Congressional Republicans hail ‘big beautiful bill’ in Las Vegas hearing; Democrats skeptical

The U.S. House Committee on Ways and Means met in Las Vegas on Friday to discuss the benefits of the major tax policy known as the “One Big Beautiful Bill,” though Democrats pushed back highlighting what they said are the bill’s negative impacts.

Chairman Jason Smith, R-Mo., highlighted the benefits of the bill, including its “no tax on tips” policy, the proposal for which President Donald Trump announced on the campaign trail in Las Vegas.

Smith said 21 percent of workers in Las Vegas earn their living on tips, and tipped employees are estimated to get a $1,300 tax cut through the bill, which translates to over $230 million back into the pockets of tipped workers in Las Vegas.

He also highlighted the no taxes on overtime and no taxes on social security provisions, as well as the newborn savings account. He said the bill will stop a 22 percent scheduled tax hike on families making less than $100,000 a year and said families will get $11,000 more in take-home pay.

“That’s a huge difference for working families,” he said. “Lower taxes and a bigger paycheck are exactly what 77 million Americans voted for and President Trump delivered in the ‘one big, beautiful bill.’ All of this came from the American people.”

The hearing was held in the YESCO warehouse, where a flashing neon Las Vegas sign flashed behind the committee members. Signs reading “Largest tax cut in American history” and “no tax on overtime” stood behind attendees.

Six Nevada workers and residents were selected to testify to the committee about the benefits. They spoke about the expanded child tax credits, the extension of the 2017 tax cuts, the temporary $6,000 tax deduction for Social Security recipients and school choice opportunities provided in the bill.

State Senate Majority Leader Nicole Cannizzaro, D-Las Vegas, served as the sole speaker to testify against the bill, bringing up concerns about health care access and affordability, energy and food security.

Patrick Wrona, a server at RPM Italian in Caesars Palace, called the no tax on tips provision a “game changer” for him and his wife. The provision allows for up to a $25,000 deduction in tips from their taxable income through 2028.

“This policy will let hard working service professionals in Nevada like me keep more of what we earn,” Wrona said. “We are working class people. We have mortgages and families.”

Nancy Overman, a retired hospital and hospice volunteer manager, said the Social Security deduction will give her and other seniors breathing room.

“For me personally, this deduction means I will be better able to manage the basics, like groceries, utilities and the occasional unexpected expense without draining what little savings I have left,” Overman said.

Democrats retort

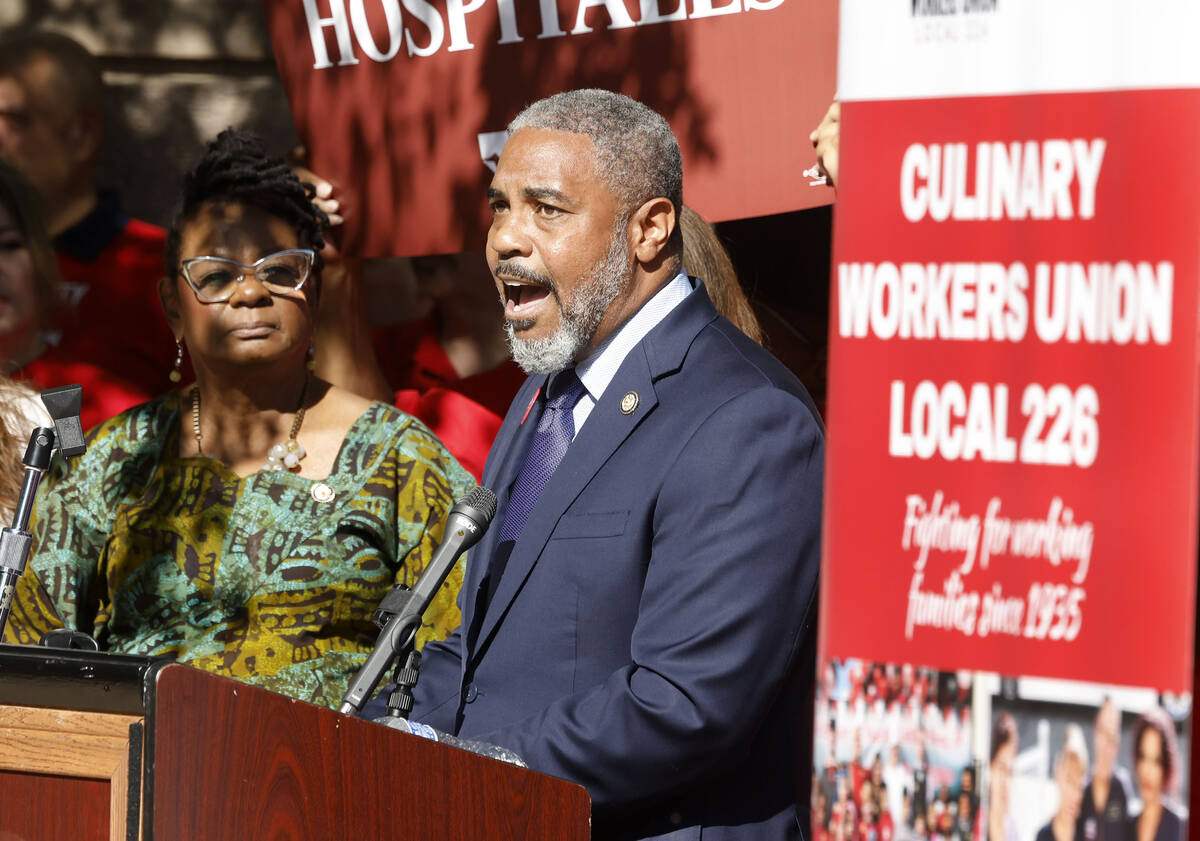

Before the committee convened, Nevada’s Democratic Rep. Steven Horsford — a member of the Ways and Means Committee — held a press conference at Culinary Local 226’s new headquarters with fellow Democratic members of the committee, union representatives and others.

“If Republicans want to have a victory lap for their new tax scam law, Las Vegas is the last place they should be doing it,” Horsford said, with Culinary union members standing behind him holding signs saying “The rich get relief we get receipts” and “Hands Off Social Security.”

Speakers highlighted concerns about health care cuts estimated to leave over 110,000 Nevadans without health care coverage, the elimination of solar tax credits, and cuts to nutrition assistance.

They said ‘no tax on tips’ provides only temporary relief, while the tax cuts that benefit the wealthy are permanent. Expanded child tax credits do not provide enough relief and are not refundable, said Gwen Moore, D-Wis.

“It grieves me so much to hear them talk about the need for people to go to work. But how can you go to work if there’s no one there to take care of your kids?” Moore said.

Democrats also criticized the committee’s meeting space, which was at YESCO, a sign company that was restricted to the general public. Horsford said it was more of a photo-op.

Ted Pappageorge, secretary-treasurer for the Culinary, said the bill provides much needed relief to tipped earners through a tax credit, but it doesn’t address automatic gratuities, are not permanent and are not stackable for spouses.

Rep. Dina Titus brought up concerns about the gambling tax changes, which will limit declarable losses for gamblers.

In the committee, Chairman Smith said members on both sides of the aisle are working to address the gambling tax changes before it goes into effect Jan. 1.

Smith also took swings at House Democrats, criticizing them for not voting against cutting taxes on tips, overtime and Social Security. Horsford and Nevada’s other Democratic members of Congress have expressed support for those provisions and have introduced their own versions of bills.

Contact Jessica Hill at jehill@reviewjournal.com. Follow @jess_hillyeah on X.