Las Vegas stadium, convention center expansion to get acid test in special session

CARSON CITY — The blitz to secure public financing for a proposed NFL football stadium and beef up convention amenities in Las Vegas begins in earnest Monday when Nevada lawmakers convene for a special session.

Gov. Brian Sandoval is summoning legislators to the state capital to act on recommendations from the Southern Nevada Tourism Infrastructure Committee. The biggest component involves raising the Clark County room tax by 0.88 percentage points to finance $750 million in bonds over 33 years to help finance the $1.9 billion domed stadium.

Mark Davis, owner of the Oakland Raiders, has committed to move the team to Sin City if the facility is built and other NFL team owners approve. The stadium would also provide a new home for the UNLV football team.

Las Vegas Sands Corp. CEO Sheldon Adelson has pledged at least $650 million for the project, and the Raiders have committed $500 million.

Besides the stadium, lawmakers will be asked to tack on an additional 0.5 percentage-point room tax increase to raise about $400 million toward a $1.4 billion expansion and improvement project at the Las Vegas Convention Center.

A separate measure would authorize the Clark County Commission to raise the sales tax to hire more police officers.

NOT UNIVERSAL SUPPORT

Sandoval backs the measures and has said the public investments will help Las Vegas retain its stature as a global tourism destination and the stadium will provide a venue to host large-scale events — an amenity it currently lacks.

“Now is the time to capitalize on the opportunity before us to invest in Nevada’s most fundamental industry, tourism, by providing for the infrastructure and public safety needs of the 21st century,” Sandoval said in a statement last week when he announced the date of the special session.

“As I have said before, we can and must usher in a new era for tourism in the Las Vegas market, while keeping our citizens and visitors safe, and ensuring our position as a global leader in entertainment and hospitality.”

Clark County Commission Chairman Steve Sisolak said the projects would put Las Vegas “on the map with other major cities.”

“You don’t get this chance very often,” he said after the infrastructure committee, formed by Sandoval, unanimously approved its recommendations. “People from around the world will be coming here to watch professional football. It’s an exciting time for Las Vegas.”

Many unions also favor the projects, citing the thousands of construction jobs and other employment opportunities they would generate.

But critics are leery of funding the projects with hotel tax dollars and argue that Clark County residents could be on the hook if another recession hits and revenue to cover bond payments falls short. They also oppose raising taxes to subsidize wealthy proponents, given the state’s needs for additional education and social services funding.

The Nevada Taxpayers Association publicly opposed the plan and listed 16 concerns, including more pressing needs for room tax revenue. The association also said there is no evidence that a publicly funded stadium brings any benefit to taxpayers and that there is “significant data indicating that subsidized stadiums can be a detriment to a community.”

Nevadans for the Common Good, a faith-based organization composed of more than 40 religious and nonprofit groups, is also against the stadium on grounds it “involves substantial risk to the public without providing commensurate community benefits.”

THORNY POLITICS

Some conservative Republican lawmakers are upset that Sandoval, who sets the agenda for items lawmakers can consider, did not include funding for a school choice program and speculated the omission could jeopardize at least some votes for the Southern Nevada development projects.

Timing is also awkward. Sandoval in March warned state agencies to prepare flat spending plans and prepare for possible 5 percent cuts for the upcoming two-year budget cycle, when the state faces a projected $400 million shortfall because of caseload growth.

And lawmakers on both sides of the political aisle have expressed concerns over the timing of the special session. It comes less than two weeks before early voting begins for the Nov. 8 general election. Incumbents, especially Republicans, fear a “yes” vote to raise taxes — even if the bulk of it will be paid for by tourists — could expose them to voter backlash at the ballot box.

“It puts Republicans in a pickle,” acknowledged Assembly Majority Leader Paul Anderson. The Las Vegas Republican doesn’t have to worry — he won his GOP primary resoundingly in June and faces no other opposition in November.

But he understands the angst, particularly after the Republican-controlled Legislature last year passed Sandoval’s $1.5 billion tax package — the largest in state history.

“Some of us will be attacked on that,” said Anderson, who supports the stadium and convention center projects. “It’s still the right thing to do.”

It’s uncertain how long the special session will last, but most wrap up in a few days.

This will be the third special session for economic development projects Sandoval has called in the past two years. Lawmakers approved tax abatements for a Tesla battery plant in Storey County in 2014 and a Faraday Future car manufacturing plant in North Las Vegas in December 2015.

Legislators are expected to recess Tuesday afternoon if necessary for Yom Kippur, and then reconvene Thursday if necessary.

The Review-Journal is owned by the family of Sheldon Adelson, chairman and CEO of Las Vegas Sands Corp.

Contact Sandra Chereb at schereb@reviewjournal.com or 775-461-3821. Follow @SandraChereb on Twitter.

HOW A SPECIAL SESSION WORKS

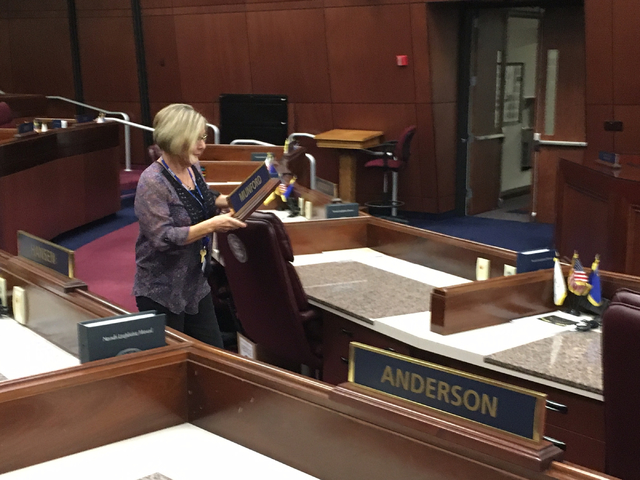

Before Nevada lawmakers delve into the nitty-gritty of hotel room taxes and the risk-reward of public financing for an NFL stadium and Las Vegas Convention Center expansion project on Monday, there are procedural rituals and other business to tend to.

Sandoval last week announced the special session will begin at 8 a.m. Monday. But time, as seasoned observers are well aware, is flexible inside the Legislative Building. Proceedings commence when leadership and staff are ready — and not before.

Once the Assembly and Senate are gaveled to order, five new members will be sworn in to fill vacancies that occurred since the last general election. The Clark County Commission last month appointed Stephanie Smith to represent Assembly District 1 and Kyle Stephens for Assembly District 5. Washoe County commissioners named Julia Ratti to Senate District 13; Jesse Haw to Senate District 15; and Dominic Brunetti to Assembly District 25.

Their terms will be short-lived, ending after the Nov. 8 election. Only Ratti is running for the seat in the election and would continue in the office if she wins.

Lt. Gov. Mark Hutchison, who presides over the Senate, and Assembly Speaker John Hambrick will then appoint committees to inform the other chamber and the governor that they are organized and ready for business.

Once those notifications are made and the committees return, the work begins.

Bills detailing the proposals will be introduced in one house or the other. During regular 120-day legislative sessions, bills are referred to specific committees after introduction. But in a special session, the entire Senate or Assembly serves as a “committee of the whole.”

Witnesses walk legislators through the specifics of the bills and answer questions. There is opportunity for public comment, and anyone can watch the proceedings on the Legislature’s website.

Lawmakers frequently break to meet behind closed doors with lobbyists, caucus members and leadership to hash out differences. If amendments are made, the entire bill must be reprinted — a requirement that slows the process and can lead to long recesses.

Afterward, the chambers dissolve as “committees” and reconvene as the Assembly and Senate to cast votes.

Lawmakers will give floor speeches urging their colleagues to vote one way or another before electronically recording their votes by pushing a green or red button.

After a bill clears one chamber, it is transmitted to the other where the process is repeated.

Passage of the measure to increase the room tax will require a two-thirds majority in both chambers — 14 votes in the Senate and 28 in the Assembly.

After the voting, the Senate and Assembly again appoint committees to inform the other chamber and the governor that they’ve concluded their business and are ready to adjourn “sine die” — meaning for the final time.

If legislation is approved, legislators and bill advocates would hike across the Capitol Complex courtyard to the governor’s office, where Sandoval would sign it into law in a bill signing ceremony.

RELATED

Nevada governor calls special session for Monday to consider Raiders stadium plan

Gov. Sandoval plans to call special session for proposed Raiders stadium