Experts say grocery market in Las Vegas Valley is healthy despite demise of two chains

The closure of two grocery chains in Las Vegas will leave consumers with fewer options, but analysts say that they don't expect other operators will flee and that others will arrive.

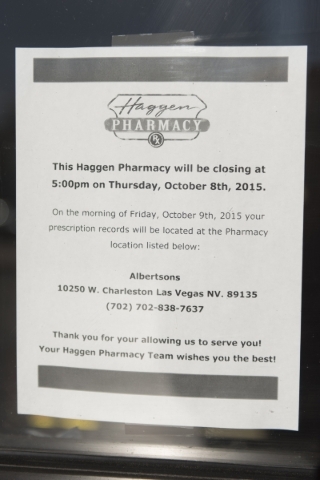

Bellingham, Wash.-based Haggen plans to close the seven stores it opened in June by the end of November after taking them over from Vons and Albertsons. (Employees have told the Review-Journal the company will close its area locations on Nov. 17; the company has not confirmed that.)

In October, Fresh & Easy announced its winding down operations of 14 stores in Las Vegas after closing three in August. At its peak, it had 25 stores in Las Vegas, but it will be gone after entering the market less than a decade ago.

A little more than three years ago, WinCo Foods opened two discount markets in Las Vegas, and given Southern Nevada's rebound from the Great Recession, they're doing well and not expected to be the last grocers to try their luck in Southern Nevada.

"There's no such thing as an overstored market because good stores will always do well," national supermarket analyst David Livingston said. "I think we saw that a couple of years ago when WinCo came in. There's nothing wrong with the market. Wal-Mart (Neighborhood Market) is doing well, and WinCo is doing well. Smiths is doing OK.

"You've had some new entrants in Sprouts and Trader Joe's, and you have Whole Foods. You have everything you need," Livingston added. "You just had some redundancies. Fresh & Easy wasn't needed before, and they came in at no relevance and now they're gone. It's like they were never here, and Haggen was just an unfortunate incident with the merger of Safeway and Albertsons. That was a situation with an inept retailer that really didn't know what they were doing."

Smart & Final has made an offer to acquire a Haggen lease in Summerlin, and Livingston expects other grocers will open in those stores if they find the locations suitable.

Underserved markets

UNLV professor Stephen Miller, director of the Center for Business and Economic Research, said if a grocer is going to enter the market, it may need to go to areas that are underserved. He said it doesn't work to have a Fresh & Easy right around the corner from a Smith's such as he has where he lives in Southern Highlands.

"They had the motto of competing with a different customer base than Smith's and Albertsons, but that wasn't working out for them," Miller said. "In a market, you have entrants and exits, and that's a natural thing. You may not want too much of that, but it's part of the competitive system. It comes down to how they're pricing their products and are they competitive with other stores they're competing against."

Retail consultant John Restrepo, principal of Restrepo Consulting Group, said Fresh & Easy, which was launched on the West Coast in 2007 by British retailer Tesco, misread consumer demand and their preferences.

"They haven't struggled in all locations," Restrepo said. "We have one near our house near Desert Inn and Fort Apache, and it has always done well, but when you went in there, the product offerings were limited. It was a good idea that was not implemented well."

Las Vegas retail analyst Brian Gordon, a principal with Applied Analysis, said the commercial retail market has been stable in the post-recession era and agreed that the shakeout with Haggen and Fresh & Easy is because of external factors rather than anything with the local market.

Hispanic grocers have been opportunistic in backfilling vacated spaces suitable for grocery anchors, Gordon said. Those stores include La Bonita, Marianna's and Cardena's.

"Changing demographics and an evolving community profile have provided an opportunity for grocers in the Southern Nevada market," Gordon said. "They have contributed to the stabilization taking place within the commercial real estate sector."

Southern Nevada's population growth is likely to continue in the future, Gordon said. That's going to lead to expansion by existing chains and newcomers to the marketplace, he said.

"That said, location, access, convenience and branding will be key elements of the success or failure of any new entrants to the Vegas market," Gordon said.

Miller said Las Vegas won't have the population growth it saw before the recession, but growing at 2 percent a year is faster than a lot of places around the country. When that happens, new homes will be constructed and push companies to expand and others to enter Las Vegas.

"When you build enough homes and get enough size, you're going to need grocers and pharmacies and restaurants and small businesses being developed," Miller said.

Failure offers lessons

Livingston said it's impossible to predict what new concepts and what new entrants will come Las Vegas. Wal-Mart is doing the best with its prices and store volume, he said. Sprouts and Trader Joe's do well, and Whole Foods is near the top in any market, Livingston said. The merger of Safeway and Albertsons can only help with the performance of its stores, he said.

WinCo has done well because they know how to cater to a local market and pick good locations, Livingston said. The failure of Haggen and Fresh & Easy offer lessons for retailers in expanding in markets like Las Vegas, he added.

Haggen erred in pursuing the acquisition of the stores dispensed as part of the merger with many of them underperforming and in poor locations, Livingston said.

"The main problem with Fresh & Easy is they picked extremely poor locations," Livingston said. "They picked locations just for the sake of opening stores and not for the sake for opening in good locations. They got a lot of stores open in a short period of time, and in order to do that you have to sacrifice something, and what they sacrificed was location."

Restrepo said it's important for existing grocers to continue to upgrade their stores and what they offer to lure customers. In recent years, many grocers have upgraded their delis to offer more and better fresh food offerings for takeout to attract customers, he said.

Their future competition won't necessarily be from a store opening down the street but what happens online, Restrepo said. That's a trend already faced by nongrocery retailers, he said.

"There are a lot of folks buying their stuff online now," Restrepo said. "It's not the fresh stuff. Most people prefer to go into the store itself to pick up vegetables and meats, but its dry products. Why hassle when you can order at Amazon Prime and get it delivered by next day for free?"