U.S. production of vital minerals and strategic resources, working with other federal agencies as needed.

The White House excluded oil, natural gas and uranium from its “critical minerals” designation. The House and Senate resolutions pertain primarily to oil and natural gas leasing and domestic coal production, signaling lawmakers’ focus on ending U.S. reliance on foreign suppliers for basic energy needs.

“For years, the Biden administration weaponized the Bureau of Land Management to indefinitely lock away millions of acres of federal land in Alaska,” said Alex Stevens, communications and policy manager for the American Energy Alliance. “Keep in mind, this is land that Congress expressly designated for multiple uses, including energy development.”

Alaska’s oil production has fallen from a peak of more than 2 million barrels daily in 1988 to fewer than 500,000 barrels daily under the Biden administration, Stevens added.

“This dangerously low volume has threatened the continued operation of the Trans-Alaska Pipeline System, which requires sufficient throughput to remain viable and prevent catastrophic technical and economic failure. In July 2023, production hit a perilous 402,000 barrels per day, perilously close to the minimum flow needed to keep the pipeline running,” Stevens said.

The Trump administration announced recently that it plans to open the entirety of California’s coastline and parts of Florida’s coast to oil exploration. Both areas have been closed for decades.

In early November, the U.S. Geological Survey released the 2025 list of critical minerals essential to economic or national security. The list contains 60 minerals, including several that power advanced electronics — aluminum for lightweight alloys for missile bodies and aircraft, along with electromagnetic shielding; terbium for magnets used in guidance systems and lasers; europium and yttrium for night vision and displays; and titanium for corrosion-resistant alloys for aircraft, armor and medical implants.

In 2024, the United States produced $3.3 billion in critical minerals, a 24 percent drop from 1923, according to the USGS. The country is also highly dependent on imports from China and Russia, with imports making up more than half of U.S. consumption for 49 nonfuel mineral commodities — a category that encompasses the vast majority of the nation’s critical minerals.

Russia is an important global supplier of strategic metals such as palladium and nickel, and the Democratic Republic of the Congo dominates mined cobalt production, much of which is shipped to China or China-linked companies for refining.

For rare-earth minerals, the United States is critically dependent on China for mined materials and, more crucially, processing and refining. That creates a chokepoint: Even if domestic or allied mining operations ramp up production, the United States still lacks sufficient refining capacity.

Seventy percent of U.S. rare-earth compounds and metal imports from 2020 to 2023 came from China, which controls about 90 percent of global processing and refining capacity, according to USGS.

In an analysis for the Carnegie Endowment for International Peace, nonresident scholar Bentley Allan and policy analyst Jonas Goldman offered a dour assessment of U.S. capabilities to boost domestic mineral production.

“Our analysis shows that even under the most optimistic scenarios, by 2035 U.S. domestic production would be able to meet projected demand only for zinc and molybdenum,” they wrote. “Even a substantial domestic minerals boom would leave the country requiring substantial imports of copper, graphite, lithium, silver, nickel and manganese to support industrial expansion and grid modernization. But greater minerals extraction is only half the picture, as a corresponding scale-up of U.S. smelting capacity would also be required.

“However, there are strong physical and practical limits on the capabilities of domestic mining in the United States. The reserves of many critical minerals are simply nonexistent.”

Jessica Towhey writes on education and energy policy for InsideSources.com.